Sridhar Vembu Portfolio and Holdings as of 2025

Sridhar Vembu, co-founder of Zoho Corporation and one of India’s most influential tech entrepreneurs, has built his wealth by steering Zoho into a global SaaS powerhouse. Vembu’s portfolio is driven largely by his family’s significant stake in Zoho. Beyond Zoho, his portfolio reflects a deep commitment to deep-tech innovation, domestic manufacturing, and R&D-driven startups across sectors like healthcare, robotics, EVs, drones, and semiconductors, making it a fascinating study for market watchers and tech enthusiasts alike.

Sridhar Vembu’s Top Investments of 2025

Here is the list of the active stocks from the Sridhar Vembu portfolio in 202″

| Company Name | Sector | Type of Investment | Reported Amount / Stake |

|---|---|---|---|

| Yali Aerospace | Drones & Aerospace | Personal | Undisclosed |

| Karuvi | Power Tools / Manufacturing | Founder / Investor | Undisclosed |

| Genrobotics | Robotics (Hazard-Tech) | Zoho-led funding | ₹20 cr |

| Voxelgrids | MRI Imaging Hardware | Zoho-led funding | ₹35 cr |

| Ultraviolette Automotive | Electric Vehicles | Zoho-led funding | ₹37 cr |

| Asimov Robotics | Robotics & Automation | Zoho acquisition | Undisclosed |

| Netrasemi | Semiconductors | Zoho-led Series A | ₹107 cr |

| vTitan | Med-tech Devices | Personal + Zoho | ₹80 cr |

| Signalchip | Fabless Semiconductors | Personal | Undisclosed |

| New Horizon Media | Vernacular Publishing | Personal | Undisclosed |

Disclaimer: Please note that the above table is for educational purposes only, and is not recommendatory. Please do your own research or consult your financial advisor before investing. The data is derived from Tickertape Stock Screener and is subject to real-time updates.

Who is Sridhar Vembu?

Sridhar Vembu is the founder, CEO, and majority owner of Zoho Corporation, an Indian multinational software company specialising in SaaS products for businesses worldwide. Starting from humble beginnings in a small village, Vembu built Zoho without external funding, emphasising self-reliance and long-term value creation. His leadership combines deep tech expertise with a unique rural development philosophy, fostering growth both in urban and underserved rural areas. He is celebrated for promoting ‘Make in India’ technology and fostering grassroots innovations.

Overview of the Top Holdings in the Sridhar Vembu Portfolio

- Yali Aerospace: Yali Aerospace focuses on advanced aerospace technologies, developing components and systems for satellites, spacecraft, and aviation applications. The company works on cutting-edge innovations in propulsion, avionics, and navigation systems, catering to both domestic and international aerospace clients.

- Karuvi: Karuvi is a technology company specialising in IoT solutions and smart devices for industrial and consumer applications. Its offerings include connected sensors, automation systems, and data-driven solutions designed to enhance operational efficiency and enable real-time monitoring across various sectors.

- Genrobotics: Genrobotics develops robotics and automation systems for industrial, healthcare, and research applications. The company focuses on designing intelligent robotic solutions to optimise workflows, improve precision, and enhance productivity across diverse operational environments.

- Voxelgrids: Voxelgrids is a tech startup working in 3D imaging, computer vision, and AI-powered data analytics. The company offers solutions for mapping, digital twins, and spatial data management across various industries, including construction, infrastructure, and urban planning.

- Ultraviolette Automotive: Ultraviolette Automotive designs and manufactures electric vehicles and mobility solutions. The company focuses on high-performance electric bikes, leveraging advanced battery technology, connected systems, and sustainable transportation solutions for urban commuters.

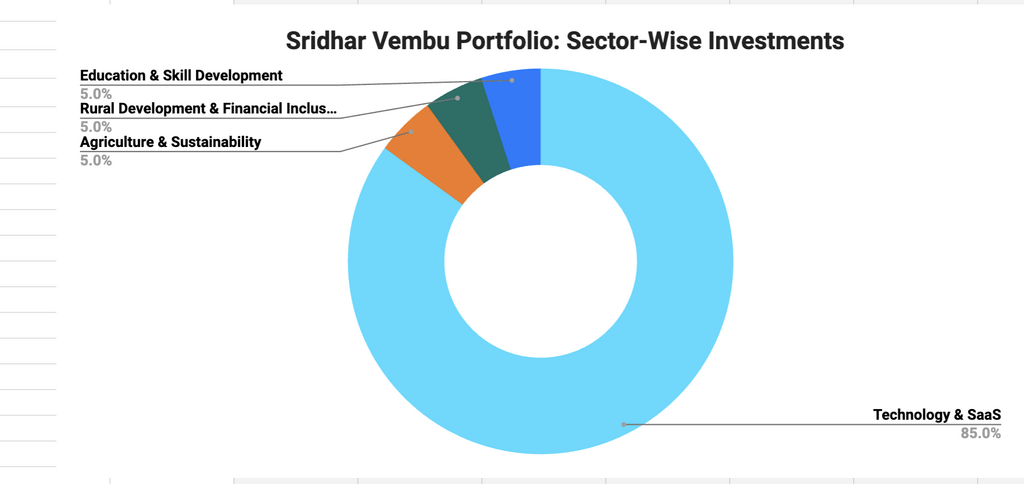

Sridhar Vembu Portfolio: Sector-Wise Investments

Vembu’s portfolio goes beyond conventional tech stocks, demonstrating a substantial commitment to creating social impact alongside wealth:

- Technology & SaaS: The foundation is Zoho Corporation, a leading privately held SaaS provider with a global clientele and robust recurring revenue.

- Agriculture & Sustainability: Investments in AgriTech startups like Aibono highlight his interest in sustainable farming, rural upliftment, and climate-resilient agriculture.

- Rural Development & Financial Inclusion: Funding microfinance and local entrepreneurship ventures that empower rural economies, reflecting his philosophy of inclusive growth.

- Education & Skill Development: Stakes in disruptive EdTech startups focusing on skill-building and digital access in rural areas, driving upward mobility via education.

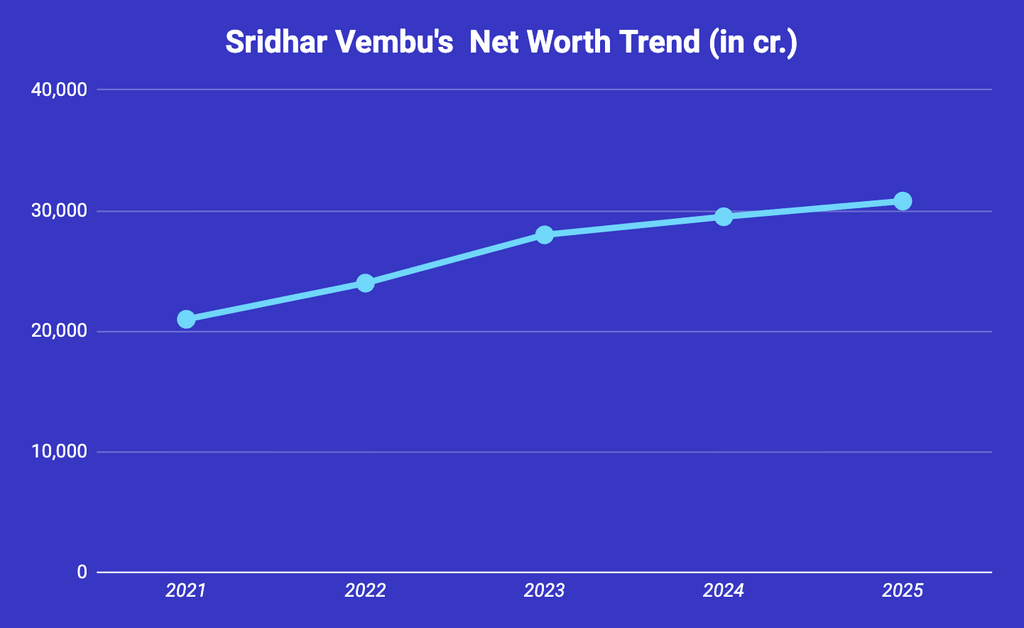

Sridhar Vembu Net Worth Trend

Vembu’s net worth has exhibited steady growth, primarily tied to Zoho’s global expansion and increasing penetration of the SaaS market. Unlike many tech billionaires who rely on venture funding, Vembu’s wealth is self-generated chiefly through organic scaling and profitability. In 2024-25, his net worth is estimated at around ₹30,000 cr, with a conservative valuation approach emphasising sustainable value rather than speculative gains.

Sridhar Vembu Investment Strategy

Key principles and strategies underpinning Vembu’s stock portfolio and investments include:

- Bootstrapped Value Creation: Prioritises organic growth and profitability over external capital, reflecting a long-term, risk-averse investment style.

- Focus on Self-Sufficiency: Investments often integrate social and economic self-reliance, primarily through rural empowerment and localized innovation.

- Sustainable and Impact-Driven: His portfolio consistently maintains a strong ESG focus with backing for climate-resilient agriculture, rural financial inclusion, and education.

- Founder-Centric Approach: Prefers investing in ventures led by visionary founders who align with the ethos of self-reliance and long-term growth, rather than just financial metrics.

- Technology-Led Transformation: Leverages deep technology insights to back companies disrupting traditional sectors via SaaS, AI, and digital tools.

Learnings from Sridhar Vembu’s Portfolio Management

Some learnings from Sridhar Vembu’s approach provide valuable perspectives for investors:

- Long-Term and Patient Capital: Vembu exemplifies the power of patience, building value over decades without chasing quick profits.

- Aligning Wealth with Social Purpose: His portfolio reinforces that financial success and social impact can coexist effectively.

- Focus on Underserved Markets: Tapping into rural India and growth-stage segments offers unique alpha opportunities underappreciated by mainstream investors.

- Technological Edge: Deep domain knowledge in SaaS and AI helps filter investments that have scalable business models.

- Avoiding Over-Diversification: Vembu maintains concentrated bets in sectors closely aligned with his philosophical and practical expertise.

To Wrap It Up…

Sridhar Vembu’s investment philosophy combines disciplined value creation with social impact and technological innovation. His portfolio highlights the synergy between profitable business models and purposeful investing, particularly emphasising rural development and sustainable technology. While his approach offers a distinct perspective, retail investors should thoughtfully adapt these insights, applying rigorous due diligence tailored to their own financial goals.

Frequently Asked Questions About the Sridhar Vembu Portfolio

No, most of his wealth is tied up in private companies like Zoho and early-stage ventures rather than public equities.

Yes, recent focus has been on AgriTech startups and rural financial inclusion initiatives, aligning with his social entrepreneurship drive.

No, many holdings are in privately held companies or startups, making direct replication impossible for most investors.

Absolutely. His emphasis on sustainable agriculture and rural empowerment underscores a strong commitment to ESG principles.

Investors can learn from his long-term, founder-led, and impact-driven approach, but should tailor strategies to their risk profile and market context.