2023 Recap: Indian Stock Market Performance, Indian Economy & Wright Portfolios Performance in 2023

In 2022, the S&P 500 recovered from its worst performance in over a decade. Continuing this upward trend, it has achieved approximately a 21% gain by November 30, 2023. This growth, primarily concentrated in the early months of 2023, signifies a notable rebound in the face of various economic challenges. 2023 marked a significant comeback for technology stocks, with the “Magnificent 7” mega-cap tech stocks – Apple, Amazon, Alphabet, Nvidia, Meta Platforms, Microsoft, and Tesla – leading the surge. These stocks significantly outperformed the S&P 500, with their gains more than doubling the index’s rise.

- Growth Sectors: Technology, communication services, and consumer discretionary stocks have seen substantial growth in 2023. This can be attributed to investor optimism about potential rate cuts in early 2024.

- Nasdaq and Dow Jones: The Nasdaq Composite, known for its tech concentration, has risen about 37%, while the Dow Jones Industrial Average is up approximately 11%.

- Sector Performance: High-growth sectors such as technology, telecom, and consumer discretionary have topped the performance charts in the S&P 500 for 2023. In contrast, traditionally defensive sectors like utilities, healthcare, and consumer staples have lagged behind.

And for Indian stock markets, Nifty 50, India’s leading stock market index, has demonstrated significant resilience. As of December 22, the index has recorded an impressive year-to-date increase of approximately 18%. The last week saw a minor blip with heavy profit booking & selling mid-week, but Indian markets seem to have picked up again. Could it be the Santa Claus rally that is resulting in this last week pick up ?

Despite the hurdles of inflation, rising interest rates, US banking crisis, and global geopolitical tensions such as the Israel Hamas War, the continuing Russia-Ukraine conflict, Indian economy has shown remarkable resilience. This robustness is reflected in increasing corporate profits, particularly in the technology sector. Let’s recap 2023 for India & Global stock markets.

The Banking Crisis of 2023

Silvergate Bank, Silicon Valley Bank, Signature Bank, and First Republic Bank faced a banking collapse in 2023. The crisis was triggered by significant losses in cryptocurrency investments, declines in bond portfolios and commercial real estate investments, and intense withdrawals from bank deposits. Following these events, stock prices of U.S. regional banks dramatically fell, fueled by diminishing investor confidence and concerns about potential impacts on other banks. We also saw a repercussion of this for Indian banks that had exposure to startups in the US & Europe.There was also a knock on effect for IT firms that had BPO & other services for US & European markets.

To avert the banking catastrophe, the Fed intervened by providing emergency loans to distressed banks. It reassured the public that customers of the failed banks would recover their deposits in full, even beyond the FDIC’s $250,000 insurance limit. Major banks like JPMorgan Chase and New York Community Bancorp acquired assets of the collapsed banks, helping to stabilize the situation. Fed reassured investors & the public about the stability of the banking sector and the safety of their deposits. Despite the initial turmoil, the crisis was contained with minimal disruption to the equity markets.

Inflation & Interest rates in 2023

US Fed’s actions in response to high inflation levels and their impact on interest rates have had significant effects on economic growth, consumer behavior, and corporate profitability in 2023. This was one of the key points for stock markets throughout 2023 and will impact us in global and indian stock markets in 2024 as well.

Starting in March 2022, the Federal Reserve embarked on a series of rate hikes to combat soaring inflation. We have some indications that the Fed’s aggressive monetary policy rate cuts have been successful in curbing inflation, without leading to a full recession for the US economy. US consumer price index (CPI) inflation peaked at 9.1% in June 2022 but decreased to 6.4% by January 2023, eventually reaching 3.2% in October 2023.

Fed had implemented 4 rate hikes of 25 basis points each in 2023, pausing rate increases after July. While inflation rates remained above the Fed’s 2% target, the downward trend allowed for a slower pace in rate hikes. Bond markets anticipate an 80% chance of the Fed shifting from rate hikes to cuts by May 2024.

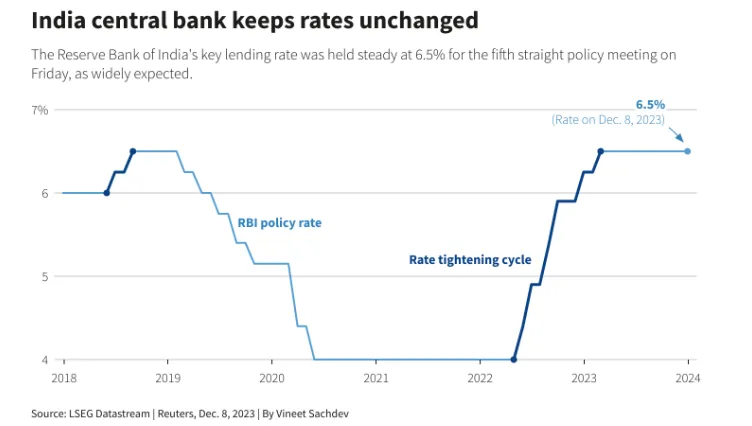

To control Inflation in India RBI followed suit to US Fed & other central banks in 2023. Since May 2022, the RBI has raised the repo rate by a total of 250 basis points in an effort to control inflation. But, after multiple increases throughout the year, since July 2023 rates have been kept constant.

Inflation fell to a four-month low of 4.87% in October but is expected to remain above the RBI’s 4% medium-term target for the foreseeable future. While core inflation, which excludes food and fuel, has generally moderated, there are concerns about potential increases in food inflation in the near term.

RBI projects consumer inflation to be at 5.4% for the fiscal year 2023-24, consistent with previous projections. RBI Governor Shaktikanta Das has also emphasized that policy loosening is not being considered currently, stating that inflation management requires active intervention and cannot be on autopilot. Supply-Side Measures to control food inflation would continue.

Indian Economy Overview of 2023

2023 for the Indian market was a year of contrasts, marked by both progress and challenges. Here’s a snapshot:

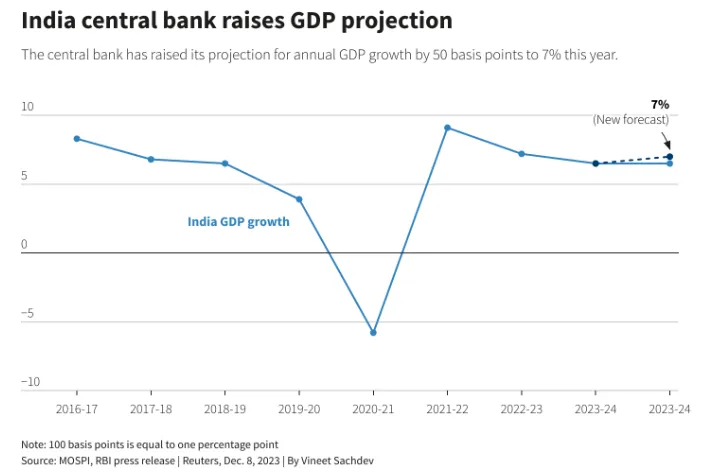

- High growth: India boasted the highest growth rate among major economies, estimated at 7%, propelled by strong domestic demand and government initiatives.

- Manufacturing push: The “Vocal for Local” initiative and Production-Linked Incentive (PLI) schemes spurred investments and production in crucial sectors like electronics, automobiles, and semiconductors.

- Fiscal consolidation: The government focused on fiscal prudence, aiming to bring the fiscal deficit below 4.5% by 2025-26.

- Global headwinds: Rising interest rates, the Ukraine war, and a slowdown in global trade impacted foreign direct investment inflows and the stock market.

- RBI expects the economy to expand 7% in the current fiscal year from 6.5% after stronger than expected growth in the July-September quarter.

Recap Of Indian Stock markets in 2023

India’s stock market has reached a new peak, surpassing a $4 trillion market value for the first time. This marks a significant milestone, positioning India as the world’s fifth-largest equity market. The market capitalization of companies listed on Indian exchanges has grown by $1 trillion in under three years, according to Bloomberg. India’s key stock benchmarks have hit all-time highs, recording a rise of over 13% this year. Foreign investors injected over $15 billion into India’s stocks on a net basis, while domestic funds contributed more than $20 billion. India’s efforts to enhance investment in its capital markets and industrial production have attracted significant foreign investor interest.

In the Nifty 50, out of the 50 stocks, 48 have shown positive growth, with only two – Adani Enterprises and UPL – experiencing declines of 27% and 19%, respectively. Notable gains have been seen in stocks like Tata Motors and NTPC, which surged 87% and 82%, respectively. 27 stocks in the Nifty 50 have gained over 20%, and 40 have increased by more than 10%. Most of the index’s gains occurred post-October, with only a modest 5% increase recorded until October 31. After a drop in October, the Nifty 50 achieved a 5.5% gain in November and continued to rise by 6% in December.

- The Sensex also faced some dips, with the biggest on November 9th, but overall witnessed a positive trajectory led by banking, auto, and real estate sectors.

- Startups continued their IPO frenzy, with several achieving strong results, indicating investor confidence.

- Information technology remained a bright spot, with mobile phone manufacturing reaching $44 billion, and exports showing promise.

Nifty 50’s rebound can be attributed to the return & bullishness of foreign portfolio investors (FPIs) , influenced by the easing of US bond yields and the perception that interest rates may have peaked. NSDL data reveals a significant turnaround in FPI activity. After two months of net selling, FPIs injected approximately ₹24,546 crore into the Indian financial market in November, followed by an even larger investment of about ₹77,388 crore in December.

Top Investment Themes of 2023: AI, Defense Stocks & Geopolitical Factors

AI and Generative Technologies

2023 witnessed a surge in interest in generative AI technologies, exemplified by ChatGPT and similar services. This technology’s potential for reshaping various sectors of the economy attracted substantial investor attention. The market is seen as being in the early stages of a prolonged AI technology expansion. Stocks linked to AI technology experienced significant inflows from investors, anticipating AI’s expanding role in the future economy.

We at Wright Research have also been building our AI capabilities & have been recently accepted to Google’s AI Accelerator Class 8 program.

The Rally in Defence and Railways Stocks

Indian defence and railway stocks have experienced a meteoric rise in 2023, fueled by a confluence of favorable factors. Increased government spending and focus on domestic production spurred the defence sector, with prominent players like HAL and Mazagon Dock witnessing over 150% growth. The railways sector enjoyed similar gains, exceeding 200% for companies like RVNL and IRFC, driven by ambitious modernization plans and dedicated funding streams. Geopolitical tensions, strategic importance, and historically undervalued valuations further contributed to the rally. Analysts foresee continued growth in both sectors for the foreseeable future, fueled by ongoing government initiatives and strong fundamentals. However, cautious optimism remains prudent, as profit booking and short-term volatility are possibilities. For discerning investors, the Indian defence and railways sectors offer significant opportunities, but careful navigation and professional guidance are paramount.

Geopolitical Factors

Israel’s declaration of war on Hamas in October 2023 has contributed to a more tense global geopolitical environment. The ongoing conflict in Ukraine and the new tensions in the Middle East have likely led to increased global defense budgets. As a result, space, aerospace and defense stocks like TransDigm, Kratos Defense & Security Solutions for US stock markets & Titagarh, RVNL, Taneja Aerospace and Aviation, Data Patterns, among others have shown strong performance in 2023 for Indian stock markets.

Other highlights

Budget 2023

Budget 2023 has taken center stage, aiming to revitalize the Indian economy by prioritizing three key pillars: job creation, infrastructure development, and rural empowerment. With an eye on the upcoming elections, the government seeks to unlock India’s growth potential and address pressing concerns. Job creation initiatives focus on stimulating sectors like manufacturing, MSMEs, and tourism, while skilling programs and entrepreneurship support aim to equip the workforce for the future. Infrastructure receives a massive boost with increased allocation for roads, railways, and digital connectivity, paving the way for improved logistics and efficiency. The rural economy takes center stage with increased farm investments, enhanced market access, and social safety nets, aiming to bridge the urban-rural divide and drive inclusive growth. While challenges remain, Budget 2023’s focus on these critical areas offers a roadmap for a more vibrant and equitable Indian future.

Geopolitical landscape:

In 2023, India stepped onto the global stage with confidence, shedding its traditional cloak of diplomatic reticence. The year was marked by its assertive participation in shaping the geopolitical landscape, particularly through two key events:

- G20 Presidency: As host of the G20 summit, India championed the interests of the Global South, advocating for multilateralism and economic inclusion. It navigated a complex international environment, deftly managing relationships with diverse players like the US, China, and Russia.

- Strong Diplomatic Positions: India emerged from the sidelines on critical issues, taking strong stances on the Russia-Ukraine war, promoting climate action, and upholding its regional security interests. This decisive approach showcased its growing stature and willingness to contribute to global governance.

However, this increased visibility also brought challenges. Balancing competing interests, navigating internal political considerations, and maintaining strategic ambiguity remain crucial issues. Nonetheless, India’s proactive engagement in the global arena in 2023 cemented its position as a rising power with a voice that demands to be heard.

Our Milestones

Alpha Prime

As we reflect on the past year at Wright Research, the stellar performance of our Alpha Prime portfolio undeniably stands out. Launched this year and already trending on Smallcase, Alpha Prime has delivered a remarkable 60% return in just six months, drawing in thousands of investors. This exclusive, high-risk strategy is meticulously crafted around a concentrated selection of 10 high-potential stocks from the top 500 corporations, each demonstrating strong earnings momentum. Alpha Prime exemplifies our commitment to aggressive momentum investing, carefully balancing the potential for substantial gains in bullish markets with resilience in more volatile scenarios. The weekly rebalancing and proactive portfolio churn are key to capitalizing on emerging market opportunities, making Alpha Prime a quintessential choice for investors seeking high momentum, alpha-generating strategies. As we close the year, Alpha Prime portfolio not only marks a significant achievement for Wright Research but also sets a new benchmark in intelligent, high-risk investment management.

Portfolio Management Service

As we approach the end of a remarkable year, it’s a perfect time to reflect on the successful journey of Wright Portfolio Management Services (PMS) since its launch. In a short span, Wright PMS has established itself as a beacon of innovation and performance in the investment world. Our inaugural year has been nothing short of extraordinary, marked by the strategic deployment of over ₹50 crores in assets. Our flagship schemes, the Wright Factor Fund and Wright Alpha Fund, have outperformed expectations, delivering returns of 29.2% and 33.1% respectively. These achievements are a testament to our commitment to data-driven, scientifically-backed investment strategies. As we celebrate these milestones, we remain focused on our mission to deliver sustainable, long-term growth for our clients. We’re grateful for the trust you’ve placed in us and are excited to continue this journey, aiming for even greater heights in the coming year.

Portfolio Performance

In a year marked by dynamic market conditions, the performance of Wright Portfolio Management Services ‘ diverse range of funds has been nothing short of impressive, especially when compared to major indices. Our Alpha Fund led the charge with a stellar 57% return, significantly outpacing benchmarks like the BSE 500 (1.96%), Nifty (17.32%), and even specialized indices like Midcap (-8.34%), Multicap (23.50%), and Smallcap (50.75%). The Balanced and Growth funds also delivered robust performances with 45.69% and 37.93% returns, respectively, showcasing our ability to create value across different investment styles. The Innovation and Momentum funds, with returns of 59.14% and 44.26%, further highlighted our expertise in identifying high-potential sectors and trends. Finally, the New India fund also outperformed the markets this year. This exceptional performance underscores our strategic prowess and deep market understanding, reinforcing our position as a leading player in the investment management landscape.

Check out Wright Research smallcases here!

Wryght Research & Capital Pvt Ltd•SEBI Registration No: INA100015717

103, Shagun Vatika Prag Narayan Road, Lucknow, UP 226001 IN

CIN: U67100UP2019PTC123244

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary.

Disclosures: Link