Complete Guide to Indian Railway Sector and Top Railway Stocks in India 2023

India has the world’s 4th largest railway network, trailing behind the US, Russia, and China. The railway system, a crucial part of India’s infrastructure for over 160 years, connects major cities to remote villages, impacting the lives of millions daily. It spans 126,366 km with 7,335 stations, and FY23 saw 5,243 km of track commissioned, a record at 14.36 km per day. The Indian Railways employs over 1.4 million people, making it India’s largest employer and the 8th largest globally. It operates 13,523 passenger trains and 9,146 freight trains daily.

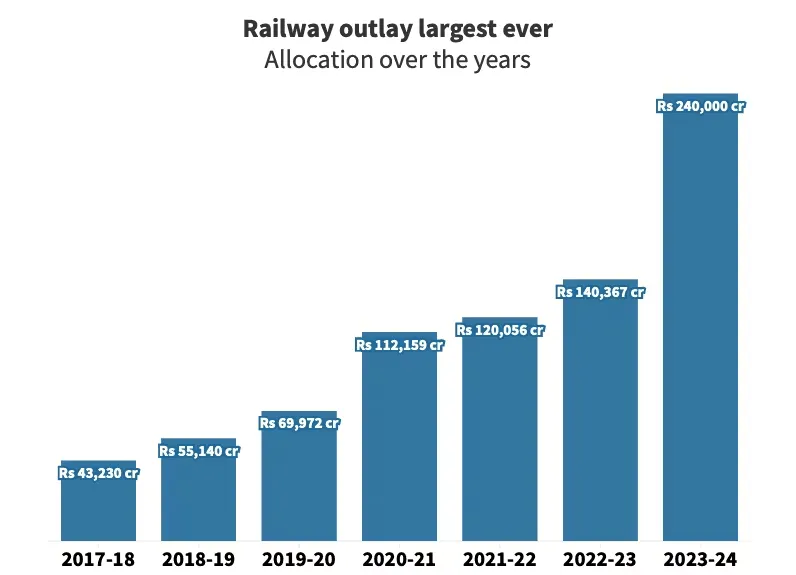

In the 2023-2024 Union Budget, Rs. 2.40 lakh crore is allocated for railway infrastructure revitalization. Recent stock market surges, with Nifty surpassing 20,000, have driven impressive gains in railway stocks in just one month.

Historic Boost for Indian Railways Sector in Union Budget 2023

In the FY22 Budget, the Indian Railway Sector received an allocation of Rs 1,40,367.13 crore, showing an increase from the previous year. An additional Rs 38,686.59 crore was allocated for investments in PSUs, joint ventures, and special purpose vehicles.

In the 2023-24 Budget, presented by the Narendra Modi-led government ahead of the 2024 general elections, there was a remarkable 75% increase in the railway budget. Union Finance Minister Nirmala Sitharaman announced this boost, making it a record-breaking allocation for the Indian Railways.

- The Union Budget allocated a substantial Rs 2.40 lakh crore as capital investment for the Indian Railways Sector – a significant increase. A marked increase of 1.03 Lakh crore compared to the previous year’s Rs 1.40 lakh crore, and 9x the amount spent in 2013-14.

- Railway receipts are projected at Rs 2,65,000 crore for BE 2023-24, a growth from the previous year’s Rs 2,42,892.77 crore. The capital expenditure’s total outlay is Rs 2,60,200 crore

- The budget earmarked for the reimbursement of losses on operation of strategic lines has decreased from Rs 2,461.90 crore in RE 2022-23 to Rs 487.51 crore in BE 2023-24.

- A sum of Rs 780 crore has been set aside in BE 2023-24 for debt servicing related to market borrowings for national projects.

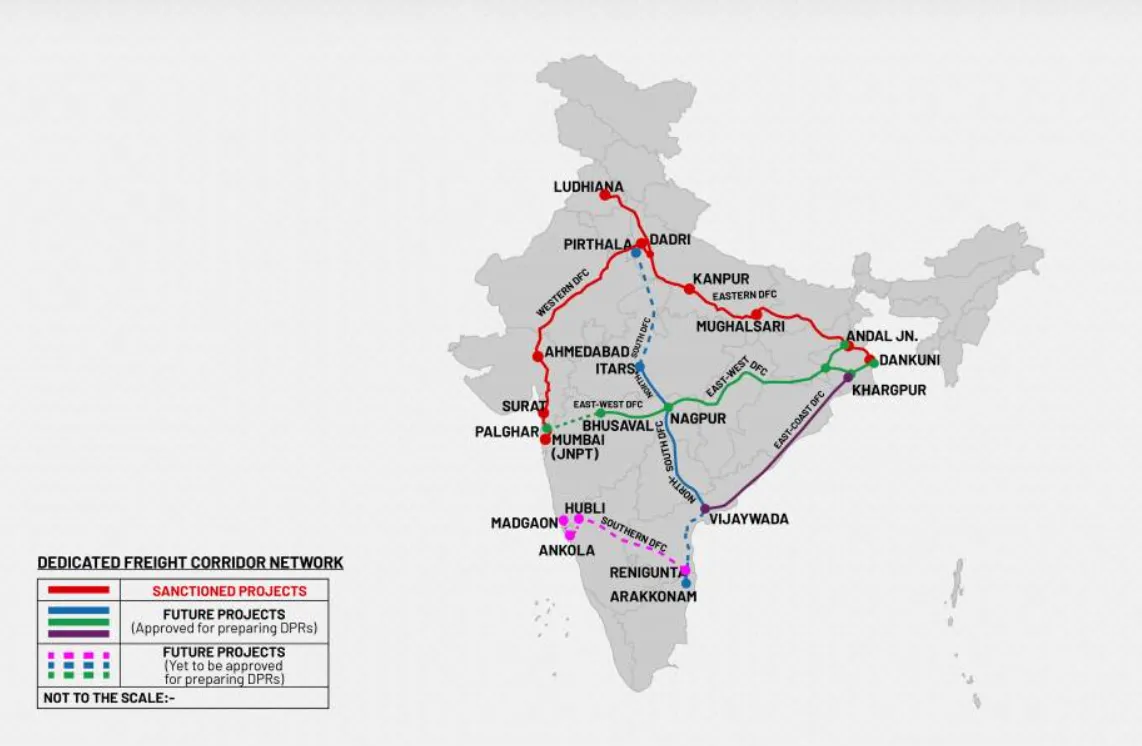

- The current budget also dedicated Rs 15,710.44 crore to the dedicated freight corridor (DFC), with asset monetization plans for operations and maintenance by the Indian Railways.

- The Finance Minister highlighted 100 critical transport infrastructure projects focused on enhancing connectivity for coal, fertiliser, and food grain sectors. These projects are estimated to cost Rs 75,000 crore, of which Rs 15,000 crore will be sourced privately.

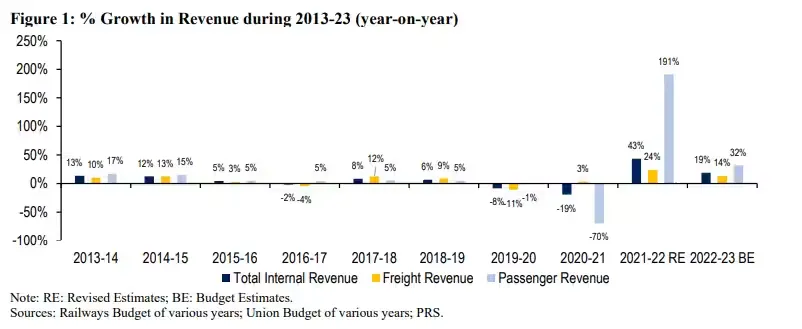

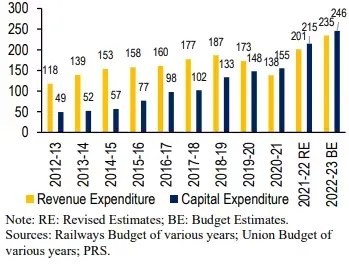

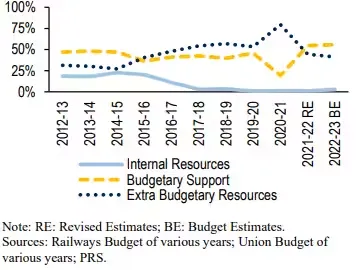

The revenue source for the railways includes passenger and freight traffic, leasing of railway land, central government support, and extra-budgetary resources. The major chunk of the internal revenue (69%) is predicted to come from freight, 24% from passenger traffic, and the remaining 7% from other diverse channels like parcel services and platform ticket sales.

Operational expenses of the railways, covering salaries, pensions, and asset maintenance, are addressed through its internal resources. Capital expenses, on the other hand, are managed through multiple channels: internal resources, central government support, and extra-budgetary resources.

There is also a strong push for the Make In India Initiative for high-speed trains and incomplete railway projects. The government’s PLI scheme aims to incentivize local train component manufacturing and reduce import dependency. Expectations indicate that capital expenditures for the railway system will continue to rise in the coming years, positioning it as a critical driver of national economic growth.

Major Developments in Indian Railway Sector

1. Electrification of Indian Railways:

- Over 90% electrification (59,096 RKM) achieved by June 2023.

- Aim to achieve 100% electrification (65,350 RKM) by the end of 2023.

- Expected annual energy savings of ₹15,000 crore.

- 6,542 RKMs electrified in 2022-23.

- Electrification efforts intensified since FY18, averaging 6,000 RKM per year.

2. Upgrading Indian Railway Stations:

- Redevelopment of 508 railway stations under the Amrit Bharat Station Scheme (₹24,470 cr).

- Focus on improving convenience, comfort, and local cultural connections.

- Wi-Fi available at 6,089 railway stations.

3. Upgrading Passenger Trains:

- Vande Bharat Express trains offer higher speeds (160-180 km/h), reducing journey times.

- Plans for 400 new-generation Vande Bharat Express trains in the next three years.

- Additional funding for sleeper-class Vande Bharat 2.0.

- Emphasis on the Make In India Initiative for high-speed trains.

4. Green Energy in Indian Railways:

As part of the Indian Railways push to transition out of coal and diesel to cleaner, green fuels-

- Transitioning to green fuels, aiming to become the world’s largest green railway network.

- Over 1,000 stations solarized.

- Introduction of hydrogen fuel cells for 35 trains.

- Targeting Net Zero Carbon Emissions by 2030.

5. Safety Improvements in Indian Railways:

Kavach, an indigenous railway protection system, also known as a Train Collision Avoidance System is currently being phased in by the Indian Railways.

- When activated it will stop all trains within a 5km radius. This automated system eliminates the need for human intervention via loco-pilots to identify cautionary signs and signals.

- This integrated system also provides regular data enhancing communication across the entire Indian Railway network.

- Slow deployment progress with plans for 6,000 RKM coverage.

- Increased capital expenditure for passenger safety.

6. Indian Railways’ Dedicated Freight Corridors for India’s Energy Security

Majority of coal transportation stems from eastern states like Odisha, Jharkhand, and Chhattisgarh, with destinations primarily in northern, western, and southeastern parts of India. Establishment of exclusive railway tracks dedicated to coal movement and aligning them to the Dedicated Freight Corridors.

- Establishment of dedicated coal transportation tracks within Dedicated Freight Corridors.

- Expected rise in coal consumption to meet energy demands.

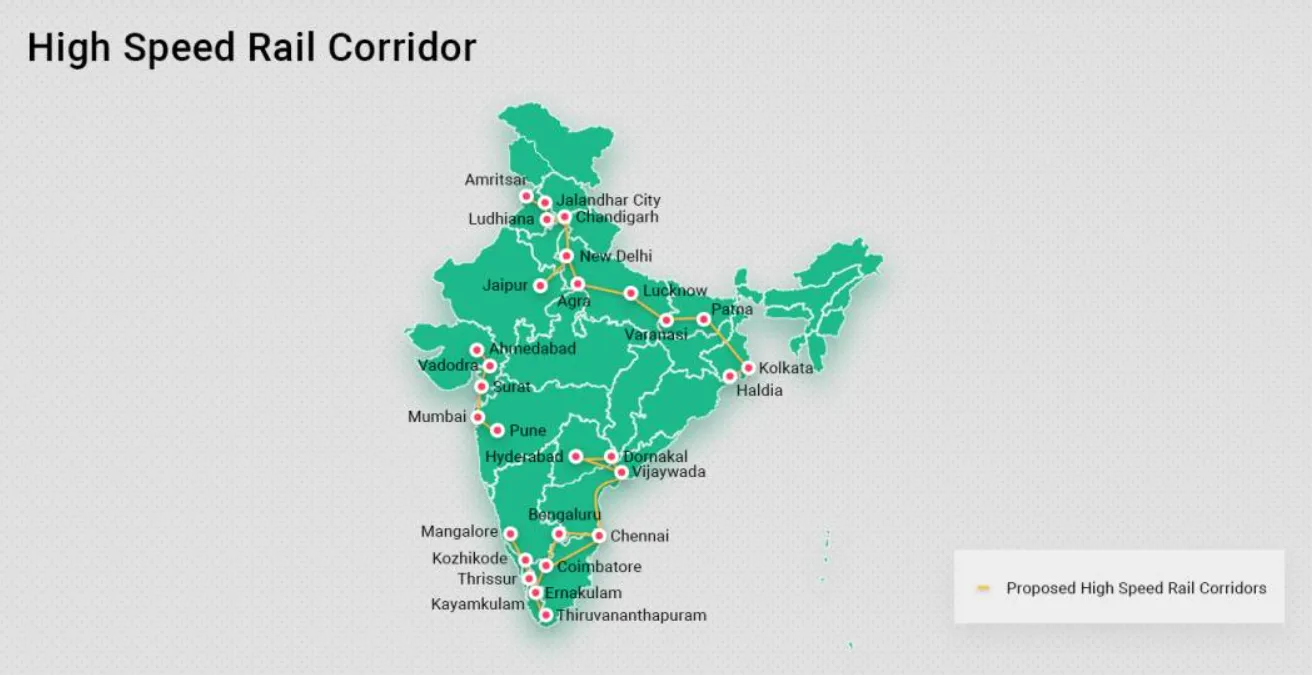

- Plans for six Dedicated Freight Corridors to enhance transport and energy security.

- 615 priority projects identified.

7. Freight Loading Mixed View, But is Up in 2023:

Freight loading’s share of freight transport market share has been declining due to decreasing speed and efficiency. Rail freight costs are the lowest at ₹1.6/tonne-km, the Indian Railways’ freight basket is heavily dependent on a limited range of commodities, causing vulnerability. Obsolete technology, complex regulations, lack of flexibility, and last-mile connectivity challenges impede growth. However, improvements in Indian Infrastructure can improve freight loading’s market share.

- Decline in freight loading’s market share due to various challenges.

- FY 2022-23 witnessed record-breaking freight loading of 1,512 MT.

- August 2023 registered 6.38% growth in freight loading compared to August 2022.

- Ambitious Vision 2024 aims for 2,024 MT freight loading by 2024.

- Target to increase rail modal share in freight to 45% by 2030.

Other notable developments in Indian Railway include progress on doubling railway tracks between various locations across the country, and improving connectivity in North East India.

Top Reasons to Invest in Indian Railway Stocks

Indian Railway Sector will continue to see increased participation from private investors, given 100% FDI is allowed with nearly $1.23 Bn already invested over the last 23 years. The railway sector aims to contribute approximately 1.5% to India’s GDP by enhancing infrastructure to manage 45% of the economy’s modal freight share. Here are a few reasons to consider investing in Top Indian Railway Stocks:

- Government Support:

- Increased budgetary allocation for railways.

- Boosting confidence in railway stocks as a dependable investment.

- Revenue Pipeline:

- Diverse projects planned for FY 2023-24, including hydrogen trains, line doubling (2,800 km), gauge conversion (150 km), and new line construction (600 km).

- Upgrades planned for major stations, with 1,275 stations earmarked for improvements.

- Rising Passenger Traffic:

- Predicted passenger traffic to reach 12 billion per year by 2031.

- Focus on revamping coaches on premier trains and improving passenger amenities.

- Track Renewal Commitment:

- Allocation for track renewal increased from Rs 15,388.05 crore (RE 2022-23) to Rs 17,296.84 crore.

- Emphasis on safety and maintenance.

- Shift in Freight Transport:

- Estimated freight demand of 8 million tonnes by 2031.

- Development of six high-capacity, high-speed corridors for efficient freight movement.

- Atmanirbhar Bharat Abhiyaan:

- Promoting manufacturing in India, leading to investments in railway manufacturing and maintenance.

- Expected boost in railway traffic.

Overall, the Indian Railway sector presents long-term growth opportunities for investors, given the substantial government support, increasing demand for both passenger and freight services, and commitments to infrastructure development and safety.

Top Indian Railway Stocks of 2023

Top Railway Stocks #1 – Indian Railway Catering & Tourism Corporation (IRCTC)

In Q1 FY24, IRCTC, known for its diverse services, showed promising performance:

- Revenue Growth: Achieved a 17% YoY revenue increase, reaching ₹1,001 crore from ₹852.6 crore, highlighting strong operational revenue growth.

- Catering Segment: The catering segment exhibited robust growth, with revenue up by 35% YoY to ₹471 crore, showcasing resilience despite a decline in overall profit.

- Rail Neer Segment: Saw a modest 10% increase, from ₹87 crore to ₹96 crore, indicating steady demand for Rail Neer.

- EBITDA and Margins: EBITDA grew by 6.9% YoY to ₹343 crore, but margins reduced from 37.6% to 34.2%, possibly due to increased operational costs or other expenses.

- Debt Profile: IRCTC maintains a low debt-to-equity ratio and a high interest coverage ratio, signifying strong financial stability.

- Expansion: IRCTC is expanding by developing and operating budget hotels across the country.

Overall, IRCTC displayed promising revenue growth, particularly in its catering segment, despite some margin reduction, reflecting resilience and potential for continued success.

Top Railway Stocks #2 – Indian Railway Finance Corporation

The Indian Railway Finance Corporation (IRFC) is actively involved in lending to rail-related organizations and leasing railway assets for national projects. It primarily engages in financial leasing of rolling stock assets, including coaches, wagons, and more. The government holds an 86% stake in IRFC, and there are plans to dilute around 11.36% to comply with SEBI regulations.

In Q1 FY24, IRFC reported:

- 18.7% YoY increase in revenue, reaching ₹6,679.2 crores.

- Higher expenses at ₹5,124.5 crores compared to ₹3,965.9 crores in Q1FY23.

- Operating profit margin declined to 23.28% from 29.53% in Q1FY23.

- A 6.3% YoY decrease in net profit, amounting to ₹1,556.6 crores, though a 17.2% sequential rise from ₹1,327.7 crores in Q4FY23.

Despite the Q1 profit dip, IRFC remains bullish due to the government’s focus on railway infrastructure development, including a ₹24,470 crores capex program. While all of this will help grow in the Indian Railway Sector, it will also provide strong revenue visibility for IRFC – as it is the government’s primary arm for financing railway projects. There are several key developments –

- IRFC and RITES signed an MoU to enhance cooperation in financing and developing railway infrastructure projects.

- G-20 summit saw India partnering with the US, UAE, and Saudi Arabia for developing shipping and railway connections.

Top Railway Stocks #3 – Titagarh Rail Systems (Titagarh Wagons)

Titagarh Rail Systems Limited, an Indian holding company, has shown impressive Q1 FY24 performance:

- Revenue Surge: The company’s net revenue rose significantly by 107.5% to ₹914.65 crore for the quarter.

- Earnings: Ebitda stood at ₹118.78 crore with a margin of 13.04%.

- Profit Turnaround: Titagarh reported a net profit of ₹61.78 crore, a remarkable turnaround from the previous year’s loss of ₹604,000.

- Segment Performance: Key segments, Freight Rail Systems and Passenger Rail Systems, reported revenues of ₹746.08 crore and ₹164.68 crore, respectively, showing substantial growth.

- Growth Factors: Titagarh’s growth is attributed to government infrastructure projects and strong demand for railway wagons in the private sector.

- Capacity Expansion: Plans to invest in capex to raise production capacity from 600-700 wagons per month to 1000 wagons by year-end.

- Impressive Order Book: Holds an order book worth ₹27,000 crore as of March 2023.

- Strategic Agreements: Entered agreements with BHEL Ltd. to supply 80 Vande Bharat trains to Indian Railways and a joint venture with Ramakrishna Forgings Limited to establish a significant train wheel manufacturing plant in India.

Titagarh Rail Systems is poised for growth, supported by strong fundamentals, government initiatives, and strategic partnerships.

Top Railway Stocks #4 – Rail Vikas Nigam Limited (RVNL)

RVNL is a leading player in India’s railway development projects, with a strong focus on the Golden Quadrilateral. They manage various initiatives, including new rail lines, track doubling, electrification, and more, providing turnkey solutions.

Financial Highlights (Q1FY24):

- Revenue increased by 20% YoY to ₹4,640.7 crore.

- Net profit jumped by 15% YoY to ₹343 crore.

RVNL’s Robust Outlook:

- Secured a ₹322 crore order from Madhya Gujarat Vij Company.

- Bagged ₹11,256 crore worth of orders from Chennai Metro Rail for Phase II.

- Emerged as the lowest bidder for Maharashtra Metro Rail projects worth ₹256.19 crore, among others.

RVNL exhibits strength and resilience, with a bullish outlook. Potential investors should monitor for short-term corrections.

Here is a detailed analysis of RVNL, RVNL’s Complete Stock Analysis: Opportunity or Risk?

Top Railway Stocks #5 – Container Corporation of India

Container Corporation of India Limited (CONCOR) is a logistics company handling container transportation by rail and road, with a wide infrastructure network. Here’s a concise summary with key statistics:

- Revenue: CONCOR’s quarterly revenue was ₹1,919.3 crore, falling short of the estimated ₹2,072 crore by 7.4%.

- Profit After Tax (PAT): The company reported a standalone PAT of ₹244 crore, significantly lower than the estimated ₹296 crore, representing a 17.6% shortfall.

- Margins and EBITDA: The margins stood at 20.4%, below the expected 23.07%. EBITDA was ₹392 crore, missing the estimate by approximately 17% (expected ₹472.5 crore).

- Dividend: Despite financial shortfalls, CONCOR declared an interim dividend for FY2023-24 totaling ₹121.86 crore, possibly to maintain shareholder confidence.

The company faces challenges such as weaker realization and high land license fees, affecting profitability. CONCOR plans to invest in new terminals, wagons, and advanced technologies like blockchain and AI for future growth. However, the results indicate immediate challenges that need addressing.

Top Railway Stocks #6 – Jupiter Wagons

Jupiter Wagons, a leading railway equipment manufacturer, has shown remarkable financial performance:

- Revenue: Impressive YoY growth of 155%.

- EBITDA: Grew by 223%, with a robust EBITDA margin of 12.9%.

- Net Profit: Consolidated net profit soared by 392% YoY to Rs629 mn.

Key developments and prospects:

- Expected Capex (FY24E): Around Rs4.5 billion, and the company maintains a net debt-zero status.

- Order Book: Includes a significant order from private entities and anticipates a large-scale tender from Indian Railways, totaling Rs62.1 billion.

- Capacity Expansion: Plans to expand wagon manufacturing capacity to 1,000 wagons per month.

- Global Expansion: Engaging in international tenders with an MoU signed with RITES and bidding for orders in Zimbabwe.

- Acquisition: Successfully acquired Stone India to enhance production capabilities.

- Diversification: Venturing into the Lithium-Ion battery sector in collaboration with Siemens.

- Valuation: Despite strong growth, the company is trading at a 10% discount compared to its closest competitor, Titagarh Wagons.

Jupiter Wagons is well-positioned to benefit from the thriving Indian Railway sector and its expanding global presence.

Top Railway Stocks #7 – RITES Ltd.

RITES Limited is an Indian engineering and consulting firm offering transportation infrastructure services worldwide. In Q1FY24, its financials showed:

- Total Revenue: ₹563 crore (down from ₹637 crore in Q1FY23).

- Consultancy business contributed ₹270 crore with a 44.2% margin.

- Leasing revenue was ₹31 crore, while Turnkey revenue was ₹165 crore.

- EBITDA: ₹161 crore with a 29.6% margin.

- PAT: ₹120 crore with a 21.3% margin.

Despite Q1FY24 revenue challenges, RITES is optimistic. It’s diversifying beyond railways, eyeing growth in Project Consultancy and Export business, and has international contracts.

Key Highlights:

- Robust order book with over 70 orders worth ₹5702 crore as of June 30th, 2023.

- Focus on reviving export business with a focus on Southeast Asia, Africa, and Latin America.

- MoU with Norwegian entity DNV for international inspection opportunities.

RITES remains well-positioned for growth, making it an attractive prospect for investors.

Wright Resarch’s Take on Indian Railways Sector & Top Indian Railway Stocks

The Indian Stock Market has been somewhat volatile in August and in September, especially in the midcap, smallcap, and microcap sectors. This downturn seems to be a short-term fluctuation rather than a major trend reversal, given the bullish run observed over the last 4 to 6 months. This upswing has been especially pronounced in midcaps, with some even tripling in value.

Investment in Indian Railways Sector and Top Indian Railway Stocks

For investors eyeing midcap and smallcap railway stocks, a balanced approach is advisable. While there’s potential for high returns, consider diversifying through well-researched options like thematic smallcases or mutual funds with railway exposure for a safer investment than individual stock picking.

Microcaps are gaining attention, but caution is essential. Their value can be highly volatile, so don’t solely chase momentum when considering microcap investments.

Despite the recent growth, investors should avoid over-diversifying and in some cases can consider investing in concentrated portfolios as well. It ultimately boils down to one’s risk profile, age, and portfolio composition before making such investment decisions. Railways seem to be a strong sector, but a well-balanced portfolio would also consider other sectors, ensuring not all investments are in one basket.

Read the full article on Wright Research Complete Guide to Indian Railway Sector and Top Railway Stocks in India 2023.

Wright Research Telegram and Youtube Channel

Join our Telegram Channel to get daily morning market updates. Subscribe to our Youtube Channel to learn about all things investing, understand sector performance, get key insights into new topics like concentrated portfolio, quantitative investing and more!

Explore Wright Momentum smallcase here

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Visit bit.ly/sc-wc for more disclosures.