SME Stocks Are Booming: Should You Invest In SME IPOs?

IPOs from new age companies hitting the primary markets like Paytm, Nykaa, Delhivery and others have disappointed investors in recent years. However, there has been a steady and increased interest in Small and medium-sized enterprises initial public offerings (SME IPOs). Remarkably, in 2022 saw India lead globally in such listings with 92, as per Bloomberg data. What about in 2023?

And some of these SME IPOs have given phenomenal returns since listing such as Droneacharya at 70%, Phantom Digital at 122%. However, not every SME IPO story is a success. While Ashapura Intimates Fashion Ltd saw an 800% surge in its share prices over four years after its 2013 listing, it had to be suspended in 2020 and eventually filed for liquidation. Another company, Nureca Ltd, after gaining 61% on its debut in 2021, now trades over 80% below its peak. So is there sufficient demand for SME IPOs? Is there something else at play that is resulting in this SME IPO boom?

Indian SME IPOs are Trending

SME Stocks Have Done Well Historically

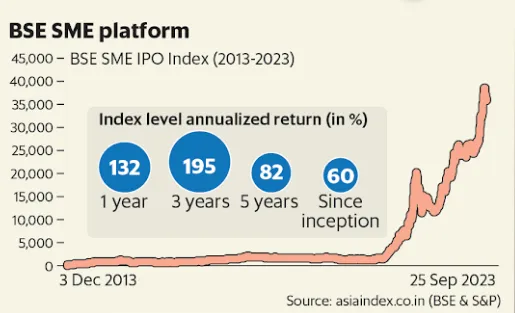

Over the past decade, the BSE SME IPO Index has flourished, showing annualized gains of up to 195%. The current listing data further solidifies SMEs as an attractive investment avenue.

A mere Rs.1,000 investment in September 2013 would be worth Rs. 1.03 lakh by 2023, translating to a staggering 10,350% return over a decade. BSE SME Index’s structure is unique, where companies only remain constituents for a year after their debut, unlike other indices like Nifty or Sensex. Nifty SME EMERGE, another index, has displayed similar growth, albeit with different stock selection criteria.

What is the difference between Main Board IPOs and SME IPOs?

The primary market or mainboard demands rigorous scrutiny and has stringent prerequisites. For instance, companies listed here must cater to at least 1,000 subscribers, maintain post-issue paid-up capital above ₹10 crore, and report financials quarterly. In contrast, SMEs only need a minimum of 50 subscribers, with capital needs ranging from over ₹1 crore to below ₹25 crore and financial reporting on a half-yearly basis.

| Main Board | SME | |

| Minimum number of subscribers/ allottees | 1,000 | 50 |

| Draft Red Herring Prospectus to provide key information to investors | Vetted by SEBI | Vetted by Exchanges |

| Minimum application amount | Rs. 13,000 – Rs. 15,000 | Greater than Rs. 1 Lakh |

| Capital & Time Requirement | Costlier and slower | Cheaper and faster |

| Reporting Mechanism | Quarterly | Half yearly |

Performance of SME IPOs in the Last 1 Year

Indian IPOs have been raging. BSE SME Index has risen by 118% in the last 1 year and has increased by 1900% since the end of 2019 compared to 59% for BSE Sensex Index. Comparatively, S&P BSE Smallcap Index has increased by 35% and BSE Sensex has given 16% returns in the last year.

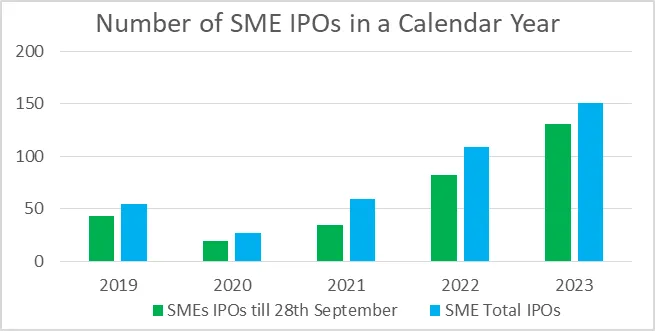

For this calendar year till 28th September we have seen 131 SME IPOs of which 83 have listed at a gain, 28 have listed in losses and the balance are to be listed. Total SME listings by the end of 2023 are expected to be around 15. Compared to 2022, this is a 60% increase in the number of SME IPO issuances. And comparing it to pre covid era of 2019, we see a 200%+ increase in the number of SME IPOs. As of 28th September, around 27 of these SME IPOs are currently in the negative territory, while the remaining in the range of 2% to upwards of 300%.

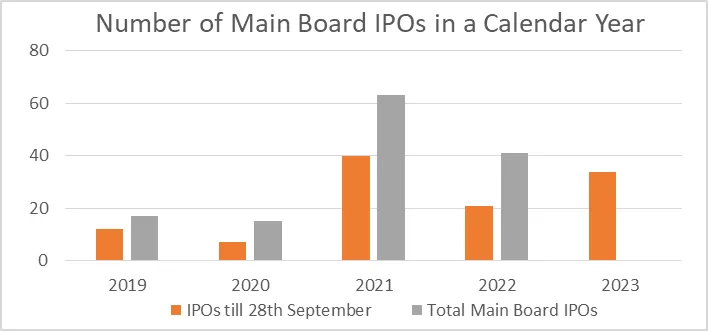

In comparison the number of main board IPOs till date are 34 in 2023 compared to 21 in 2022 and 40 in the 2021 IPO boom markets. Out of the 34, 27 have listed in gains, 1 has listed in a loss and the balance are yet to be listed. If we look the stock performance of main board IPOs since listing till today, only 3 are performing in the negative territory, while the balance are in the positive hovering between 7% to 50% with a few outliers at 80%, 100% & 160% returns.

It looks like Indian equity markets have been one of the busiest in 2023, with the most number of IPOs in a year so far and 8th in terms of issue proceeds. While the number of main board IPOs has increased significantly compared to 2022, it pales in comparison to the number of SMEs that have the Indian IPO markets. In terms of performance we see a more stable range i.e. there is definitely more volatility in the SME IPO market at the time of listing and even in price performance afterwards. That is the inherent challenge with such less known SMEs, even if there is an ongoing boom in the SME IPO space.

However, with all booms come cautionary tales. Will this momentum persist in the upcoming months? Is the ongoing SME IPO Boom a concern? Are markets acting irrationally?

Why are Indian SMEs Choosing to go public?

Favourable eligibility criteria with post-issue paid-up capital between Rs 1 to Rs 25 crore, SMEs can enter public markets via IPO and leverage capital markets for the funding needs. This platform has become a magnet for both retail and smaller institutional investors. The performance numbers as we saw above, while volatile are still promising. Since January 2022 to August 2023, over 160 issues on the SME board have had an average listing day return of 25% and the average return of SMEs listed in 2023 is around 80%. Some, like Droneacharaya and Phantom Digital, have given staggering returns of 90% and 200%, respectively.

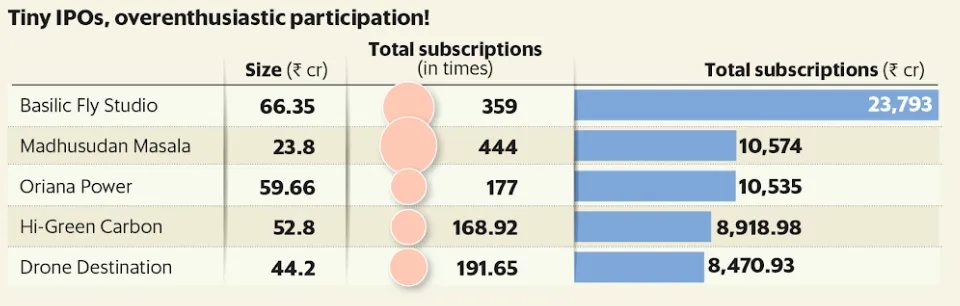

There is also significant public interest, probably a carry over effect from the smallcap rally earlier in the year. We are seeing a surprising trend where SME subscriptions levels have outpaced those of large-cap firms.

Why are Indian SME IPOs Booming?

Despite concerns such as poor trading liquidity and lenient disclosure norms, the SME IPO boom is hard to ignore. Many retail investors have placed bids that are over 100 times the IPO offerings. Such bullish behavior is underscored by the fact that the SME IPO index has surged 118% in the last year compared to Nifty50’s 15.8% and BSE Smallcap index giving 35%.

- Small and medium-sized enterprises have seen their offerings oversubscribed, reflecting high investor interest. For instance, the IPO of drone-maker ideaForge Technology Ltd garnered bids 106 times more than what was sought. Similarly, Utkarsh Small Finance Bank’s IPO received bids up to 102 times.

- SMEs often operate in niche markets with innovative business models providing unique products or services catering to a very specific segment. Investing in such companies offers investors a front-row seat to their growth journey at a very early stage, and the potential to benefit from significant future expansion.

- SMEs faced immense challenges during the pandemic lockdowns, inflation , global supply chain disruptions, and reduced consumer spending – hitting them hard. And these smaller firms are now being impacted by rising interest rates, are looking to equity markets to raise funds to meet their capex and working capital requirements. They are capitalizing on a market rally that has spanned 5+ months.

- The underwhelming performance of some large-scale IPOs, especially those that were hyped in 2021 and 2022. Notably, the Life Insurance Corporation of India and Delhivery, 2022’s biggest share sales, are trading below their sale prices. Similar story for Paytm, which is trading over 45% below its listed price.

- We are also seeing a surge in retail investors’ participation in equity markets and in mutual funds. 3 Million new demat accounts were opened in July 2023 compared to 12-month average of 2 million – a 50% increase and the highest since January 2022.

- At a broader level, India’s strong macroeconomic prospects , promising corporate earnings, an upcoming election year which could see increased government spending, potential of a festival season to hopefully boost lagging consumption demand etc. are giving investors confidence in the performance of these SMEs

Combination of ample liquidity and a buoyant secondary market are acting as a primary catalyst for this SME IPOs boom. Prevailing sentiment suggests that we are in the midst of an unparalleled IPO boom. In September, however, the grey market premium (GMP) seems to have been falling for new listings. While, investors have found profits can be made in stocks that are under-the-radar be it micro-cap, smallcaps or SME IPOs, especially as nearly 75% have listed in the green and have given varied listing returns and even post listing performance, are markets acting irrationally? Will every SME IPO give positive returns?

FOMO, Hype & Irrational Exuberance in SME IPOs & Stocks?

Another reason for increased interest in SME IPOs could also be that there is a strong correlation between strong bull markets and the number of companies hitting the IPO markets in such bullish phases. IPOs are seldom a feature of bear markets, a time characterized by investor rationality and a reluctance to overpay for stocks. Bull markets, on the other hand, fueled by investor optimism, often see an irrational exuberance, leading them to pay exorbitant prices.

While small IPOs currently offer higher returns, potential investors must approach with caution. SME IPOs are relatively unexplored, with minimal institutional ownership, an absence of foreign investors, mutual funds, analyst coverage etc. There is limited liquidity in SME stocks, traded in lot sizes that are larger in size than the liquidity and very little dissemination of company updates. SME stocks are also more prone to price rigging and notorious pump-and-dump schemes. These stocks are relatively easier targets for price manipulation, largely due to their thin trading volumes and the absence of a broad investor base, making them more volatile. There also appears to be a misconception that SME stocks are penny stocks in that they are undervalued or may present a bargain opportunity.

A prevalent FOMO (Fear Of Missing Out) sentiment, and the potent combination of all these elements with widespread social media activity opens the SME segment to rampant speculation, a conducive environment for price manipulators and the current exuberance driven by inflated valuations, could fall flat.

Manipulation & Fraud Tactics in SME IPOs

Livemint reported how certain tactics are being used to artificially inflate share prices, misleading unsuspecting investors. The article is an interesting read as it highlights the case of PMC Fincorp showing potential fraud by promoters. They issued warrants to non-promoters but declined conversion when share prices fell, effectively collecting funds without issuing shares. It also mentions STL where the promoter’s initial claims of being duped were false and investigations unearthed a web of deception, manipulation, and unethical diversion of funds. Here are 2 common scenarios of manipulating SME IPOs:

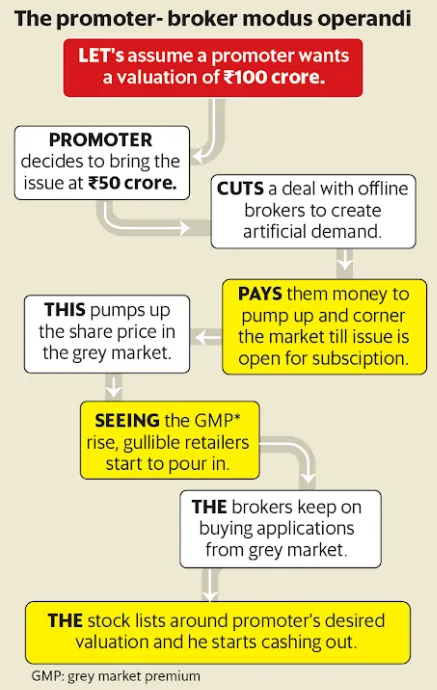

1. Grey Market Premiums To Artificially Boost SME Stocks Demand

Grey markets play a pivotal role in influencing stock valuations before they’re even officially available to the public. Imagine a promoter seeking a ₹100 crore valuation for a company. The promoter might undervalue the issue at ₹50 crore, thereby creating a seemingly lucrative opportunity. To artificially boost demand, the promoter strikes deals with offline brokers. These brokers, in turn, inflate the grey market premium (GMP), creating an illusion of a hot, in-demand stock. Unsuspecting retail investors, observing the rising GMP, jump in, adding fuel to the artificial hype. Once the stock lists and reaches the intended valuation, both the promoter and the brokers cash in, often leaving retail investors in a pickle.

2. Social Media To Create FOMO For SME IPOs

Brokers and savvy businessmen identify a potential stock and then orchestrate a social media campaign, leveraging influential accounts to create a buzz around the stock. This synchronized online propaganda draws retail investors, leading to an uptick in demand. When the stock lists, it attracts a modest premium, and retail investors, observing the minor uptick, start liquidating their holdings. This orchestrated exit gives the cartel a chance to buy at lower prices and benefit from the subsequent price increase.

SEBI Checks the SME IPO Market To Control Price Manipulation

On Tuesday 26th September, SEBI’s decision to enhance the trade-for-trade settlement framework and the short-term additional surveillance measure (ASM) for SME stocks triggered a market slump. This move, effective from October 3, aims to counteract price manipulation in SME stocks, which saw the BSE SME IPO index tumble by 2.5%. The scenario on NSE was no different, with three out of every four SME stocks experiencing a decline.

The Additional Surveillance Measure (ASM) is a tool employed by SEBI and the exchanges to protect investors’ interests. When stocks fall under the ASM criteria, they move into the trade-for-trade (TFT) segment, where only delivery trades are permitted. This mechanism intends to curtail excessive speculation in specific securities, ensuring market stability.

The ASM will come into play if there’s a price shift of ± 25% in five trading sessions or if limited clients monopolize trading in a particular script. Should these conditions be met, the exchange can impose up to a 100% margin for trading in such scripts. Furthermore, the company might be probed for any corporate declarations potentially influencing the stock price. Such regulatory interventions from SEBI and stock exchanges are likely to stabilize the price movements of these stocks within reason.

Some market participants also believe that to curb rampant speculation retail investors, who are typically more susceptible to FOMO, should be limited from investing in SME stocks. In contrast, Qualified Institutional Buyers (QIBs) should have the liberty to trade without added constraints.

Also, what should investors keep in mind when investing in the upcoming IPOs?

Should you invest in SME IPOs & SME Stocks?

SMEs have definitely faced immense challenges during the pandemic, global supply chain disruptions, rising input prices, inflation , increasing interest rates, limiting capital raise from debt markets reduced consumer spending etc. Yet, many SMEs have navigated these challenges and are now looking at IPOs as a smart financial move.

Market corrections and recent market volatility can be a good time to identify the resilient from the weak and vulnerable – and the same applies to SME stocks. Finding such strong businesses with exemplary governance, strong financial standing, and resilient business strategies should be a priority especially when looking at SME stocks & SME IPOs. Investors’ focus will inevitably shift towards prioritizing firms characterized by good governance, solid financials, and enduring business strategies as the hype dies down.

While SME Stocks present promising growth prospects, they’re also better suited for investors willing to shoulder high risks with a long-term investment outlook. It is imperative to select the right SME Stocks given the vastness of the micro-cap space, numerous SMEs offer sound growth potential at reasonable valuations and it’s our job as investors to identify the right ones within all the FOMO, hype and irrational exuberance.

Read the full article on Wright Research SME Stocks Are Booming: Should You Invest In SME IPOs.

Wright Research Telegram and Youtube Channel

Join our Telegram Channel to get daily morning market updates. Subscribe to our Youtube Channel to learn about all things investing, understand sector performance, get key insights into new topics like concentrated portfolio, quantitative investing and more!

Read our article to understand impact of Inflation in India and on investment portfolios, Will market volatility continue? Where to invest in volatile times?

Explore Wright Research smallcases here

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Visit bit.ly/sc-wc for more disclosures.