The Good Bad and Ugly weekly review : 06 February 2024

Markets this week

Nifty displayed promising patterns this week. Despite a partial decline towards the end of the week, an inverted head and shoulders pattern emerged, indicating a potential downtrend. The bottom support at 21,500 to 21,450 remained crucial, while the neckline at 21,800 remained intact. If these levels are not breached, the index could potentially reach 24,000 to 24,500.

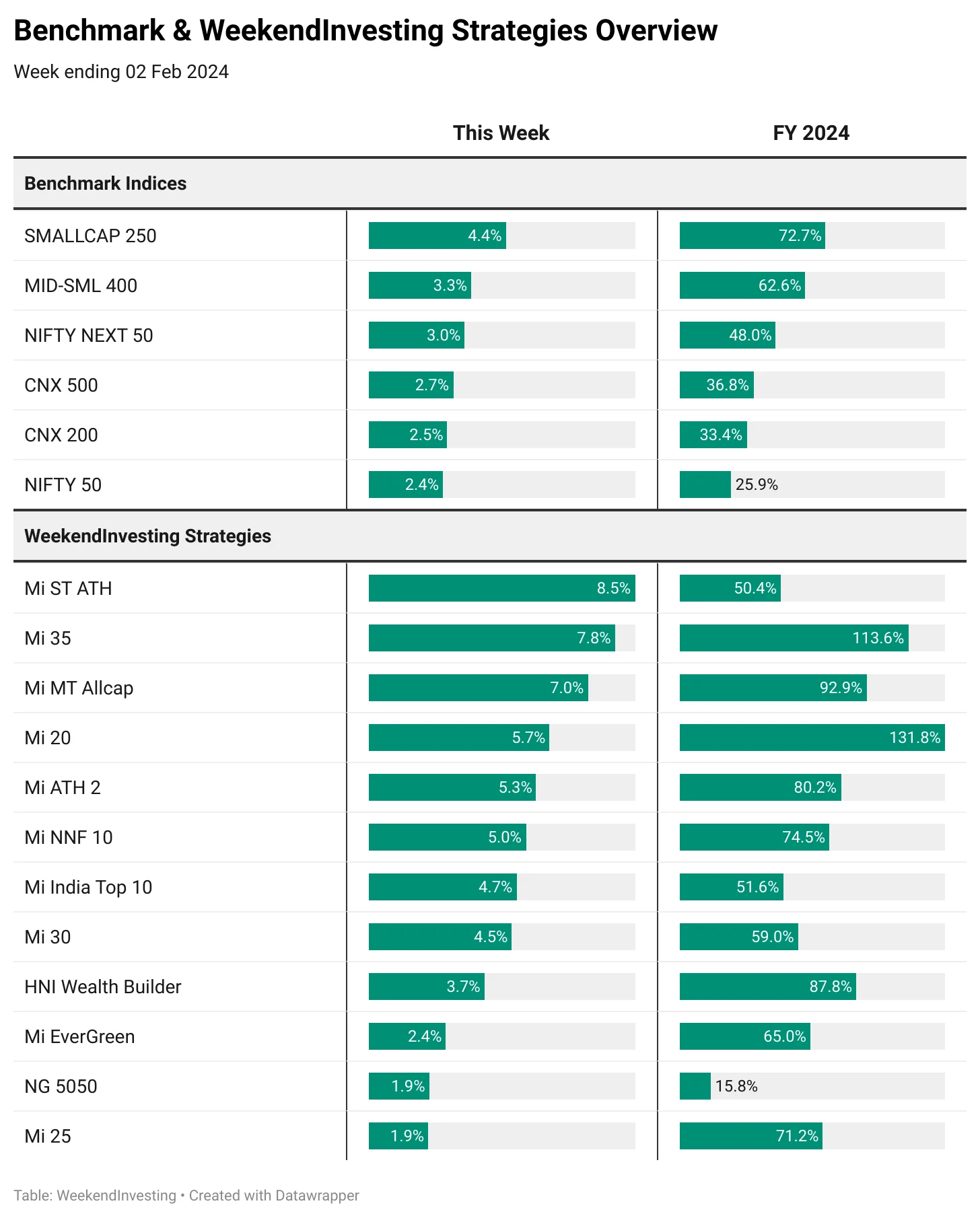

Benchmark Indices & WeekendInvesting Overview

Smallcap 250 index had a remarkable run this week clocking 4.4% followed byt Mid-Small 4oo index at 3.3% while other benchmarks were also up between 2.4% and 2.7%.

From the FY 24 perspective, Smallcap 250 leads the chart with a splendid performance of 72% followed by Mid-small 400 index at 62%. Nifty 50 however has stayed relatively weak clocking only 26% clearly indicating that money flow is predominantly seen in the lower market cap segments so far.

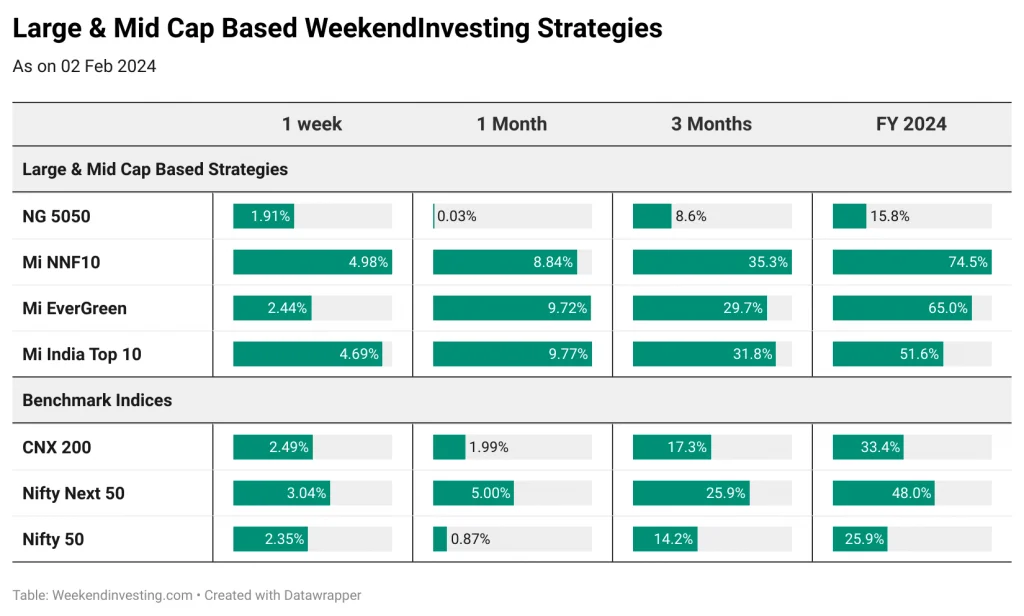

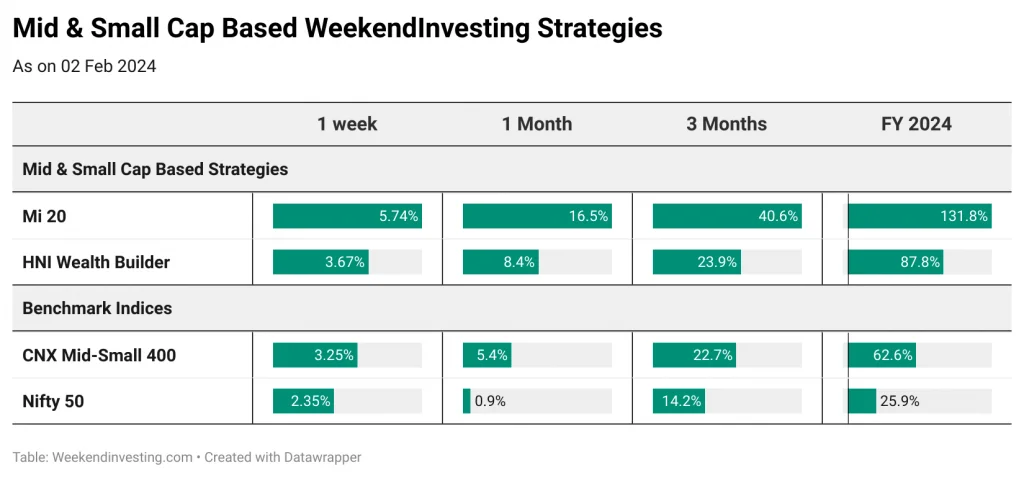

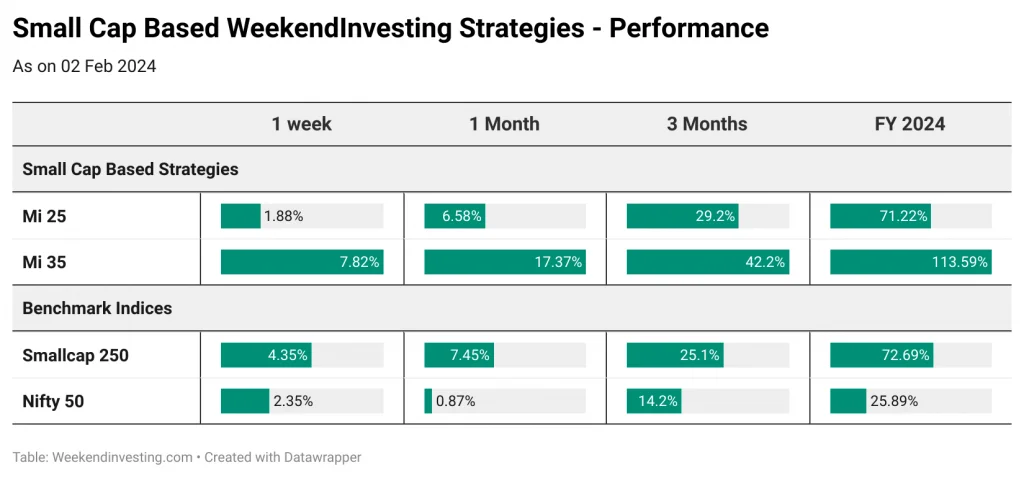

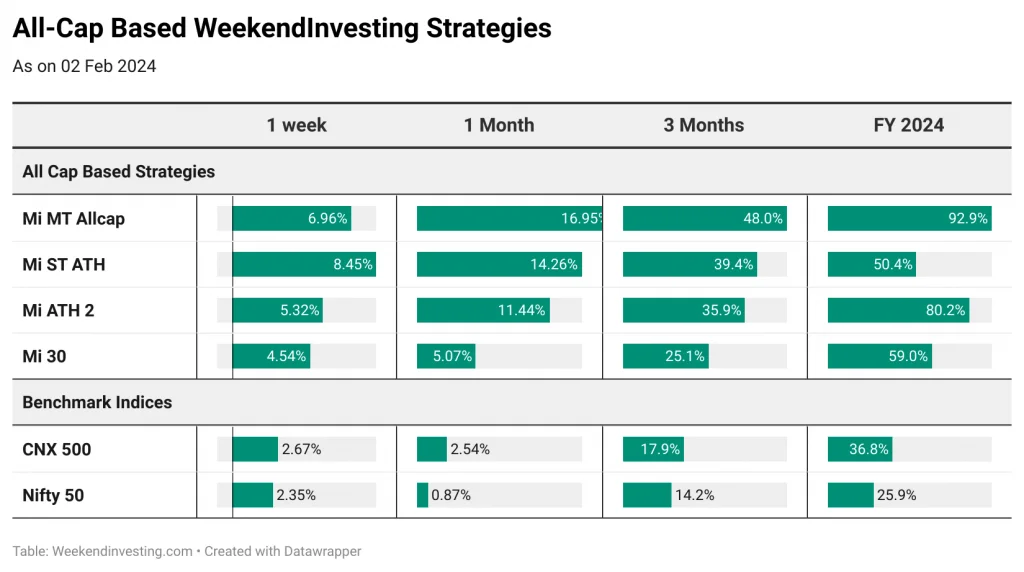

WeekendInvesting Strategies had a fantastic week with Mi ST ATH leading the chart clocking 8.5%. Mi 35 was also splendid having recorded gains of 7.8%. Mi MT Allcap comes third on the weekly chart having recorded 7% gains. The best part of the week has to be the fact that majority of the strategies outperformed their respective benchmarks.

From the FY 24 perspective, Mi 20 continues to perform beyond the realms of our imagination clocking 131%. Mi 35 has also done incredibly well to record 113%. Mi MT Allcap and HNI Wealth Builder have been really done well too clocking 92% and 87% respectively.

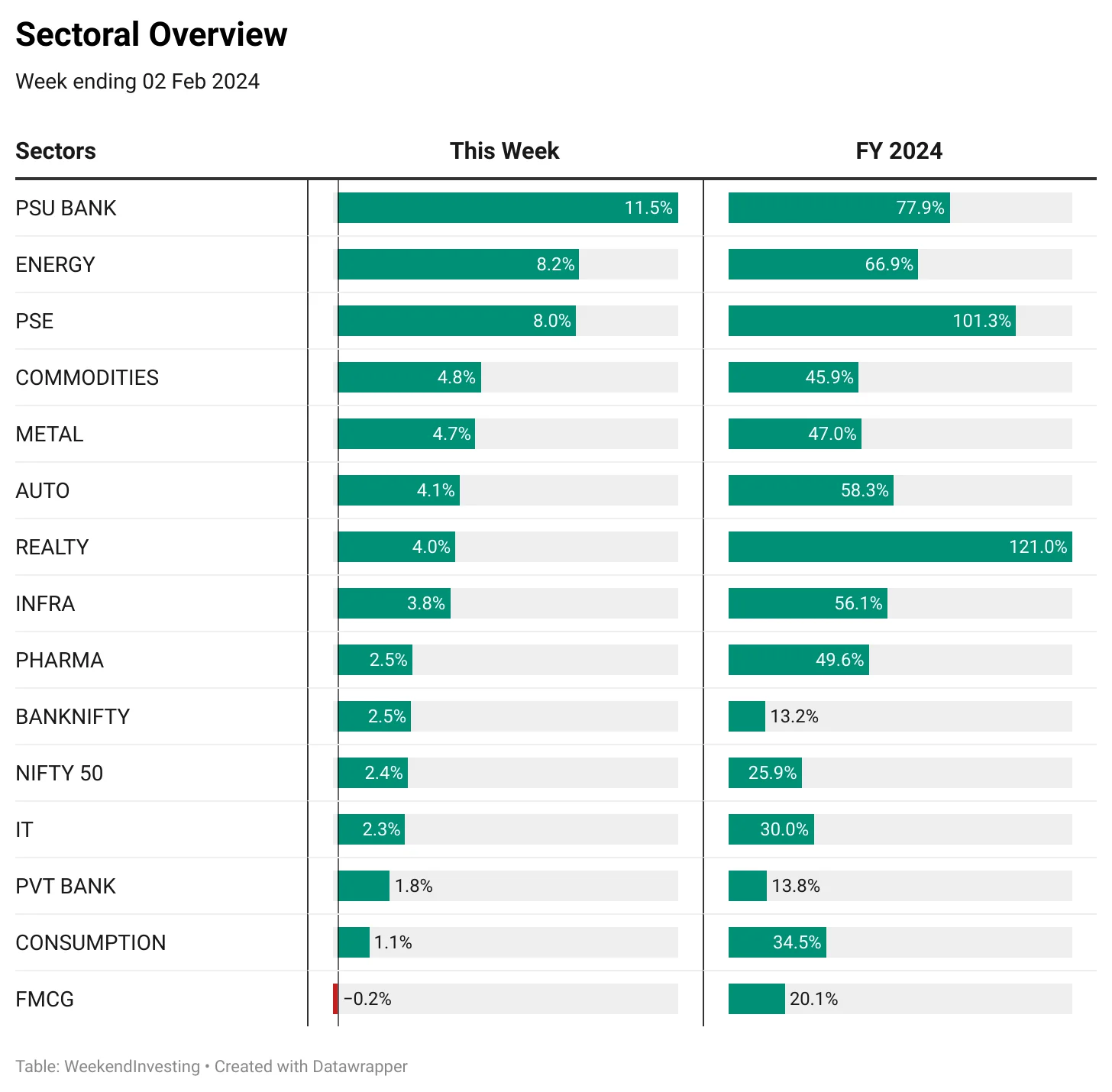

Sectoral Overview

PSU Banks had a fantastic week leading the sectoral weekly charts clocking 11.5%. ENERGY & PSE stocks also did well clock around 8% gains each. Majority of the sectors ended up doing well clocking gains in excess of the benchmark, Nifty 50.

On the FY 24 front, REALTY has stayed on top despite the recent correction at 121% gains while PSE stocks have continued on their strong momentum clocking 101%. PSE Banks have also done really well recording 78% gains while the PVT Banks have had a contrasting outcome with only 14% gains.

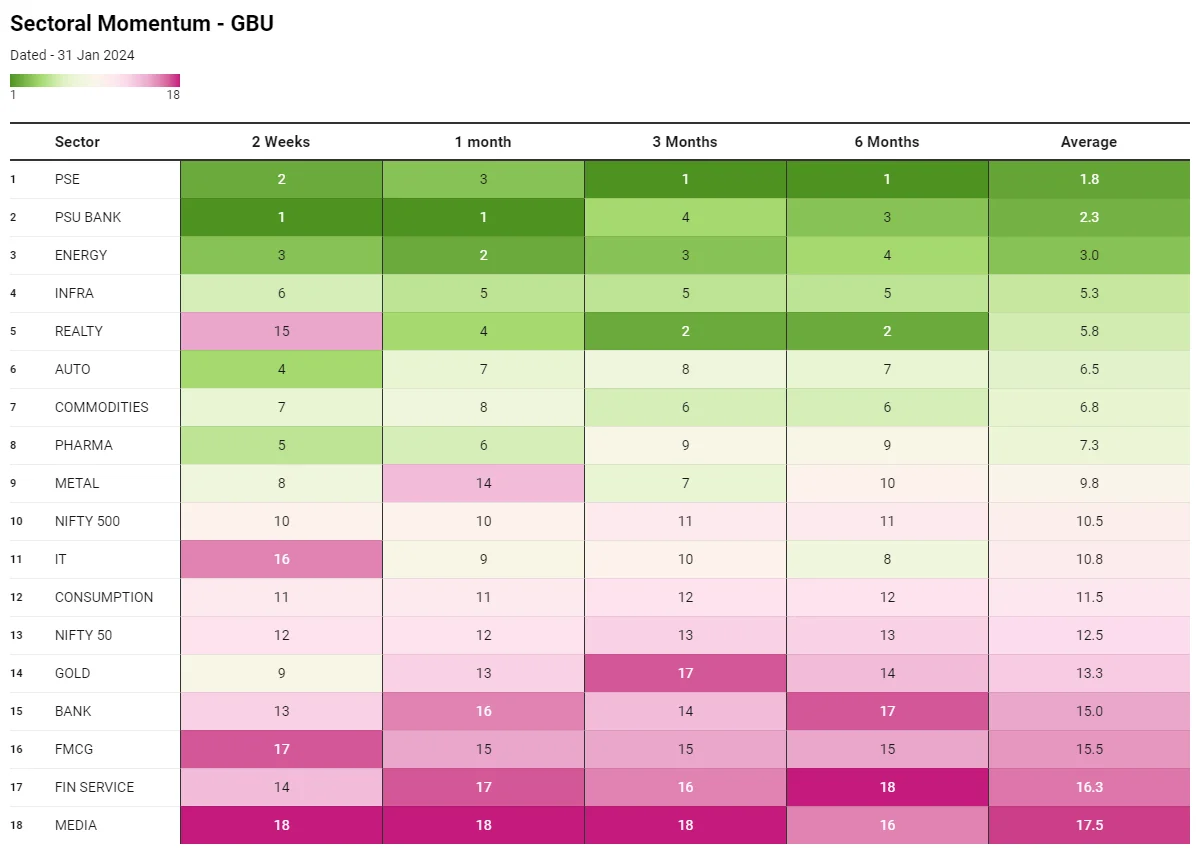

REALY continues to lose steam slipping to #15 on the weekly momentum chart. Despite the weak performance, the sector find itself in top 5 due to its strong performance in the last few months and FY 24. PSE and PSU BANKS have been super strong occupying the top 2 slots with ENERGY taking the third. METALS have done well to regain momentum after a slump in the early part of past month. IT stocks have once again fallen off the radar slipping to #16 in the fortnightly chart as BANKS, FMC & MEDIA continue to languish at the bottom.

Spotlight – JBMA scores 3x in Mi 35

We had entered JBMA back in Mar 2023 at about 629 levels and the stock has become a 3x bagger recording a superb 210% since entering our portfolio. We continue to hold this stock in the strategy and would like to further illustrate the importance of running along with your winners as far as possible while cutting down on your losers early.

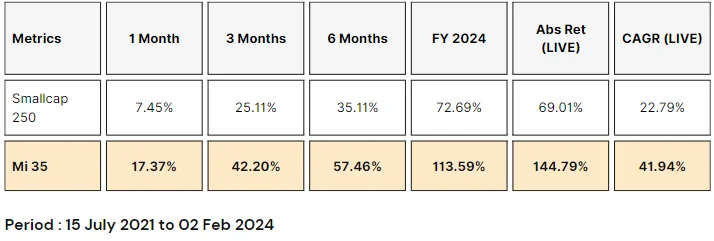

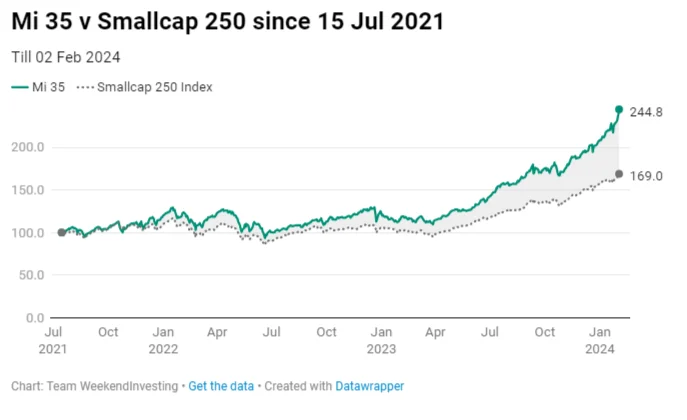

Mi 35 has done exceptionally well since launch clocking a massive 144% gains compared to it’s benchmark, the Smallcap 250 index which clocked only 69% ( 15 Jul 2021 to 02 Feb 2024 ).

What is impressive is that the strategy has managed to outperform its benchmark across all timeframes and emerge as an absolute favorite among many many folks.

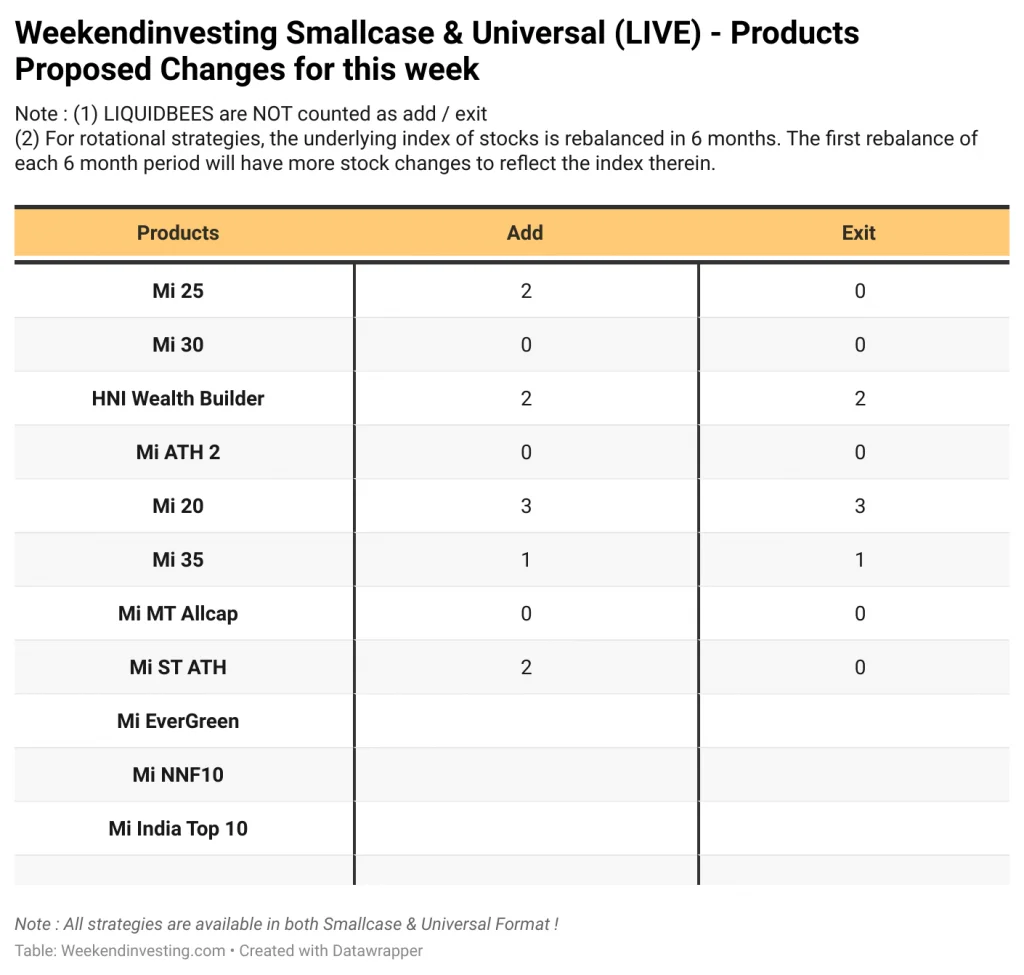

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Explore Weekend Investing smallcases here

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst