The Good Bad and Ugly weekly review : 09 Feb 2024

Markets this week

Nifty was dull this week oscillating between 21630 and 22130. This consolidation especially after such a strong really does not call for any complaints whatsoever as long as we don’t see a big move on the downside.

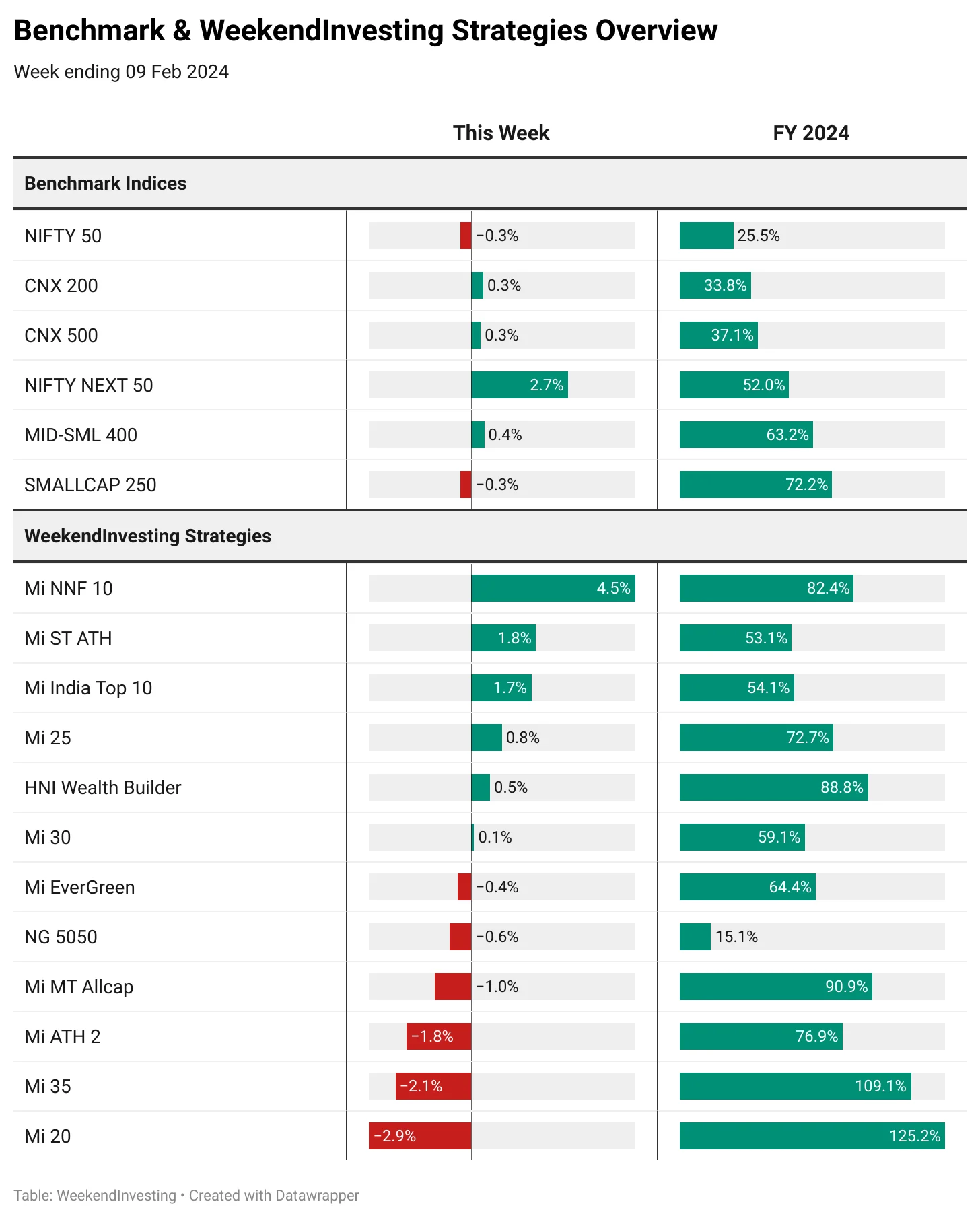

Benchmark Indices & WeekendInvesting Overview

Nifty 50 was flat at -0.3% along with most other benchmark indices barring Nifty Next 50 which did really well to clock 2.7% achieving a significant outperformance. The index has also clocked 50% gains for FY 24 and looks very strong going forward too. Smallcaps and Midcaps lead the FY 24 chart clocking 72% and 63% respectively while Nifty is the least performing index at 25.5% gains.

Mi NNF 10 rode on the strong trend in Nifty Next 50 extracting as much as 4.5% gains for this week. This solid week takes Mi NNF 10’s FY 24 tally to a brilliant 82.4% compared to 52% on its benchmark, the Nifty Next 50 index. Rest of the strategies had a mixed outing this week with the likes of Mi India Top 10, Mi ST ATH and Mi 25 doing well as others had a below par outing. Despite losing almost 3% this week, Mi 20’s FY 24 returns stand at a majestic 125% winning appreciation from all corners of our community. Mi 35 has been the second strategy to score a century in FY 24 with Mi MT Allcap. HNI Wealth Builder and Mi NNF 10 fast approaching that mark.

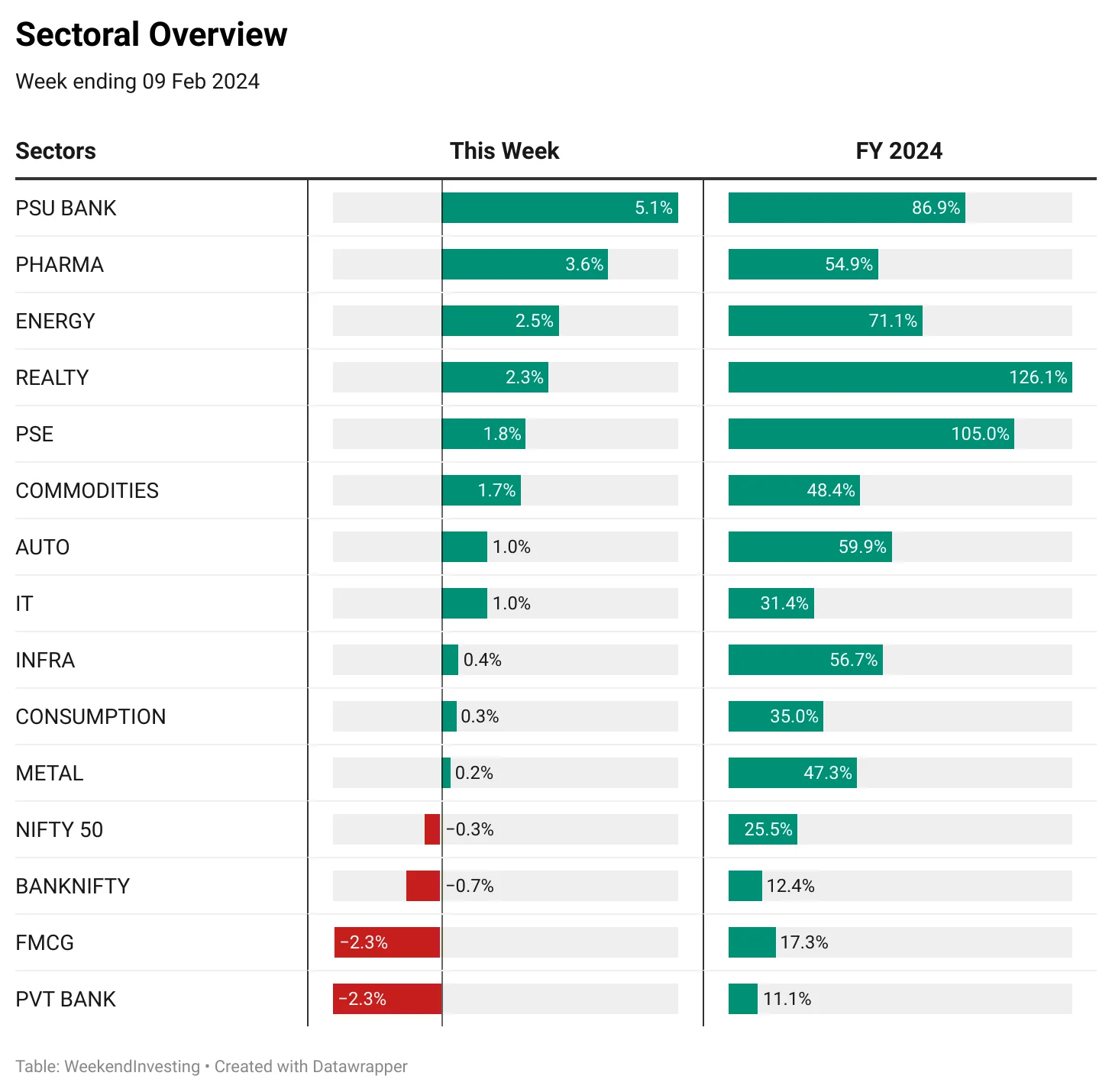

Sectoral Overview

PSU Banks continued on their exceptional momentum clocking 5% gains this week taking its FY 24 tally to 87% returns. REALTY did well this week to clock 2.3% to stage a decent recovery after a little bit of a slump in momentum recently. PSE gained 1% to hit a century in FY 24 while FMC and PVT Banks remained quite weak.

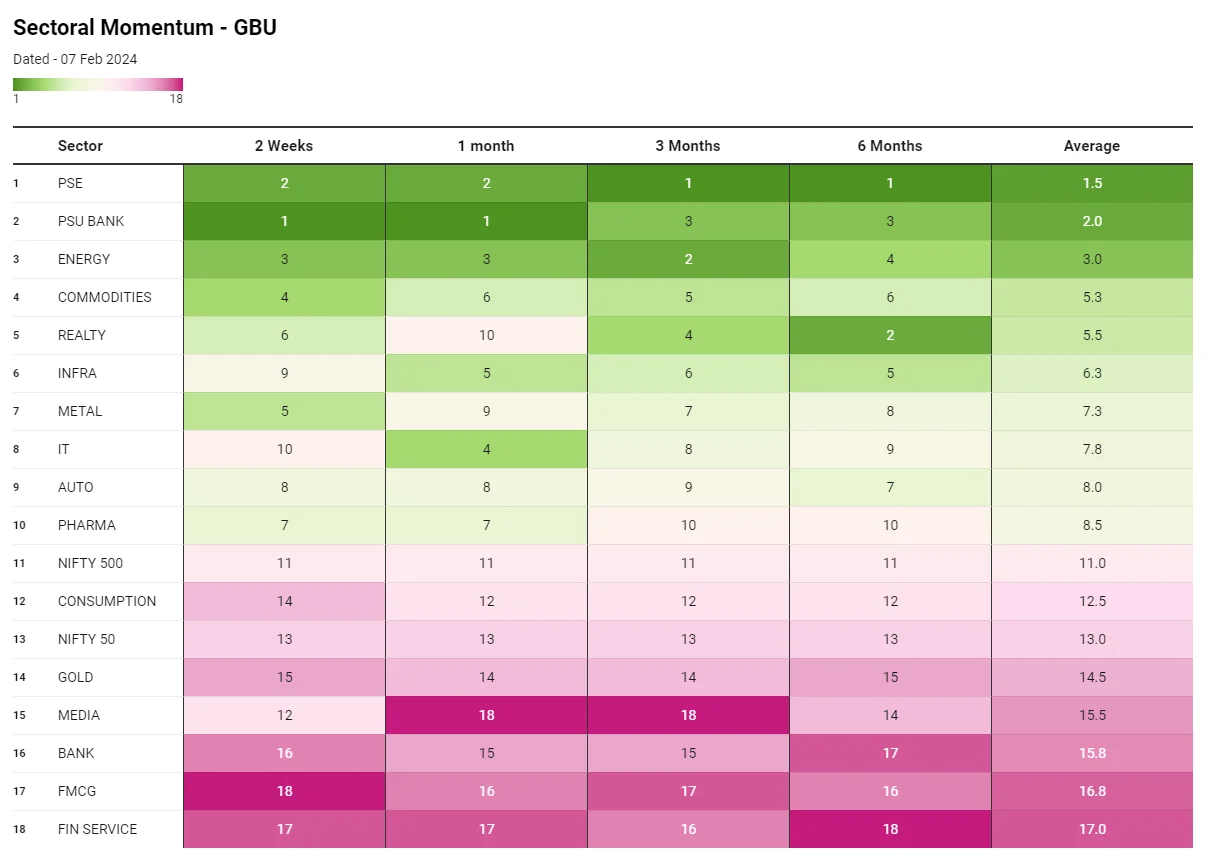

In terms of sectoral momentum ranking, PSE continues to perform splendidly retaining its position pretty firmly in the top 2 ranks across all time frames. PSU banks have also been extremely consistent securing sub #3 ranks across all timeframes. METALS and INFRA are slowly coming up the ranks while BANKS , FMCG, FIN SERVICES languish at the bottom. REALTY has lost some ground in the monthly ranking slipping to #10.

Spotlight – OLECTRA scores 3x in Mi 25

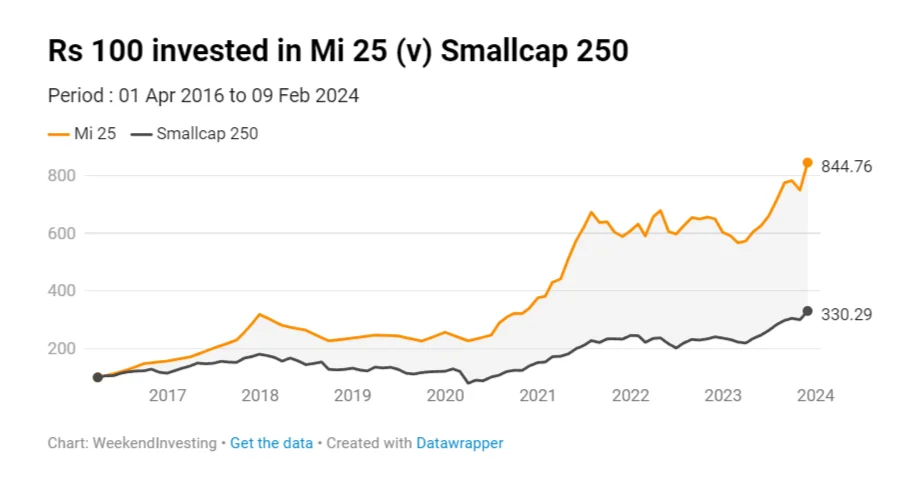

OLECTRA is the stock taking the spotlight this week having recorded 3x gains since coming into our Mi 25 strategy in March 2023.

Mi 25 went live on 01 Apr 2016 and has been a remarkable performer in the smallcap space having clocked 8.4x gains compared to about 3.3x on the benchmark – the Smallcap 250 index.

Check out Weekend Investing smallcases here

Weekendinvesting Analytics Private Limited•SEBI Registration No: INH100008717

B- 6/102, SAFDARJUNG ENCLAVE, NEW DELHI South West Delhi, Delhi, 110029

CIN: U72900DL2021PTC380866

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Disclosures: Link