The Good Bad and Ugly weekly review : 10 Oct 2023

Introducing “The WeekendInvesting Newsletter”

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our newsletters for this week.

Markets this week !

Nifty experienced some volatility, with the first half being a bit ugly. However, the last couple of sessions brought some stability. We witnessed a bounce of around 300 points from the recent peak of 20,000, marking the first significant recovery since reaching 19,300. While external challenges persist, the market seems to be indicating a correction or sideways movement, rather than a sharp drop.

Analyzing the weekly chart, we observe a very promising weekly candle formation. It resembles a long-legged hammer, usually a sign of an intermediate bottom being achieved. If the market crosses the high of the week, it would instill confidence in the bulls, potentially leading to a retest of the previous top at the 19,200 level. This level remains a major support for the market at present.

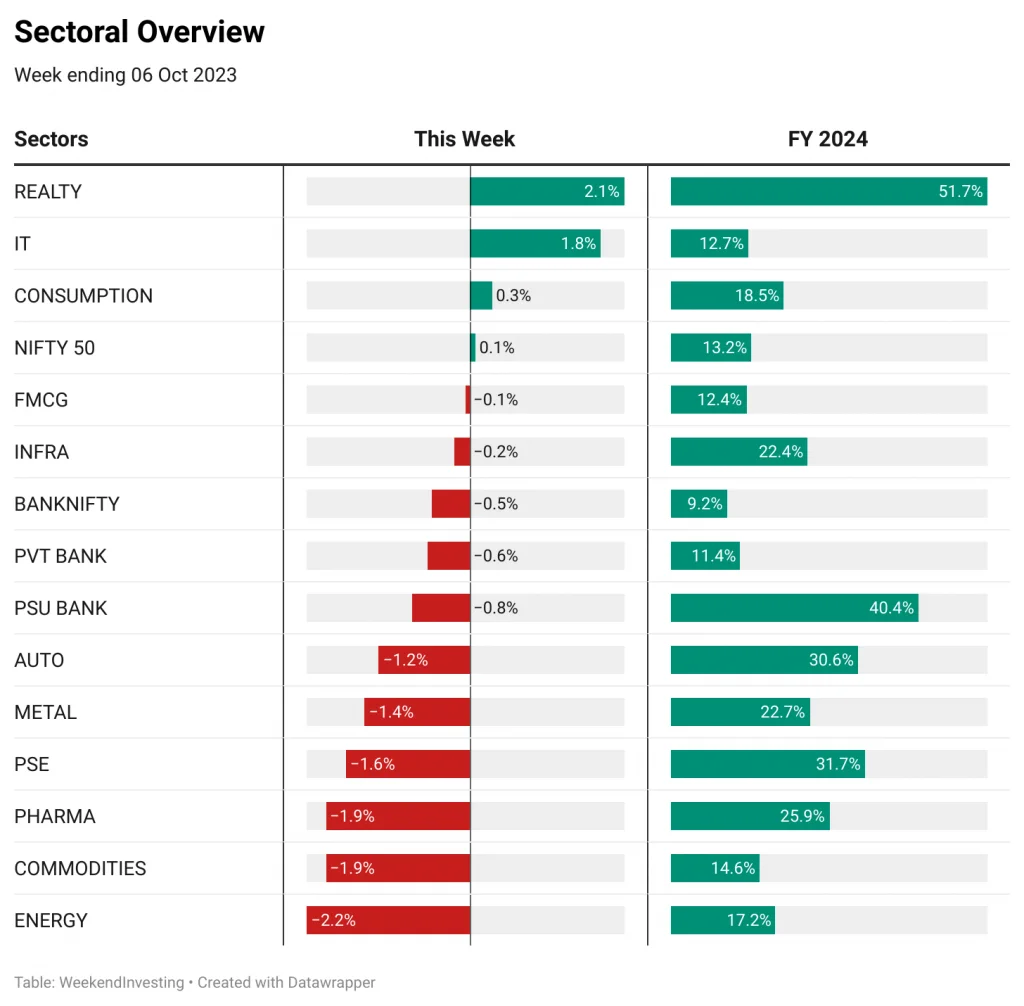

Sectoral Overview

Towards the second half of the week, real estate stocks performed well, recording a 2% increase. IT stocks also showed resilience, with a growth of 1.8%. However, consumption stocks remained flat, while other sectors witnessed a decline. The energy sector experienced the most significant loss at 2.2%, followed by commodities, pharma, and public sector enterprises, including PSU banks.

Despite the temporary setbacks, certain sectors have shown impressive growth over the financial year. Real estate has been the top performer, with a remarkable 51% increase. PSU banks and public sector enterprise stocks have also witnessed significant gains, with 40% and 31% growth respectively.

Analyzing the sectoral momentum over the past 10 to 20 days, we observe that real estate has consistently retained the top ranking. Pharma is rapidly catching up, although it experienced a slight setback this week. Infra stocks are also performing well, along with the media sector, primarily driven by ZEE holding significant weightage in the index. Public sector enterprises and PSU banks have also shown resilience.

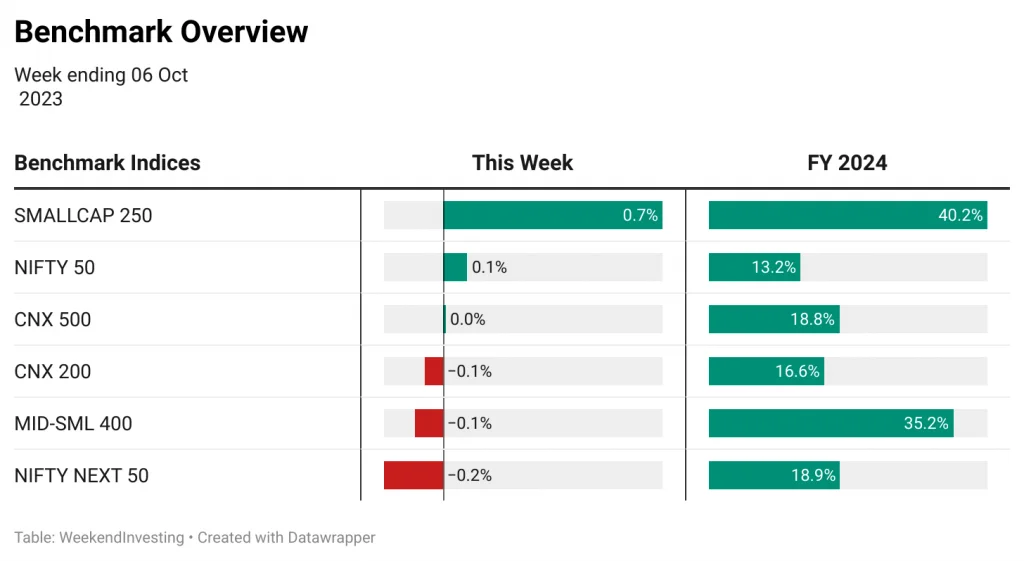

Benchmark Indices Overview

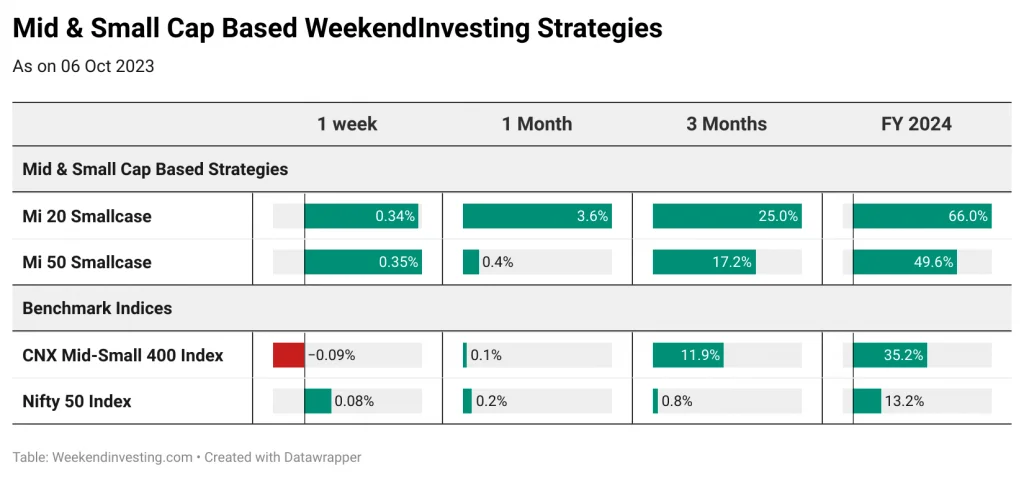

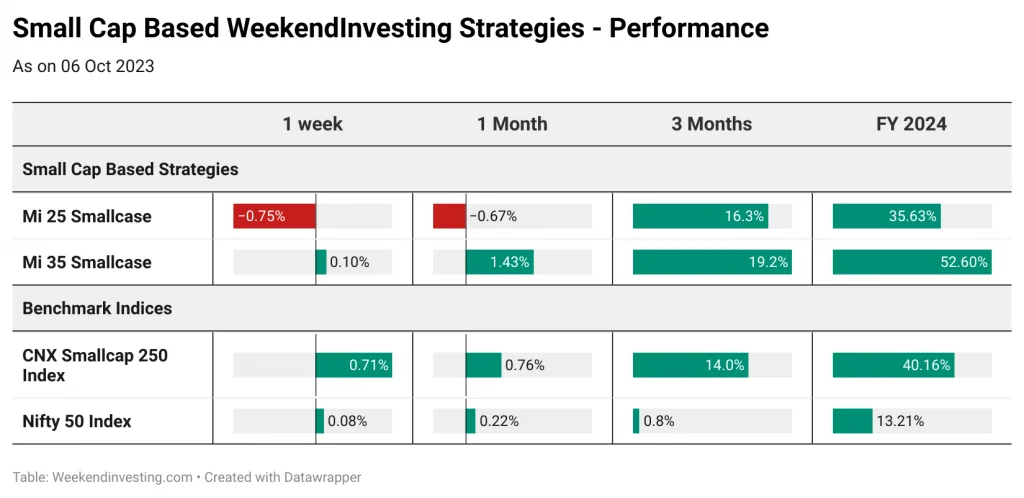

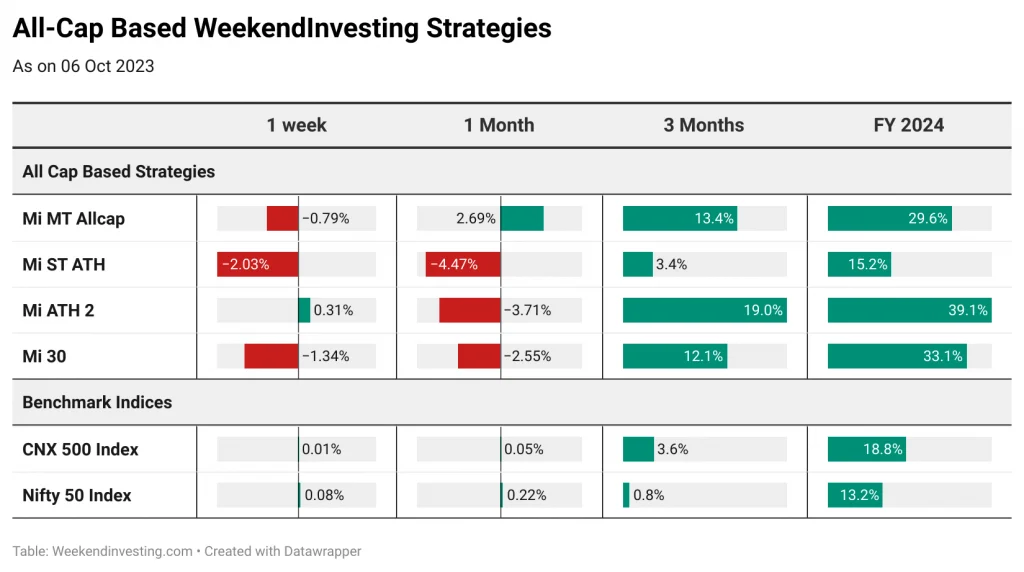

The small-cap 250 index witnessed a 0.7% rise this week, while other indices mostly remained stagnant. Small-cap stocks continue to outperform the broader market, with a 40% increase over FY 24. Mid and small-cap indices have also seen significant growth, up by 35% (FY 24). In contrast, the major indices, such as Nifty and others, have experienced high single-digit growth, ranging from 13% to 18%.

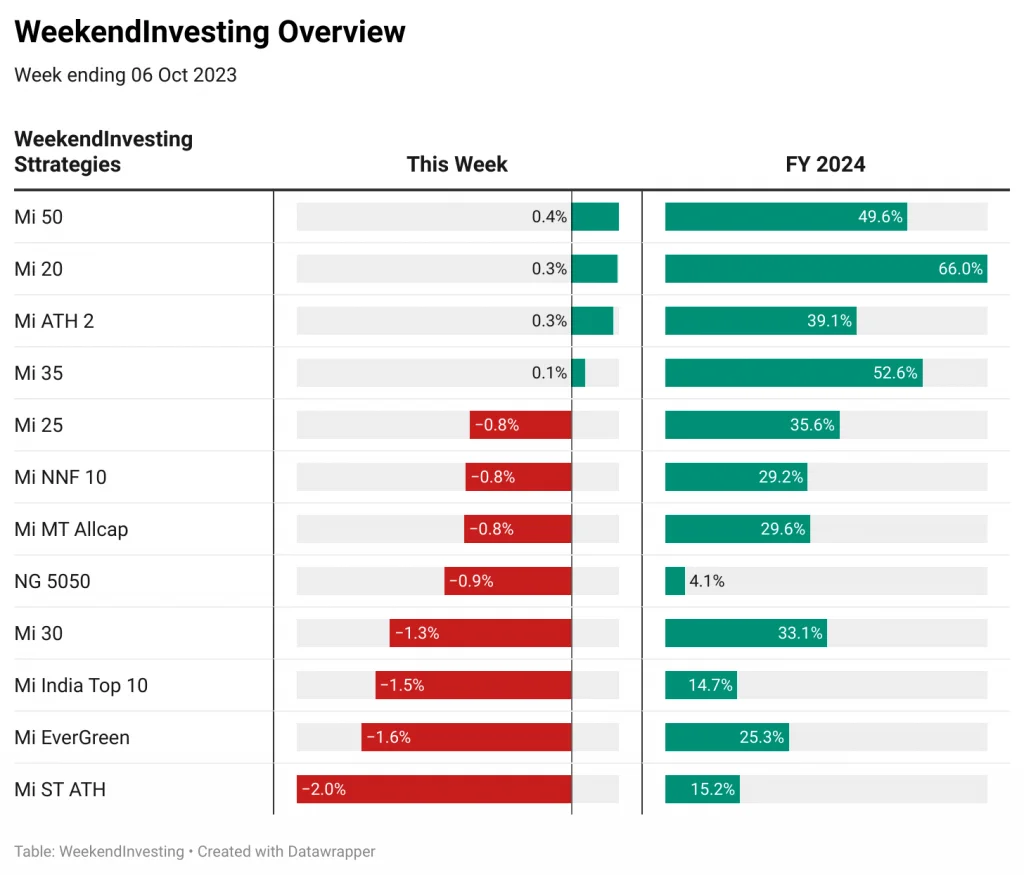

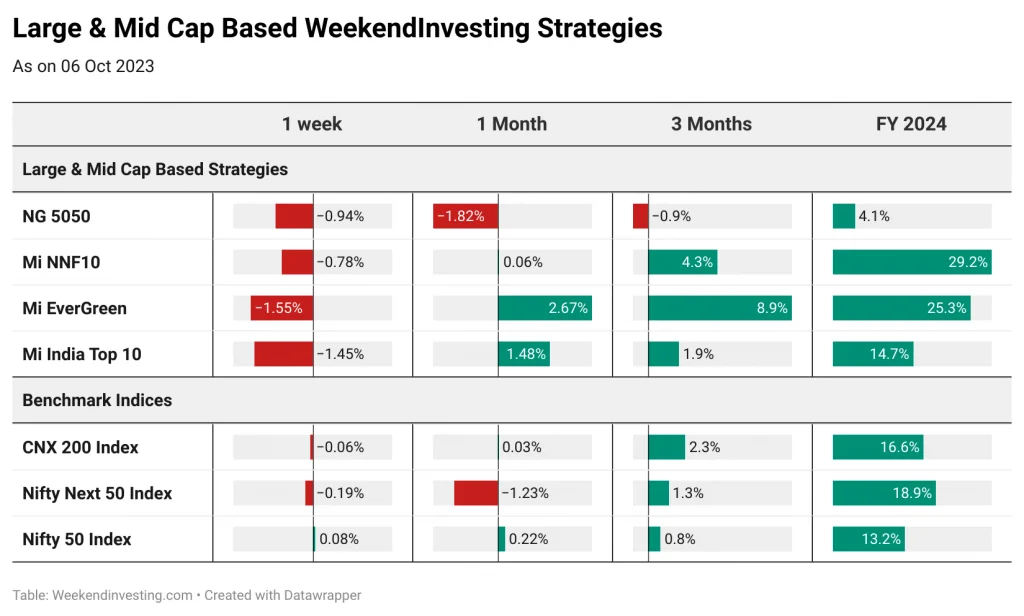

WeekendInvesting Overview

The strategies are in line with the broader indices, experiencing losses ranging from 1% to 2%. Beta plays a significant role in these strategies, especially when coming off the top. However, Mi ATH 2 has managed to survive with positive returns, whereas Mi ST ATH suffered a loss. Strategies with a small and mid-cap focus, such as Mi 20, Mi 50, and Mi 35, have performed reasonably well, with gains ranging from 2% to 66%. Diversified strategies like Mi MT Allcap, Mi 30, and Mi India Top 10 have also demonstrated positive performance. Mi NNF 10, relative to Nifty Next 50, achieved a growth of 29%.

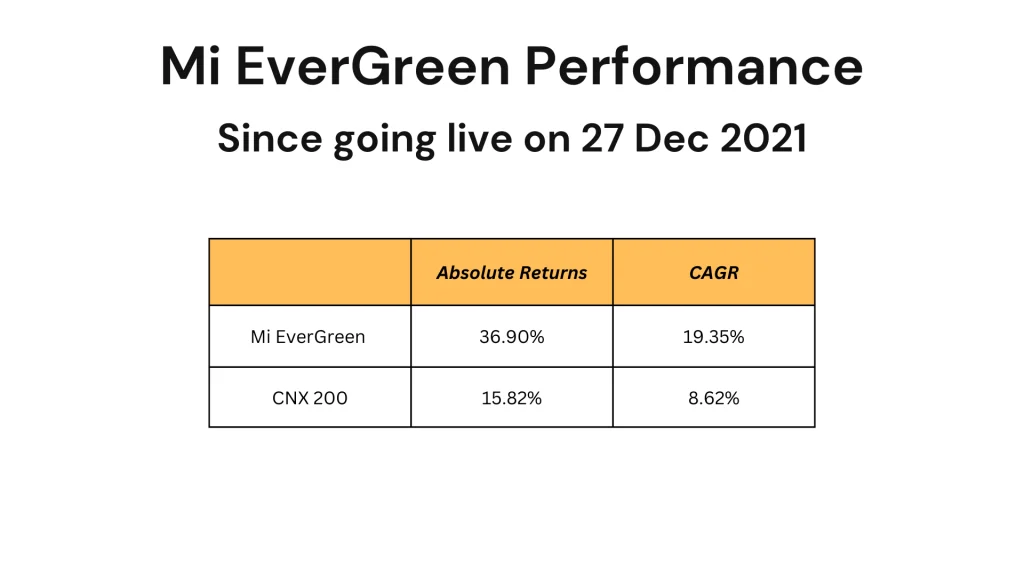

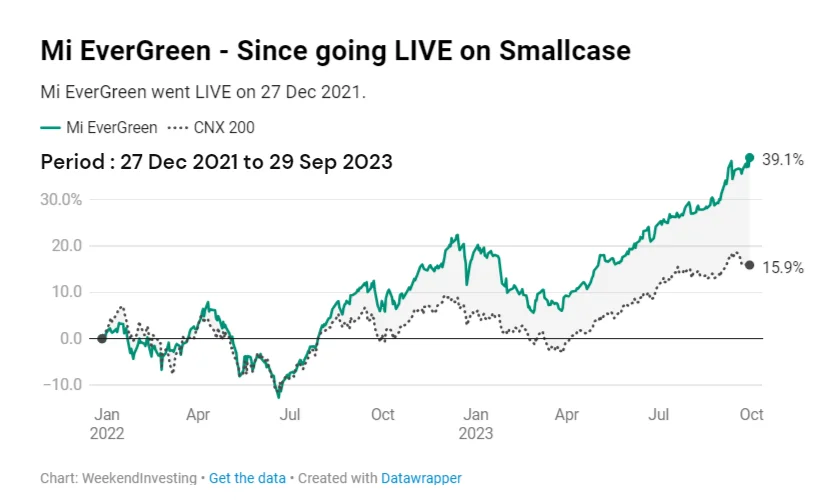

Spotlight – 2x bagger on REC Ltd in Mi EverGreen

One stock that has been in the spotlight is the Rural Electrification Corporation Ltd. (REC). After entering Mi EverGreen back in Apr 2023, REC has witnessed a massive rally, with a two-fold increase in its value. Currently, it is holding a 115% gain. REC is included in the Evergreen strategy, which is noteworthy for its monthly profit redistribution feature. This strategy allocates 25% to gold and the remaining 75% across 20 stocks. As stocks perform, the gained profits are continuously redistributed to maintain the original weightage. This profit distribution mechanism helps minimize losses when a stock starts to decline.

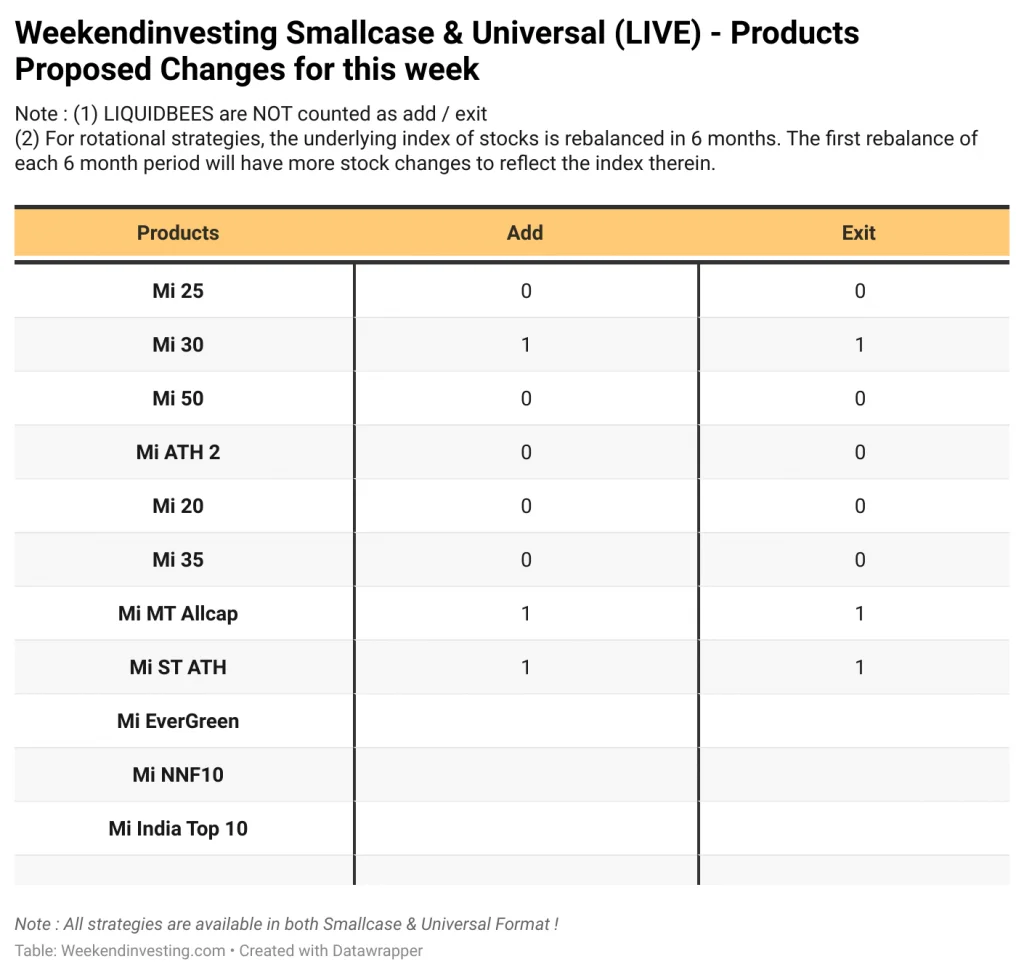

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Check out Weekend Investing smallcases here

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst