The Good Bad and Ugly weekly review : 23 Jan 2024

Markets this week

Nifty experienced a crash following the unexpected underperformance of HDFC Bank’s results, leading to a loss of over one lakh crores in market cap. However, there was a reasonable pullback in the larger markets on Thursday and Friday, mitigating the damage for the week. Despite the volatility, I believe the market will continue to march strongly towards 25,000 this year.

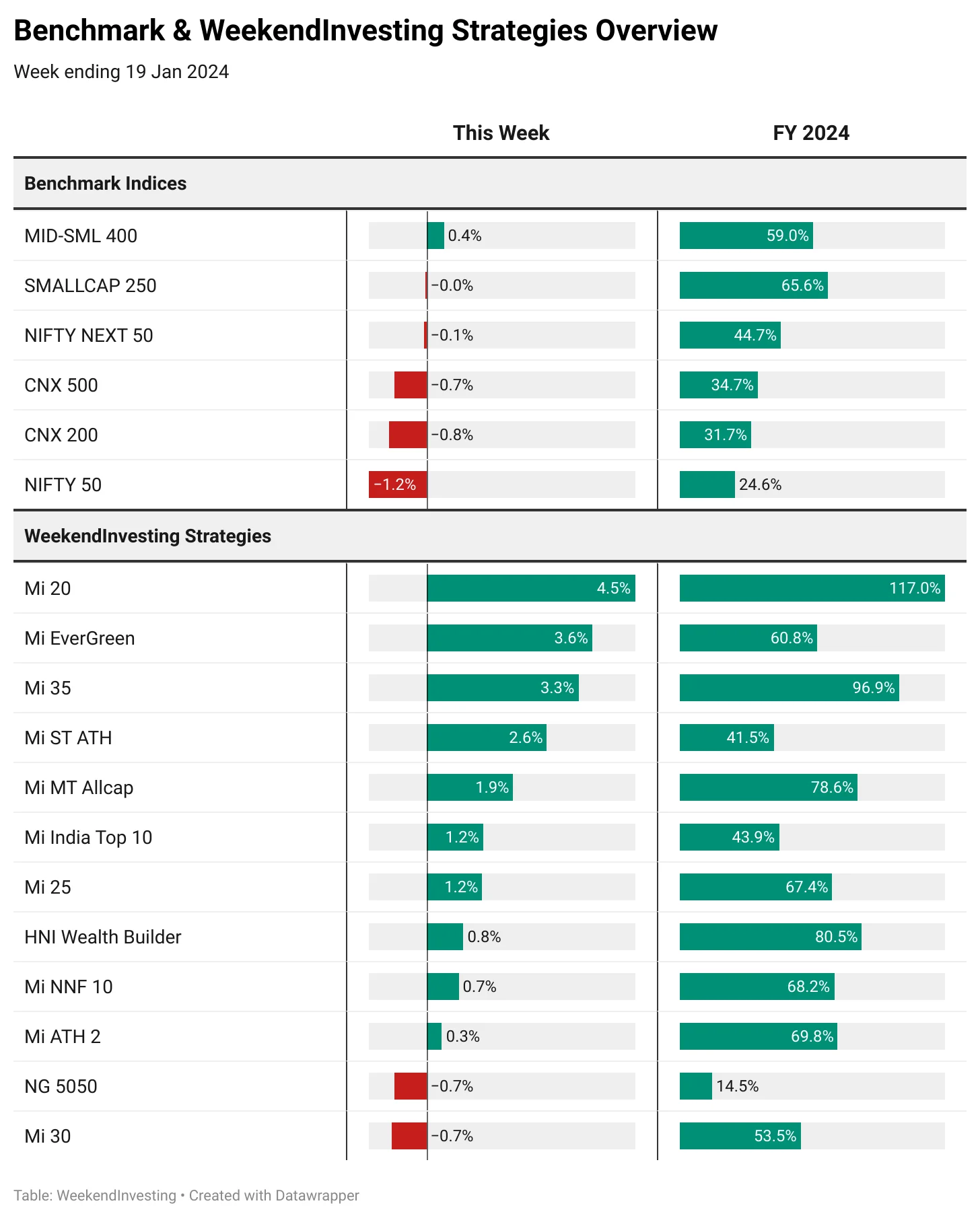

Benchmark Indices & WeekendInvesting Overview

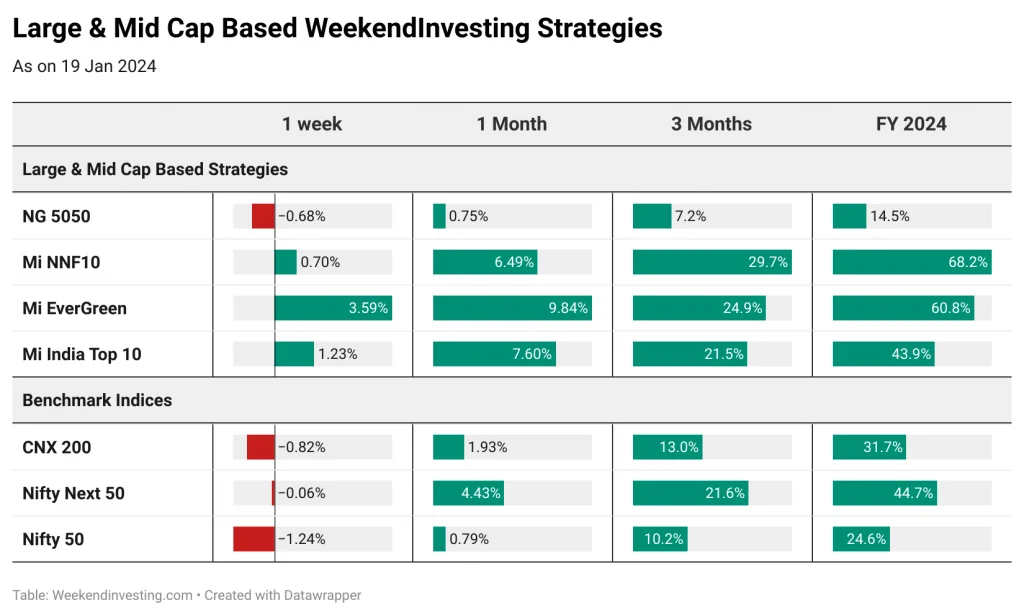

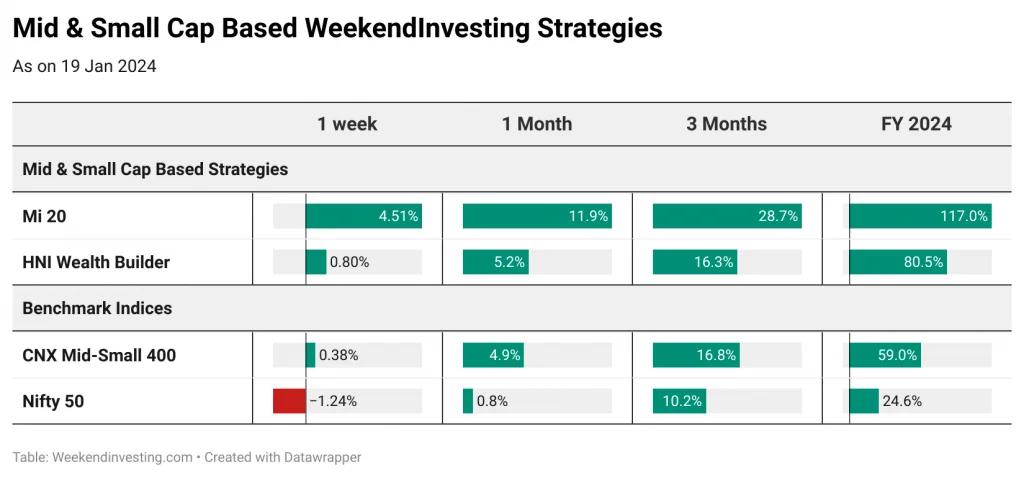

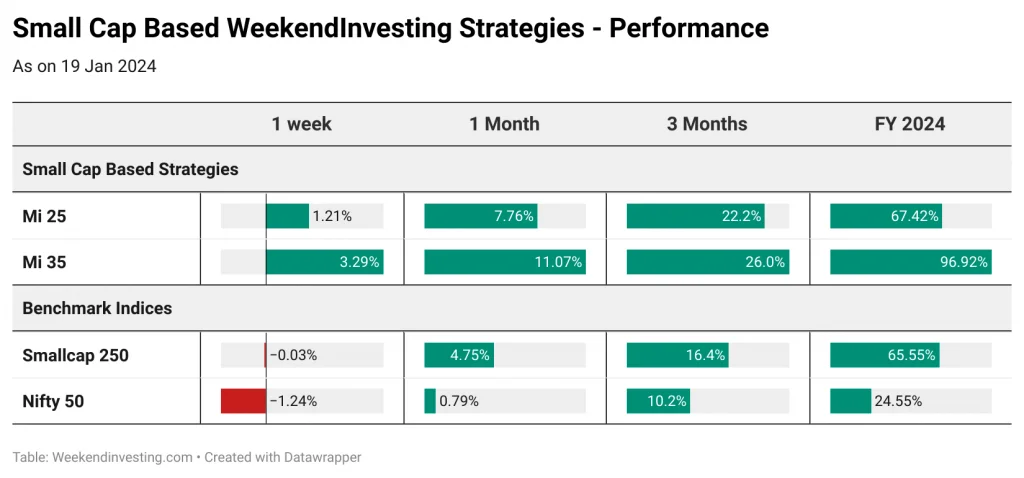

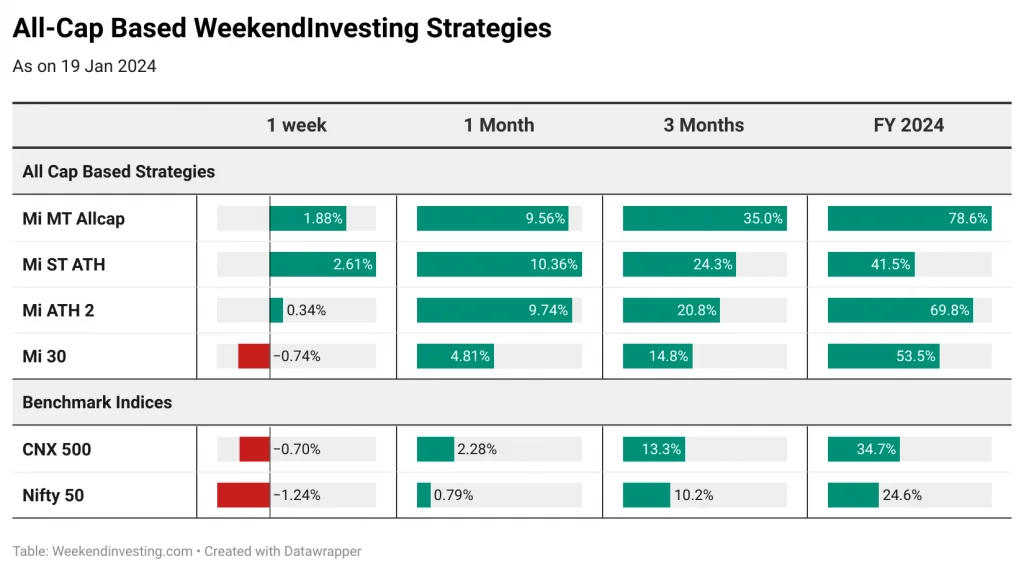

While benchmark indices remained flat or down, several of our weekend investing strategies showed strong performance. Mi 20 strategy gained 4.5% for the week and an impressive 117% for the financial year. MI Evergreen was up 3.6% for the week and 61% for the financial year. Similarly, Mi 35 saw a 3.3% gain for the week and a remarkable 96.9% gain for the financial year. Mi ST ATH also showed substantial growth, up by 2.6% and 41.5% for the week and financial year, respectively. Additionally, Mi MT Allcap demonstrated a 2% increase and an impressive 78.6% gain for the financial year.

This week & the FY 24 performance also serve as a classic example of absolute outperformance of the strategies compared to the benchmarks.

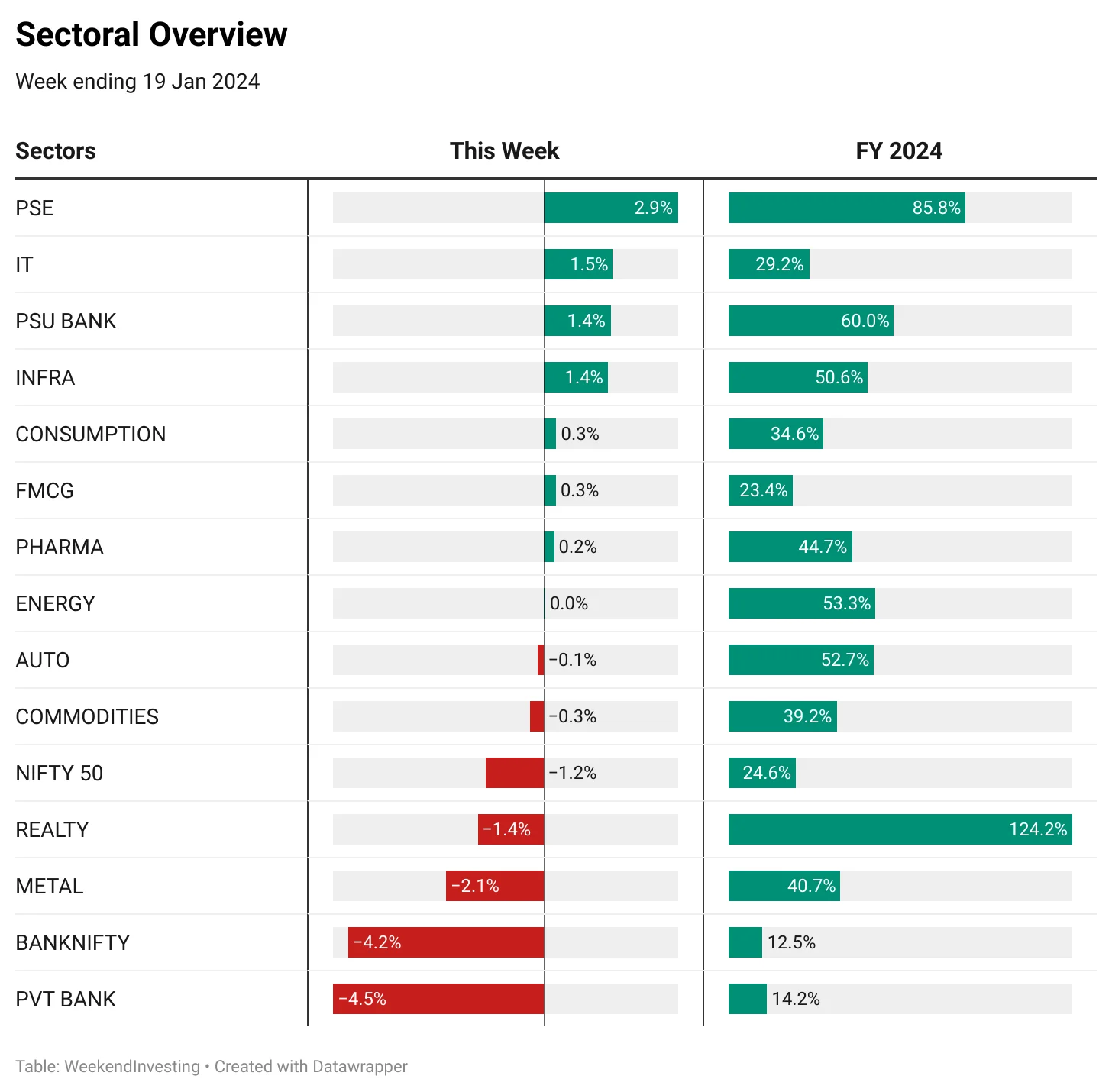

Sectoral Overview

Taking a closer look at the sectoral performance, we observed some interesting trends. Public sector enterprise stocks experienced a significant increase of 2.9%, while IT stocks made a comeback with a 1.5% gain. PSU banks also showed improvement, with a 1.4% increase. In contrast, private banks, led by HDFC Bank, saw a decline of 4.5%. Metals and real estate also took a backseat, with a decline of 1.4% and 1.2% respectively. Despite short-term fluctuations, real estate has witnessed a phenomenal 124.2% growth for the financial year.

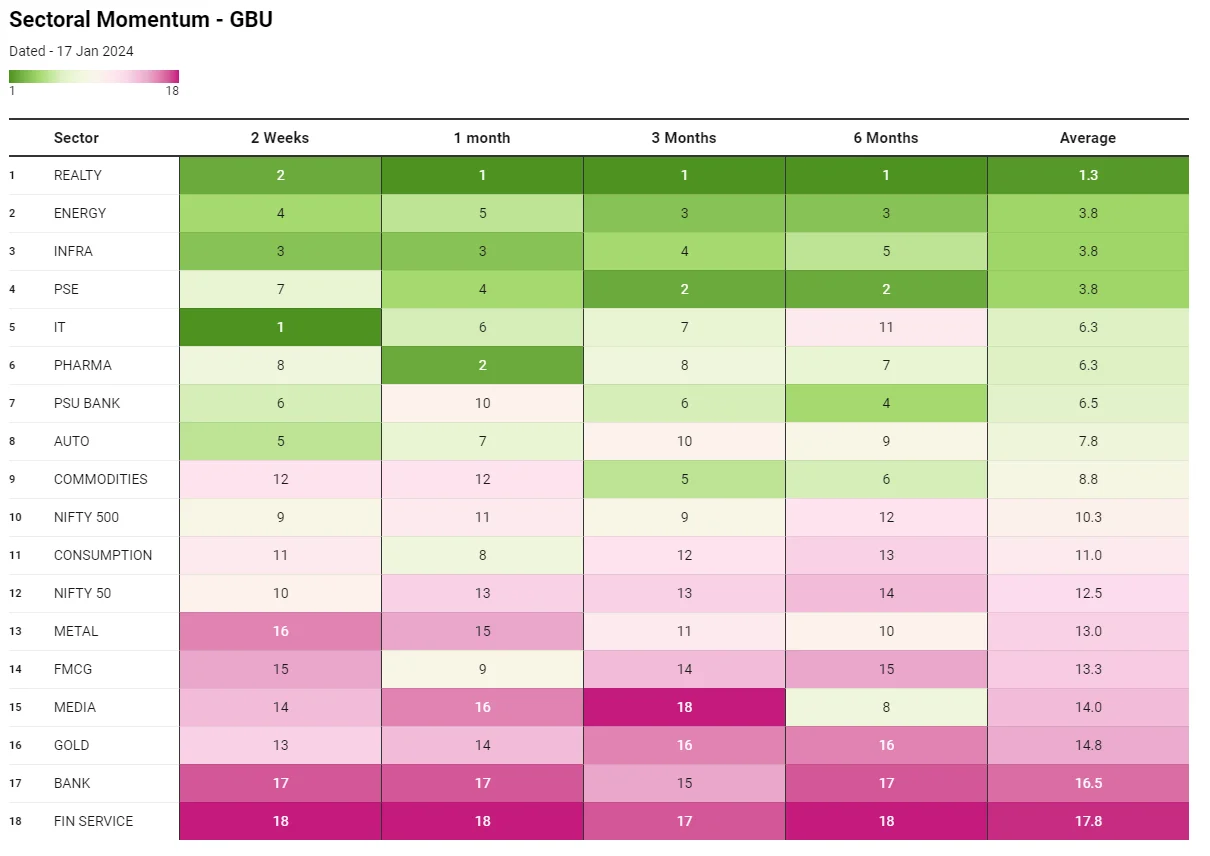

Real Estate holds on to the top spot after a consistent performance while we have Energy come up at #2 position. PSE has dropped to #7 on the fortnightly chart after putting up a relatively weaker performance while the spotlight was grabbed by IT which raked in #1 position after an impressive relative outperformance amidst overall market weakness.

Spotlight – Mi India Top 10

One of our standout strategies is the Mi India Top 10, which focuses on extracting the best from the Nifty 50 stocks. This strategy aims to concentrate on the strongest stocks within the Nifty, rather than wasting time on stocks that are not moving up.

This strategy has clocked a superb 43% in FY 24 compared to only 24% on the Nifty 50 index.

We have a special LIVE QnA session with Team Smallcase on 25th Jan 2024 (Wednesday) at 7 pm where we shall dive deep into this outperformance with real case studies. Set your reminders below!

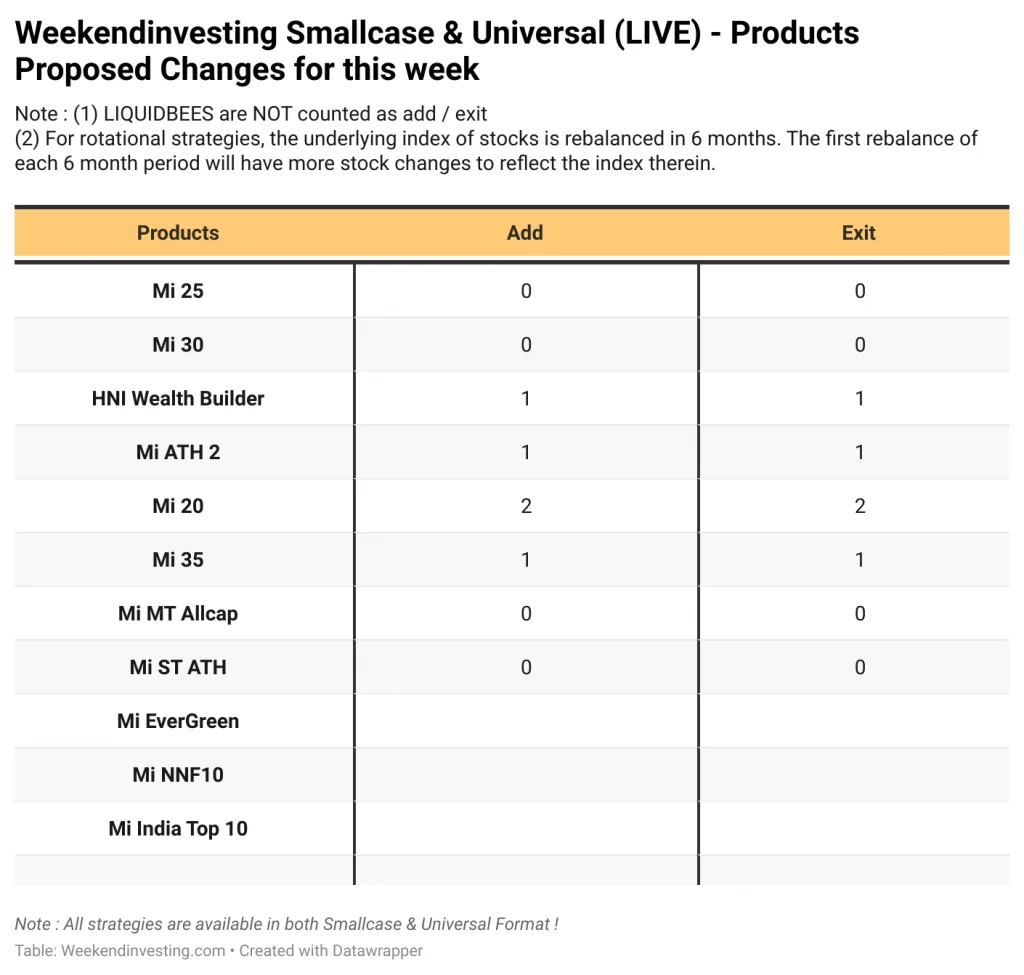

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Check out Weekend Investing smallcases here

Weekendinvesting Analytics Private Limited•SEBI Registration No: INH100008717

B- 6/102, SAFDARJUNG ENCLAVE, NEW DELHI South West Delhi, Delhi, 110029

CIN: U72900DL2021PTC380866

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Disclosures: Link