The Good Bad and Ugly weekly review : 26 Dec 2023

Markets this week

After seven consecutive positive outings, markets witnessed a bit of consolidation. Nifty almost dropped 400 points 20 Dec 2023 after almost touching 21600. The point to note is the extremely strong recovery that we have seen after a steep fall earlier this week. Mid caps and Small caps staged a much stronger recovery compared to Nifty 50 and are currently one or two decent sessions away from a new ATH.

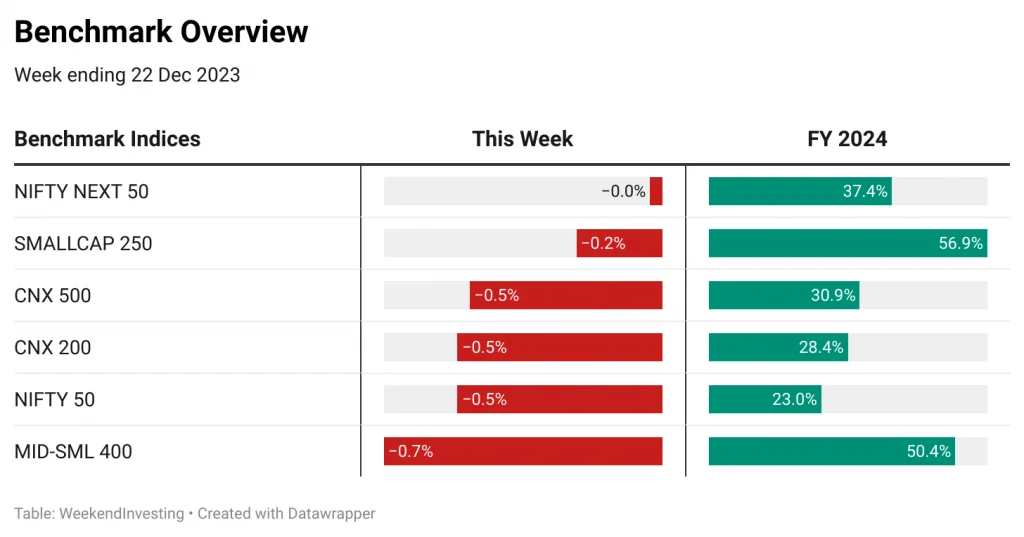

Benchmark Indices Overview

Nifty next 50 was once again the best relative performer this week staying neutral while other indices lost between 0.5% to 0.7%. Nifty Next 50 has done incredibly well in the last couple of months to occupy the third spot on the FY 24 charts behind Smallcap 250 index and Mid-Small 400 index.

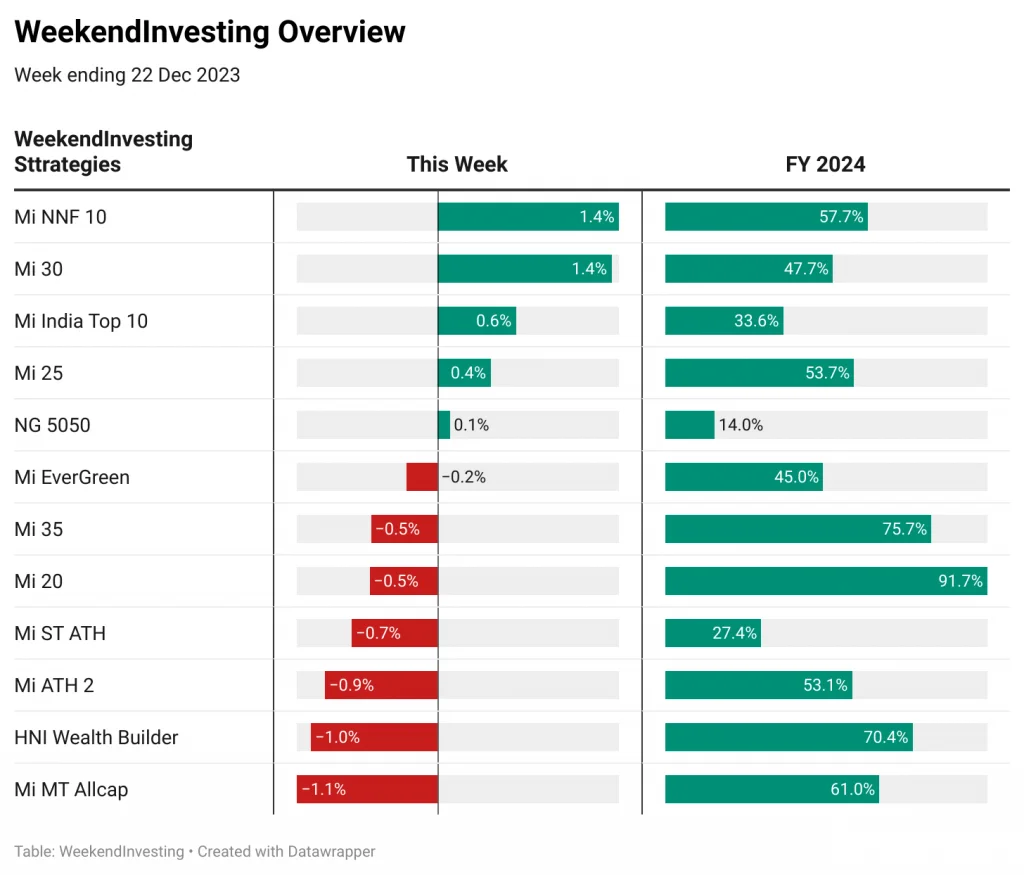

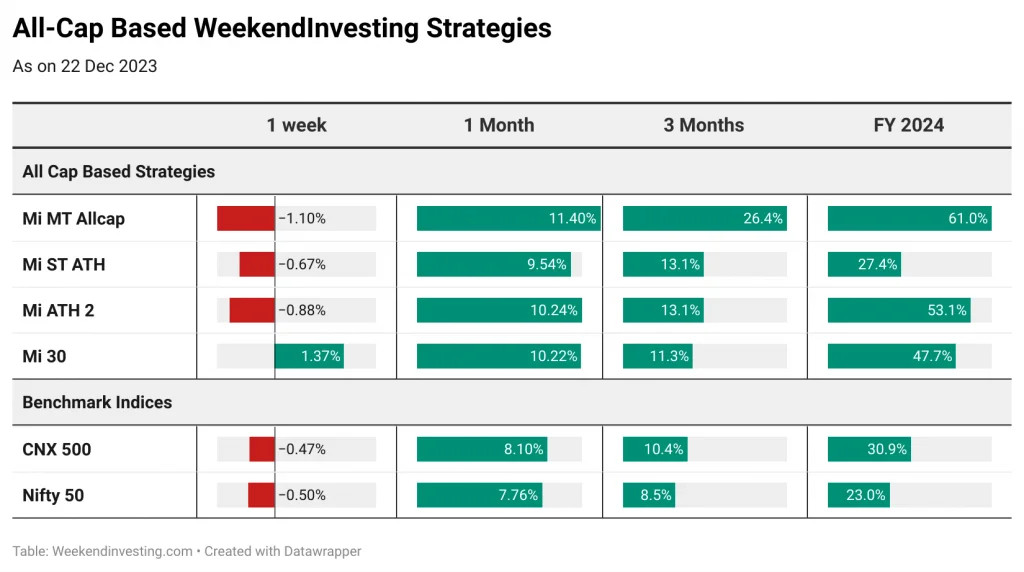

WeekendInvesting Overview

WeekendInvesting strategies had a mixed week with Mi NNF 10 continuing on the good run clocking 1.4% this week taking the FY 24 tally to a massive 57% gains. This kind of a performance for a large cap strategy is exceptional especially when it’s benchmark has returned about 37% only. Mi 30 was the second best this week clocking 1.4% while Mi ATH 2, Mi MT Allcap, HNI Wealth Builder saw a drop between 0.6% and 1.1%.

On the FY 24 chart, Mi 20 continues to lead raking in a mammoth 91% gains followed by Mi 35 and HNI Wealth Builder at 75% and 70% gains respectively. Great performance as we close in on Q3 FY 2024.

Sectoral Overview

Defensive sectors like PHARMA and FMCG put on a strong performance as markets consolidated a bit this week. Most sectors lost out a bit while BANKs took a heavy beating losing in excess of 1.8%. PSE stocks have done quite well this FY 24 clocking 70% as REALTY closes in on a spectacular 2x gains staging a very strong recovery despite a sharp 7% correction. PSU Banks have significantly outperformed the PVT banks signaling the enormous relative momentum in this segment of the banking sector.

IT has been witnessing a very strong momentum securing rank #1 on our sectoral momentum ranking charts. This sector is currently at #6 overall despite underperforming quite heavily in the quarterly charts. REALTY has slipped to the bottom of the chart after a poor outing but the recovery has been quite strong. We wouldn’t be surprised if this sector quickly gets back to the top of our ranking charts soon. FMCG and GOLD have shown recovery on the charts owing to some panic in the markets last week.

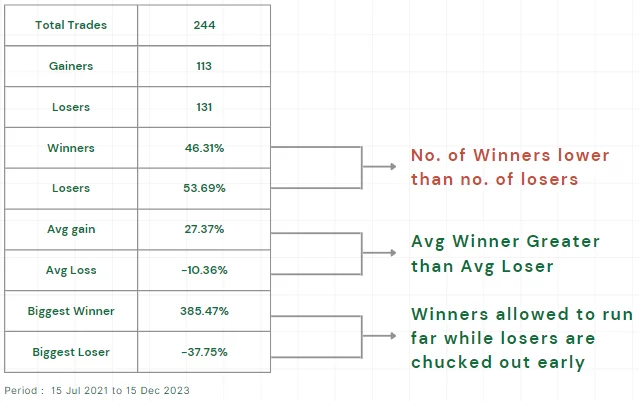

SPOTLIGHT – Mi 20 – A Standout Performer

Mi 20 has been a standout performer this FY 24 and also since launch outperforming it’s benchmark mid-small400 index by a wide margin.

The strategy has clocked 135% gains compared to 59% gains on the mid-small 400 index since going LIVE on 15 Jul 2021 (2 years and 5 months).

There were about 244 trades in total on Mi 20 out of which no. of winners were lesser than the no. of losers. The real trick is in allowing winners to run far while being nimble at chucking out losers. Winners had an average profit of 27% while losers exited at 10% loss on average.

The biggest winner stands at a majestic 385% while the biggest loser lost only 38%.

Mi 20 will soon be closing for new subscriptions. If you are considering entering the strategy, kindly do so at the earliest you can.

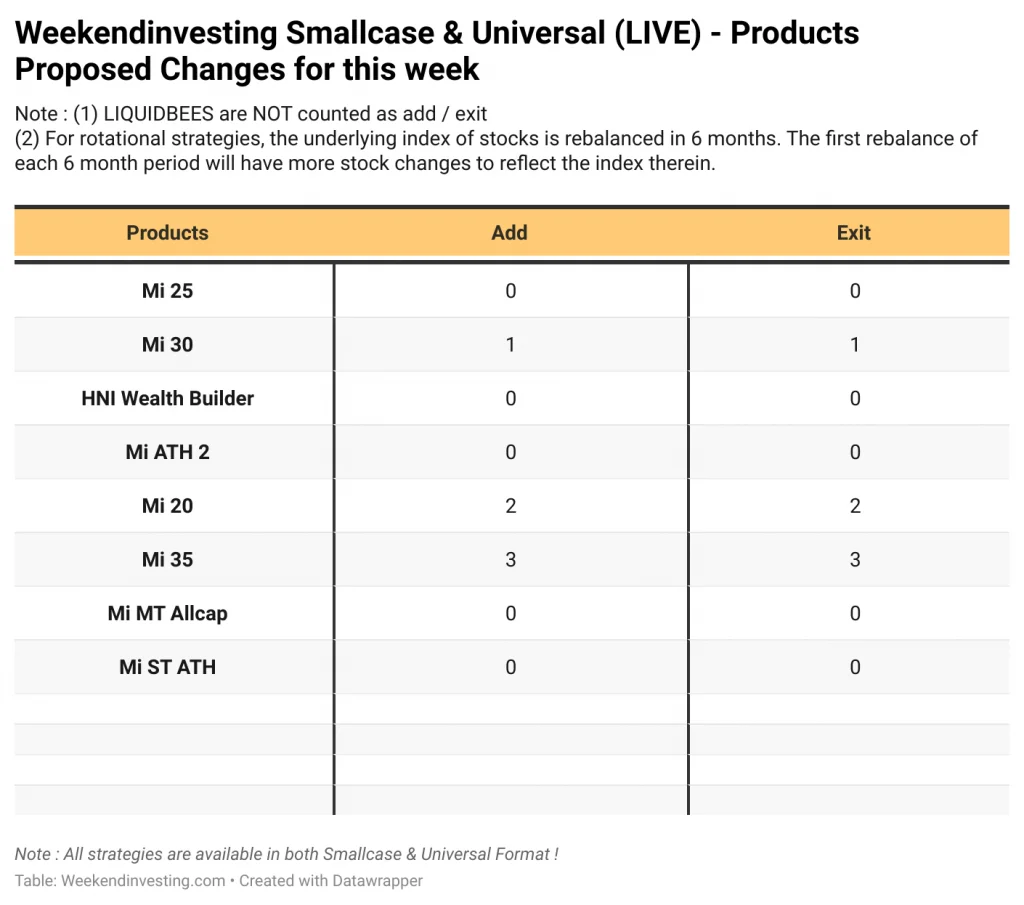

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Check out Weekend Investing smallcases here

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst