The Good Bad and Ugly weekly review : 3 Jan 2023

Markets this week

The year 2023 has been an eventful one for the financial markets, and as we approach the end of the year, it’s time to review the market trends of the last week of December. The week was marked by a surge in market activity, with the markets soaring to near all-time highs. This can be attributed to new allocations towards emerging markets, particularly India, which typically happens towards the end of the year.

It is evident that the market has been on an upward trajectory for the past eight weeks. However, it’s important to note that the market is characterized by periods of lumpy gains and long periods of stagnation. It’s crucial for investors to remain invested and wait for these lumpy gains to occur, as they have historically been a recurring phenomenon. In fact, looking at the market history of the past 20-30 years, there have been very few periods without significant gains. This is why most experts recommend staying invested for at least four or five years to experience these major market moves in one’s investment journey.

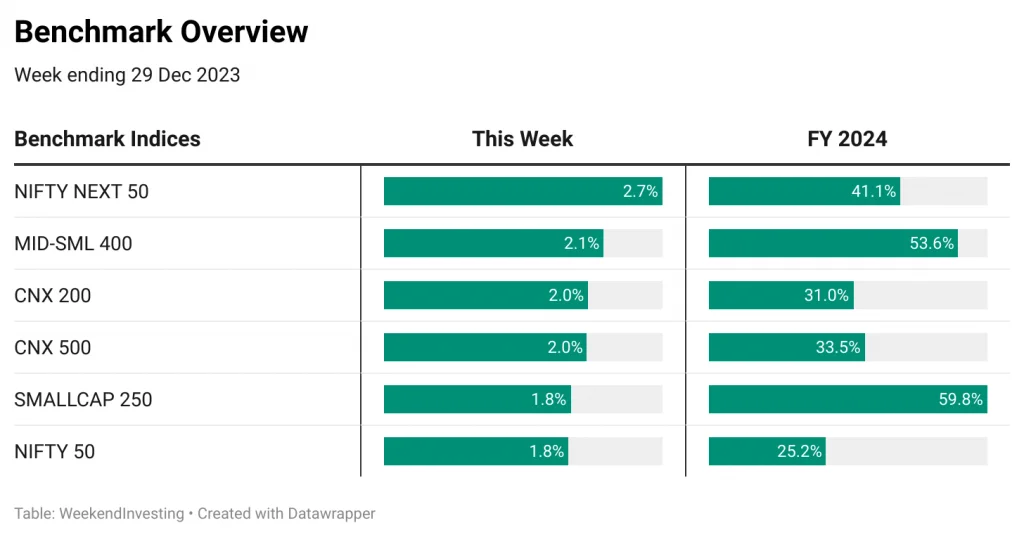

Benchmark Indices Overview

In terms of benchmark performance for the week, Nifty Next 50 index performed the best among the top indices, with a gain of 2.7%. The mid and small-cap indices also showed positive performance, with gains of 2.1% for both the CNX 200 and CNX 500 indices. The small-cap index and Nifty index both recorded gains of 1.8%.

Looking at the FY 24 performance, it’s worth noting the impressive performance over the past nine months. The Nifty Next 50 index delivered a remarkable 41.1% return, while the mid and small-cap indices performed equally well with gains of 53.6% and 31% respectively. The CNX 200 and CNX 500 indices recorded returns of 31% and 33.5% respectively. Small-cap 250 and Nifty indices also showed strong performance, with gains of 59.8% and 25.2% respectively.

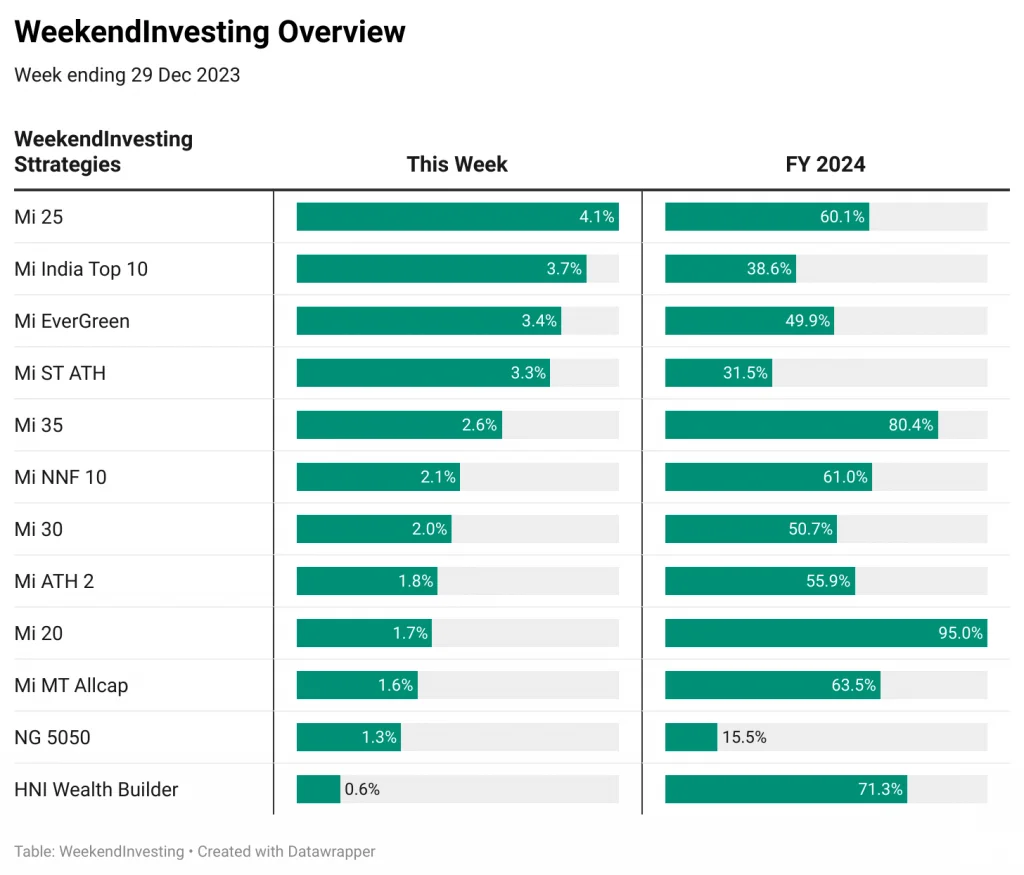

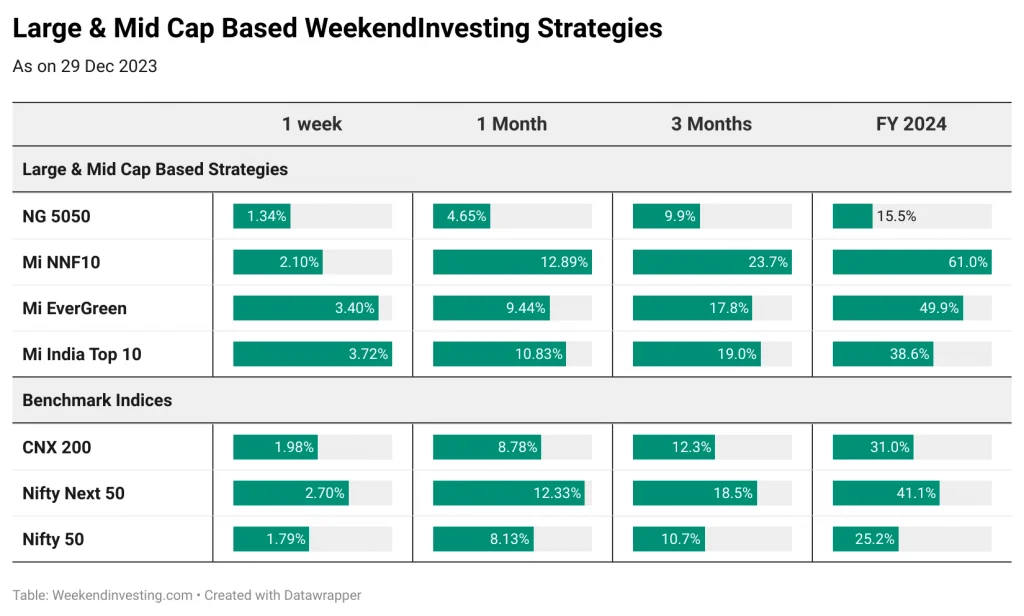

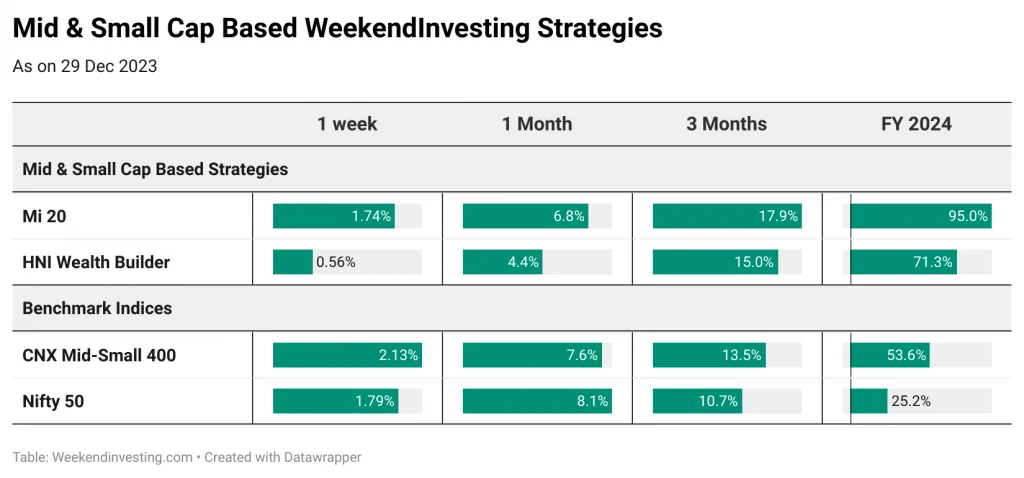

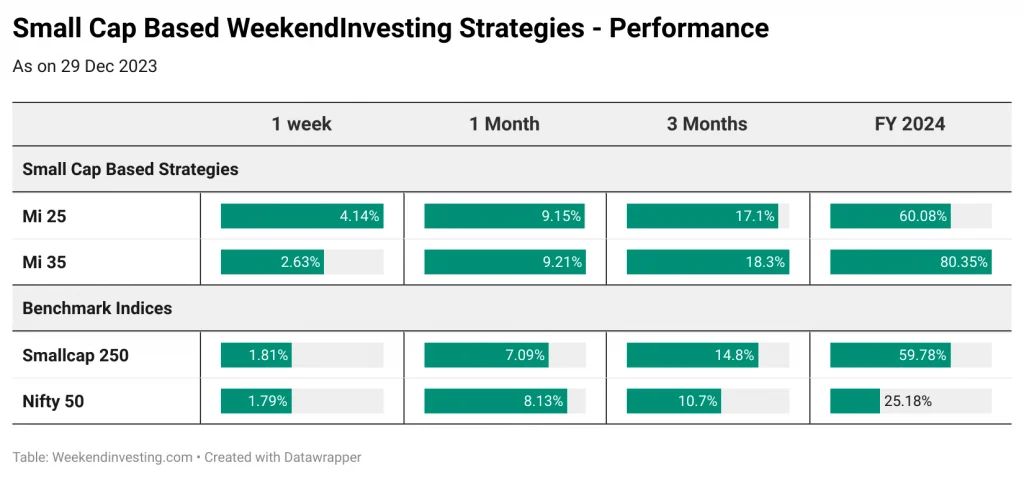

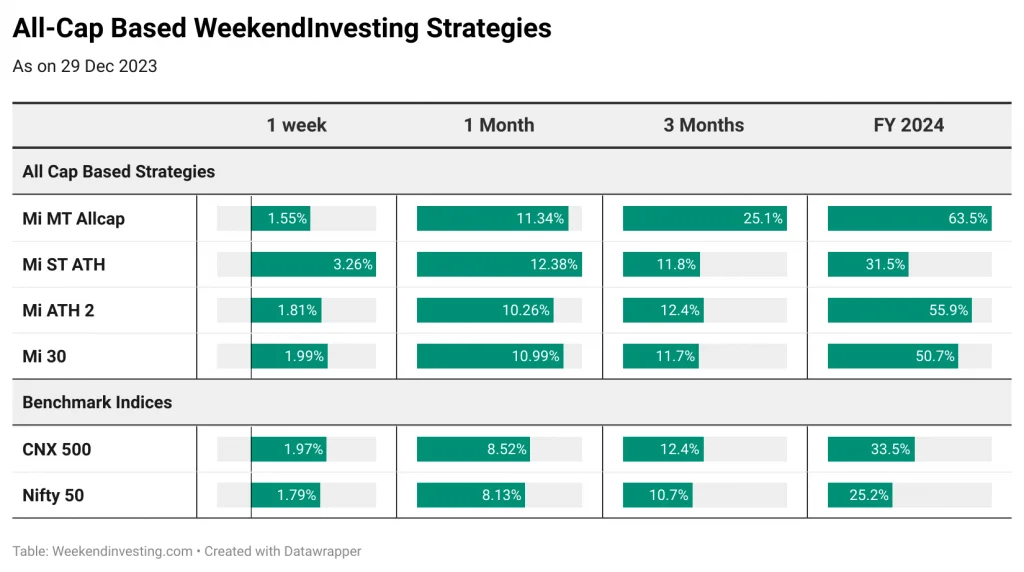

WeekendInvesting Overview

Mi 25 took the top spot with a gain of 4.1% for the week. This strategy has been performing exceptionally well, with a 60% gain for the financial year 2024. Mi India top 10 also outperformed the Nifty index dramatically, delivering a 3.7% gain for the week and an impressive 38.6% return for the financial year. Mi Evergreen, Mi ST ATH, Mi 35, Mi NNF 10, Mi 30, Mi ATH 2, and Mi 20 are among the other strategies that demonstrated strong performance, with weekly gains ranging from 1.7% to 3.4%, and returns for the financial year between 31.5% and 95%.

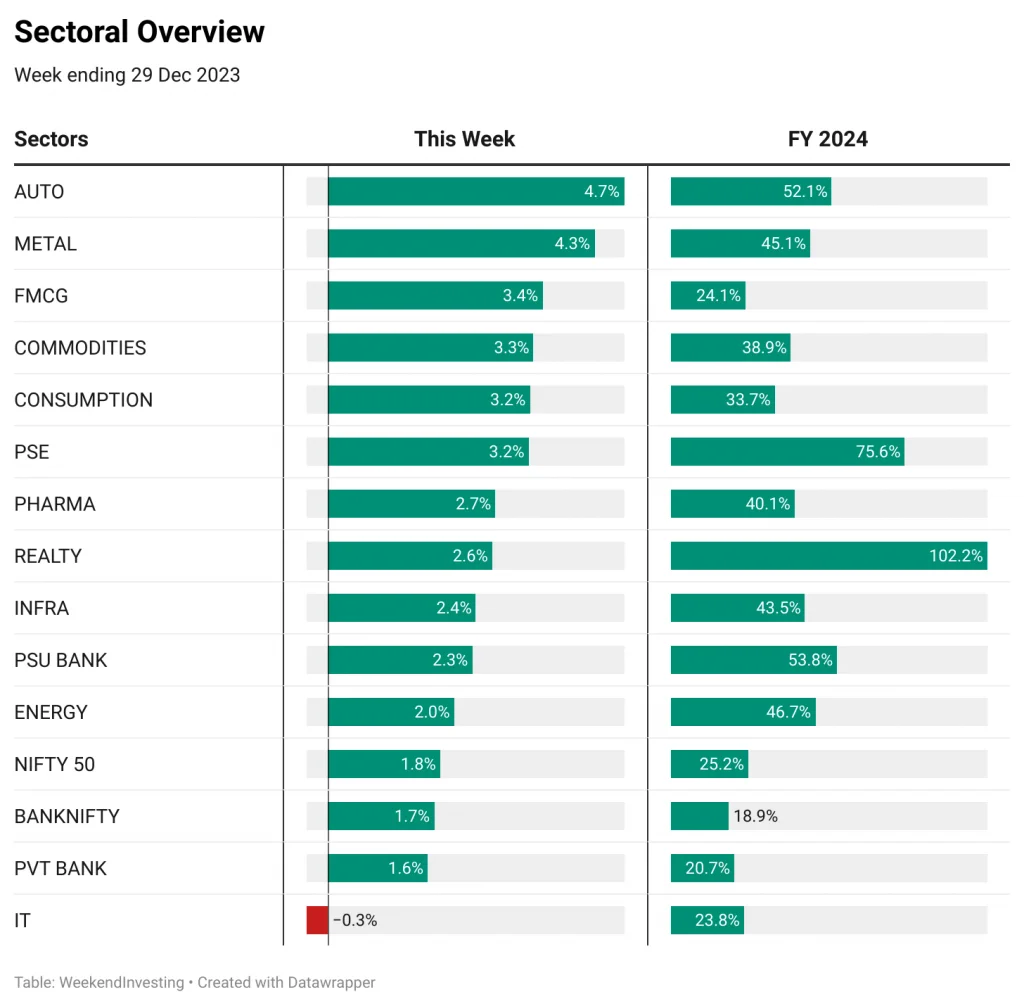

Sectoral Overview

AUTOs led the pack with a gain of 4.7% for the week, followed by the metals sector with a gain of 4.3%. FMCG, commodities consumption, and public sector enterprises also showed positive momentum, with gains ranging from 3% to 4%. On the other hand, the energy sector experienced some weakness, along with infra and some PSU banks.

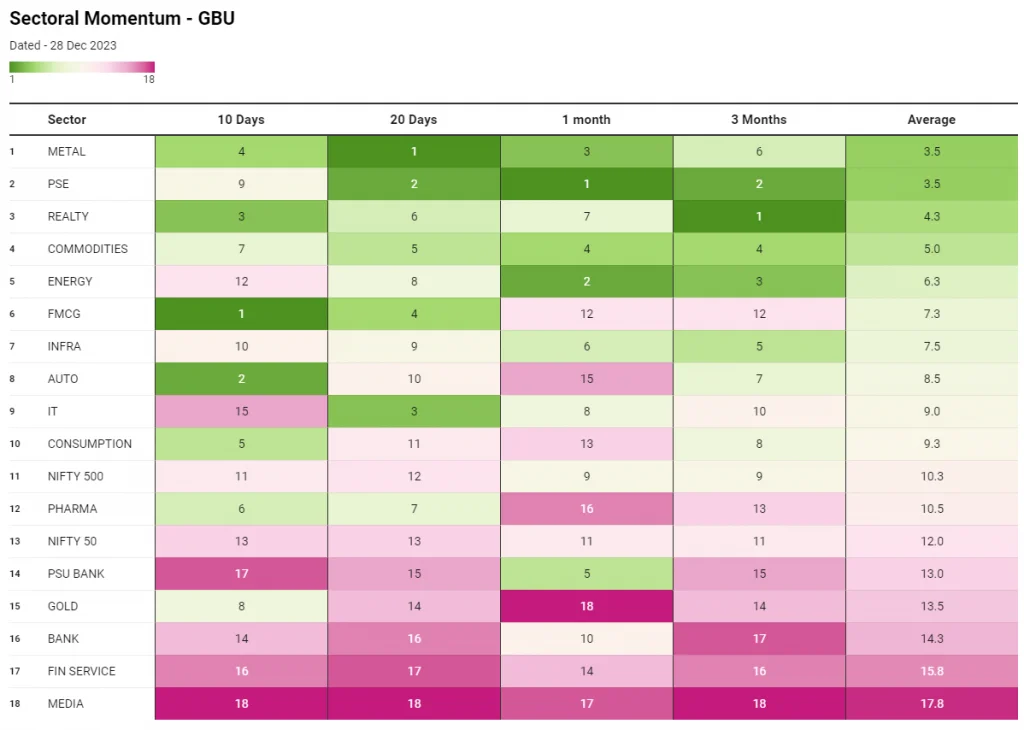

Overall, it’s important to note that the market has witnessed a rotation in sectoral momentum. The real estate, FMCG, automobile, and consumption sectors have shown strength in the short term. In contrast, the ENERGY, INFRA, and PSU BANKS have reported some weakening. FMCG took the top spot in the 10 day trend followed by AUTOs & REALTY while BANKS, MEDIA and GOLD remained weak.

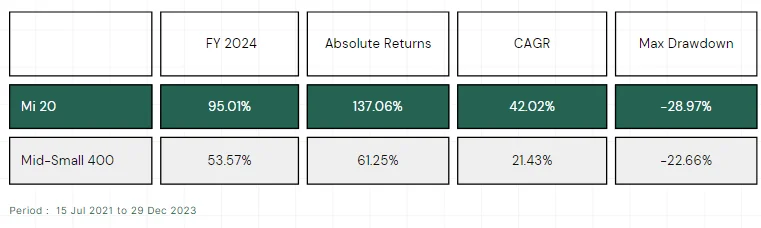

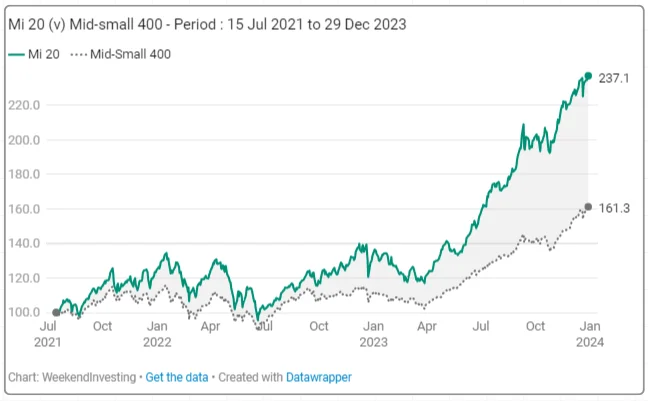

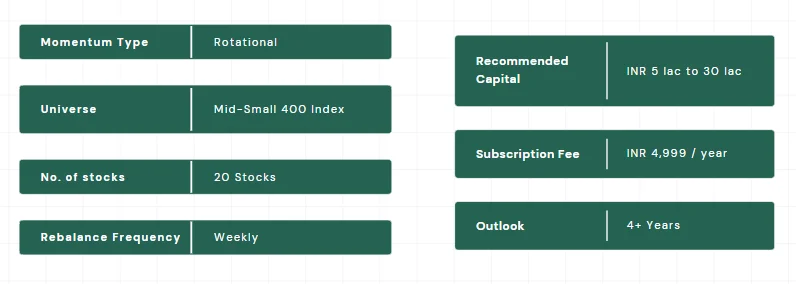

SPOTLIGHT – Mi 20

Mi 20 has been one of the most popular and successful strategies at Weekend Investing. New subscriptions to Mi 20 will be closed from the beginning of the new year with an aim to ensure optimal performance for existing subscribers.

The strategy has recorded brilliant performance right since its launch clocking a massive 137% gains at a 42% CAGR compared to 61% gains at 21% CAGR on its benchmark.

Here’s a brief summary for your reference.

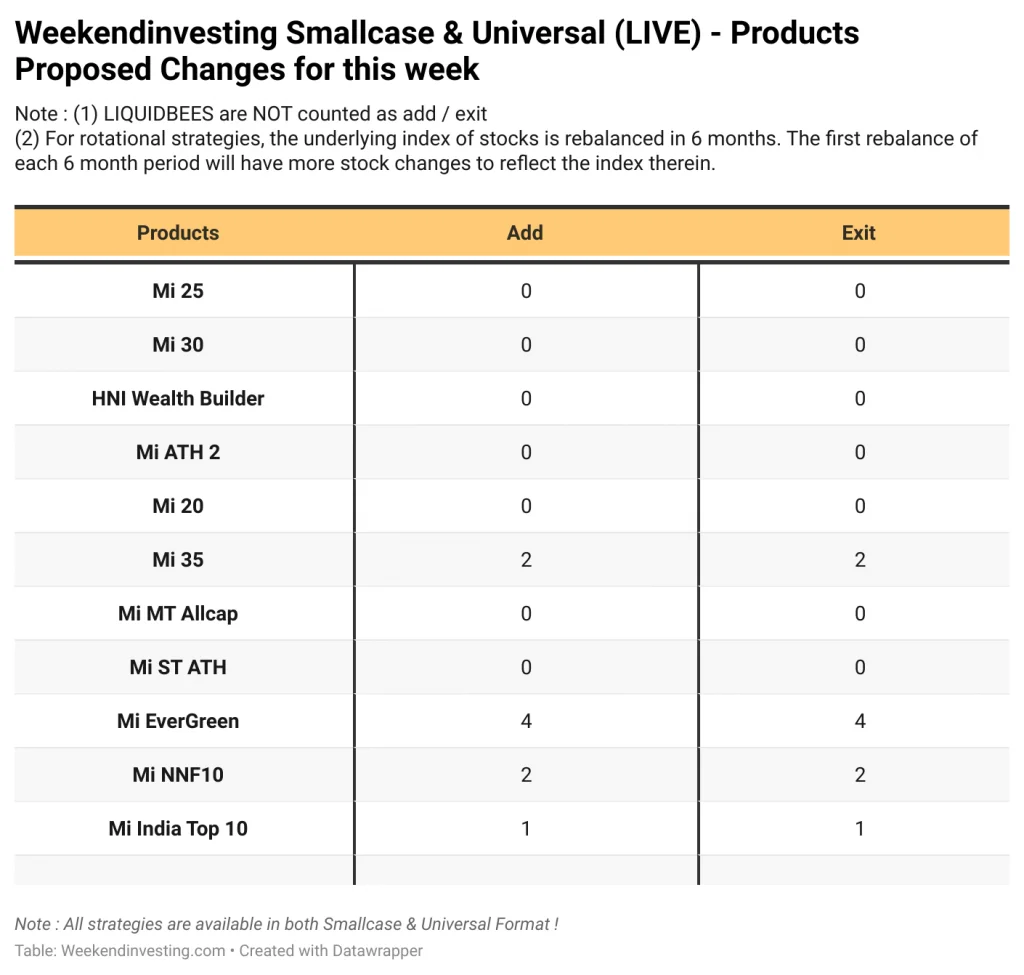

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

Is 2024 going to be the year of Large Caps?

Join us this Saturday, 6th January at 11:00 am for a Live AMA with Alok Jain, Founder at WeekendInvesting.

We will be discussing:

- How to invest in the New Year 2024

- Understanding the current market rally and recent performance of smallcases

- Q&A with the viewers at the end

Click here to set your reminders!

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Use the code ‘NYE2024’ to get a 20% discount on the Mi_NNF10 Momentum smallcase

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst