The Good Bad and Ugly weekly review : 30 Jan 2024

Markets this week

Nifty experienced a losing trend in the first two sessions of the week, followed by a flat performance. However, HDFC Bank had a significant impact on the market, causing a slump on January 23.

Market stabilization occurred in the last two days, and a correction has been observed since the market’s peak of 22,000 plus. The depth of the correction remains uncertain, but the overall sentiment does not indicate weakness at the moment, especially considering the strength of the broader market.

Benchmark Indices & WeekendInvesting Overview

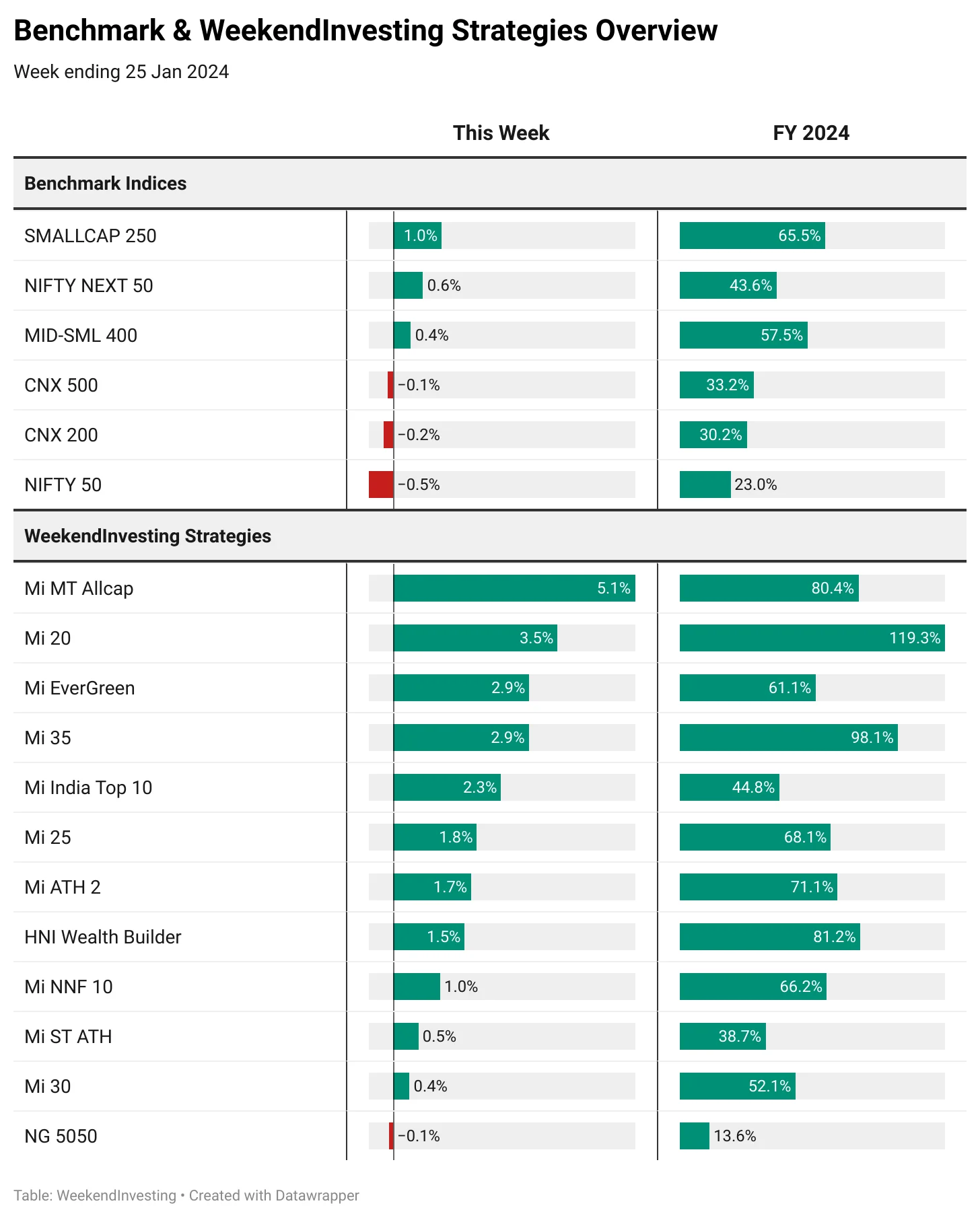

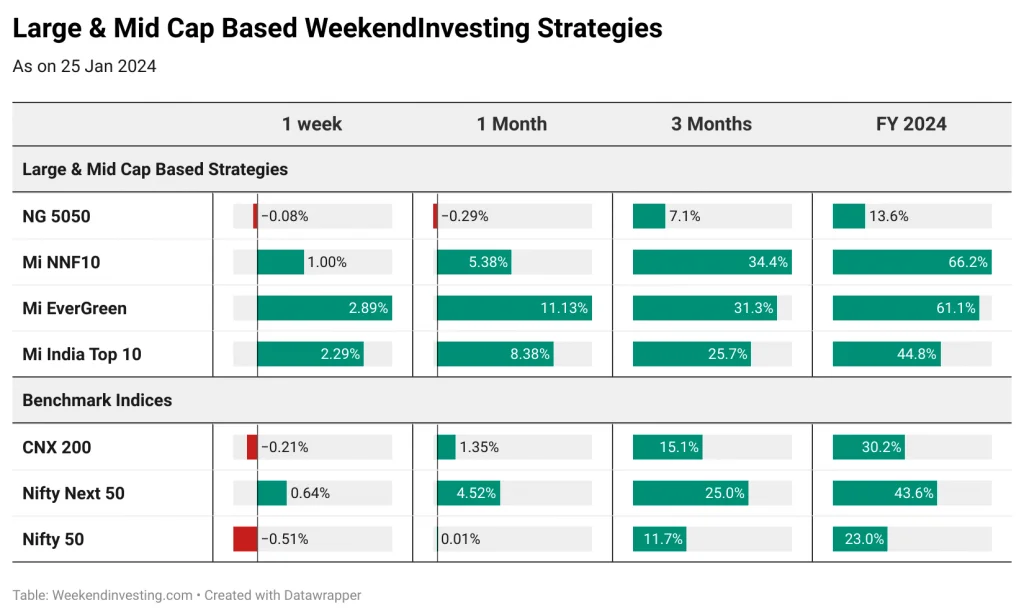

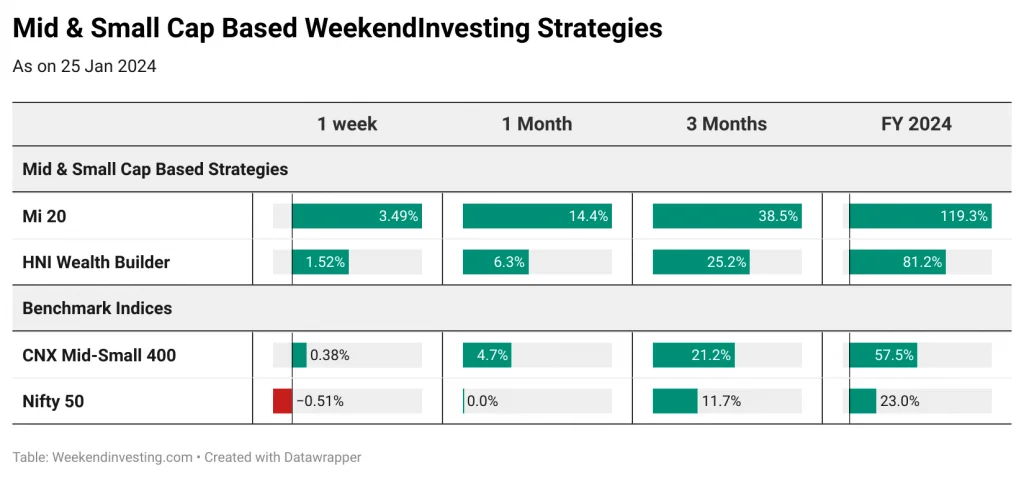

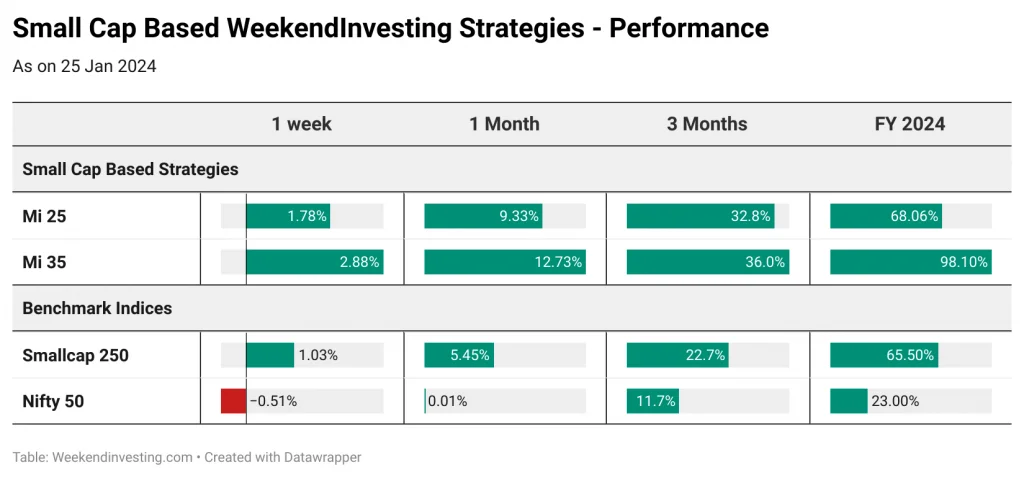

While the Nifty was down half a percent, small caps gained 1% during the week. The CNX 200 and CNX 500 lost ground, but the mid and small-cap 400 index rose by 0.4%. The Nifty Next 50 index also experienced a positive performance, up by 0.6%.

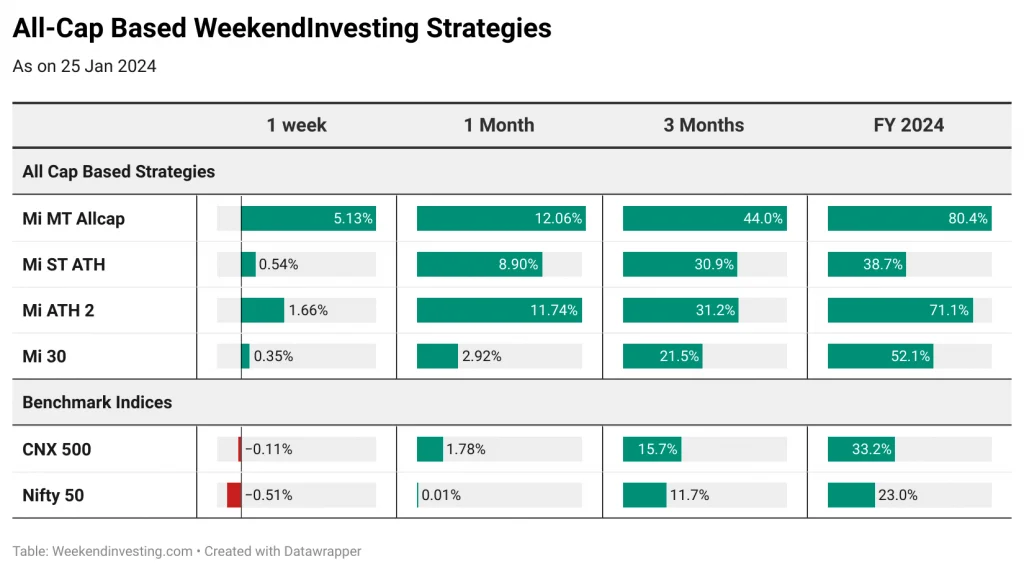

It is interesting to note that all indices have shown significant gains in the financial year 2024. Mi MT Allcap gained 5% in a single week, reaching a total gain of 80% since the beginning of the financial year. This strategy has been well-received within the Weekend Investing community.

Mi MT Allcap gained 5% in a single week, reaching a total gain of 80% since the beginning of the financial year. This strategy has been well-received within the Weekend Investing community.

Other notable performers include the Mi 20, which gained 3.5% this week and has achieved a remarkable 119.3% return for the financial year. Mi Evergreen saw a 2.9% increase this week and stands at a 61% gain for the FY, while Mi 35 recorded a 98% return (FY 24).

Mi India 10 also delivered positive results, with a 2.3% gain for the week and an overall increase of 44.8% for the financial year. These returns are particularly impressive considering that the Nifty has only gained 23% during the same period.

The HNI Wealth Builder strategies, Mi ATH 2 and Mi 25, both saw gains of over 1.5% this week. Mi 25 has achieved a remarkable 68.1% gain and Mi ATH 2 is up by 81.2% for the financial year. Mi NNF 10 outperformed the Nifty Next 50 index this week, delivering a 1% gain compared to 0.6% for the Nifty Next 50. This strategy has shown a significant 66.2% gain for the financial year compared to the index’s 43.6%.

Sectoral Overview

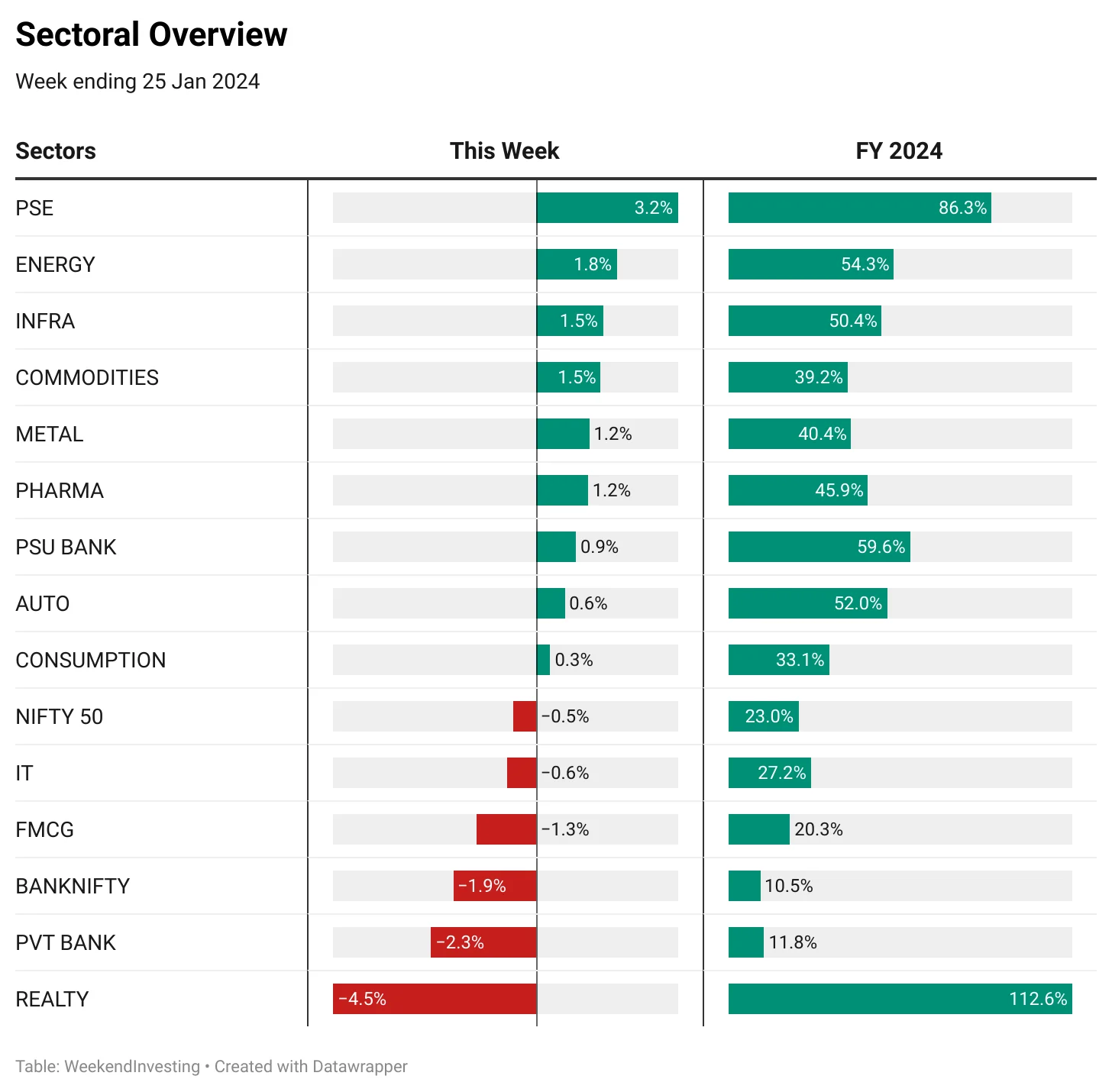

Real estate underwent a significant decline, dropping by 4.5% this week, while private banks and FMCG stocks also experienced losses.

On the other hand, public sector enterprise stocks gained 3.2%, energy stocks increased by 1.8%, and infrastructure stocks rose by 1.5%. In FY 24, Public sector enterprise stocks have shown a remarkable 86% gain, while real estate stocks have climbed even higher at 112.6%.

PSE holds on to the top spot with an impressive performance in the recent times. IT has done very well to secure the top rank in the last 2 weeks. It will also be interesting to note that PHARMA takes the #1 position on the monthly chart. An alarming sign for REALTY to have gotten relegated to #17 in the last 15 day performance.

Spotlight – How index investing does not guarantee performance always

There is a common belief that you can invest in the index and everything else will get taken care of. This is primarily due the bias that Nifty 50 has done incredibly well over the last 30 years and is expected to continue on the same trajectory.

We are not trying to say that index may not go up from here but there might be a situation where we can experience stagnation in the index as well. Check out the charts of some of the benchmark indices other countries.

HANGSENG – went no where for 25 years

NIKKEI – a story of painful wait since 1989

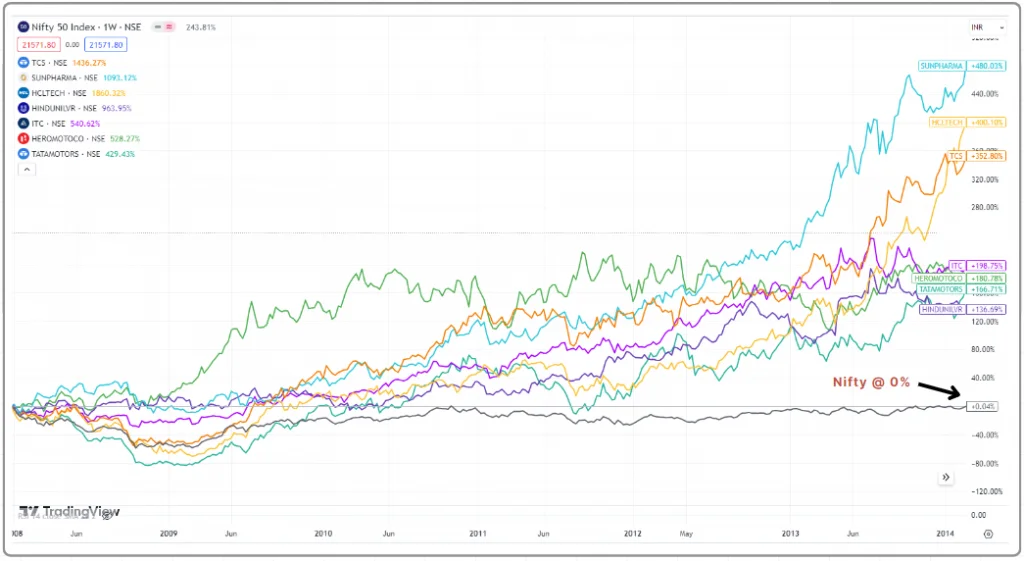

Nifty stayed flat for 6 years between 2008 and 2014

But the point to note is that there were many stocks and sectors that did extremely well during this period. Let’s take a quick look.

If you were an investor who started in 2008, you may have virtually been flat throughout the six year period while some stocks and sectors did exceptionally well.

What if you could invest in the best performing stocks / sectors without any weightage bias ?

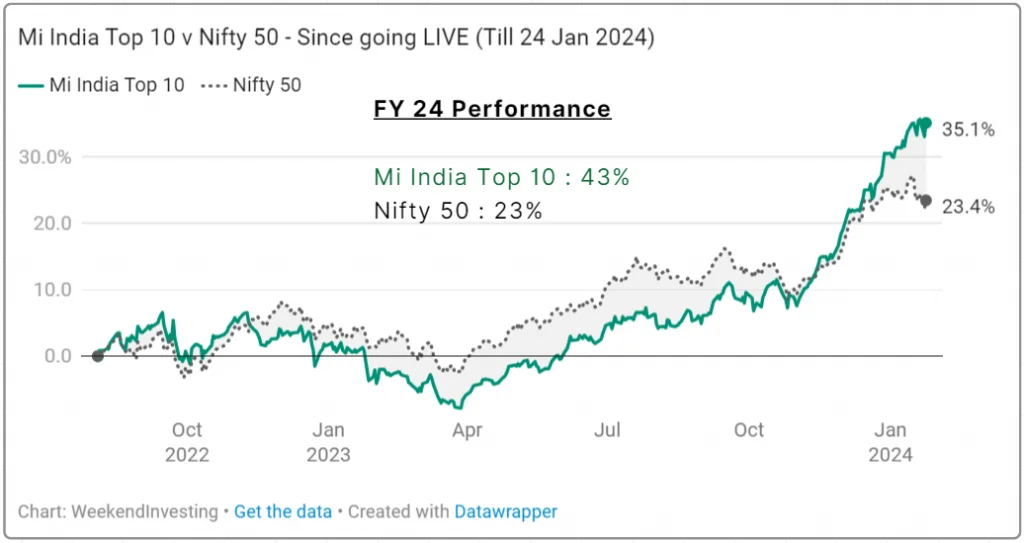

This is what Mi India Top 10 aims to accomplish. The strategy allocates 10% weights to the top 10 trending stocks from the Nifty 50 universe. The performance in FY 24 has been very impressive at 43% compared to 23% on Nifty 50.

Check out the insightful LIVE session with Team Smallcase to understand how Mi India Top 10 remains agnostic to the sector / stock / weightage to try and extract alpha from its benchmark.

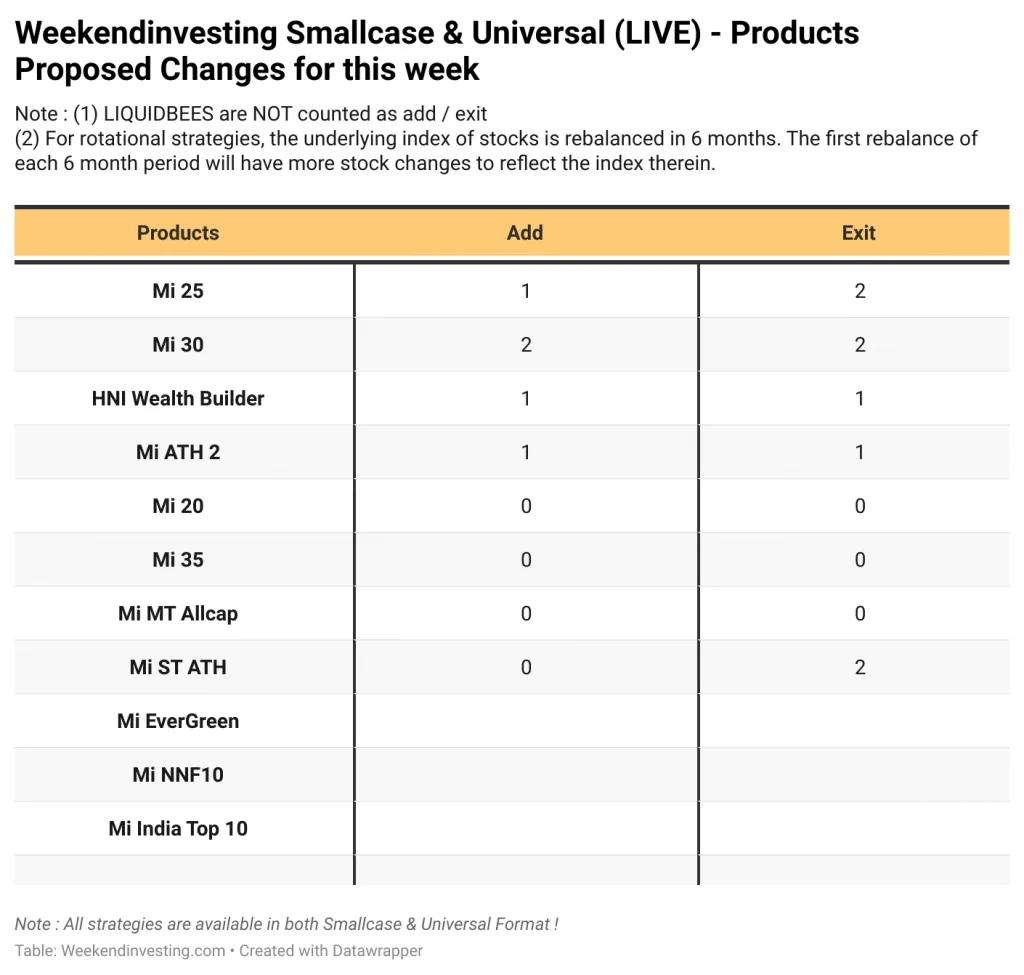

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Check out Weekend Investing smallcases here

Weekendinvesting Analytics Private Limited•SEBI Registration No: INH100008717

B- 6/102, SAFDARJUNG ENCLAVE, NEW DELHI South West Delhi, Delhi, 110029

CIN: U72900DL2021PTC380866

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Disclosures: Link