The PSU Rally: Why are they Soaring and Should You Invest?

The Indian PSU (Public Sector Undertaking) space has been on fire, defying expectations and leaving many private counterparts in the dust. This remarkable rally isn’t just a blip, with multi-year highs and impressive returns across diverse sectors like energy, defense, and infrastructure. But what’s driving this surge? Is it a sustainable trend, and should you consider joining the party?

This blog dives deep into the PSU rally, exploring the key drivers behind the surge, analyzing pre- and post-election trends, and ultimately guiding you towards making informed investment decisions. We’ll explore the pros and cons of investing in PSUs, considering their attractive valuations, sector-specific tailwinds, and potential risks like slower growth and exposure to government policies. Remember, before diving in, it’s crucial to understand your individual goals and risk tolerance. So, buckle up and get ready to navigate the vibrant world of PSU investments!

The Rally in PSU

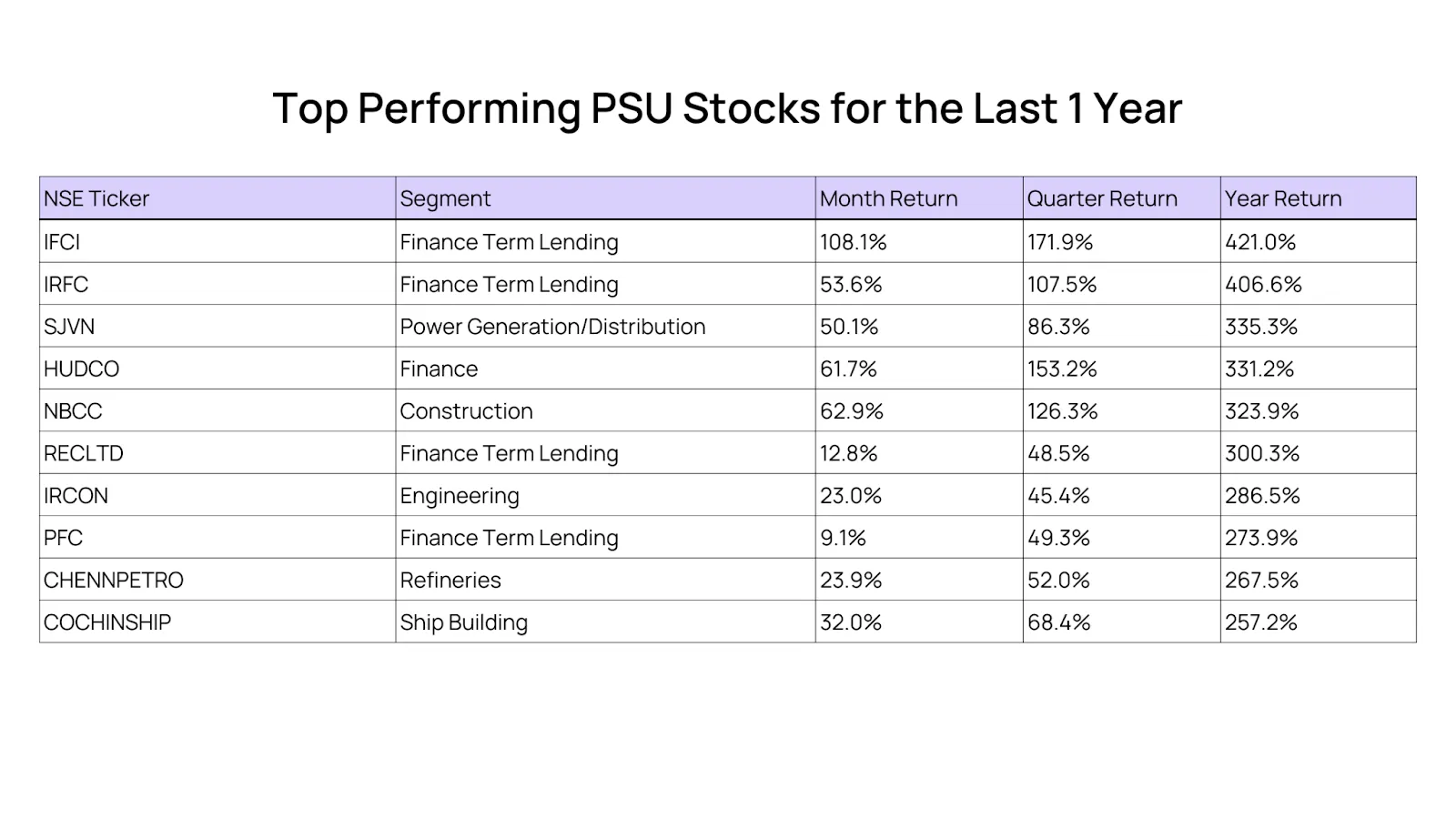

The Indian PSU space is pulsating with a vibrant rally, boasting returns soaring between 19% and 443% over the past year! Financial Lending corporations like IFCI and IRFC have surged north of 400%, while defense stalwarts like Power Generation stock likeSJVNboast a 300% rise. Even financials haven’t been left behind, with Jammu & Kashmir Bank climbing 177%. This multi-sector dominance paints a picture far surpassing the tepid performance of many private peers. But this isn’t a short-lived fling; we’re talking multi-year highs fueled by a potent cocktail of factors. Improved financial health, sector-specific tailwinds like rising oil prices, and valuations significantly lower than private counterparts are all playing their part. Even whispers of government support and potential reforms add to the excitement. However, before diving headfirst, remember the inherent challenges. PSUs often experience slower growth compared to their private counterparts, and remain susceptible to policy shifts. Ultimately, the sustainability of this rally rests on long-term improvements in efficiency and governance. So, research well, and invest wisely!

Why are PSU Stocks Rallying?

The recent rally in Indian PSU (Public Sector Undertaking) stocks is a complex phenomenon with multiple contributing factors, not solely driven by government investment or divestment plans. Here’s a breakdown of the key drivers:

- Improved financial performance: Many PSUs have shown significant improvement in financial performance in recent quarters, primarily due to:

- Reduced operational inefficiencies: Streamlining operations and cost-cutting measures have led to better profitability.

- Debt reduction: Some PSUs have actively tackled debt burdens, improving their financial health and investor confidence.

- Focus on core businesses: Divesting non-core assets and focusing on core competencies has boosted operational efficiency and profitability.

- Sector-specific tailwinds: Certain PSU sectors are witnessing positive tailwinds, further fueling the rally:

- Energy: Rising oil and gas prices benefit oil & gas PSUs like ONGC and Coal India.

- Defense: Increased government spending on defense modernization fuels growth in defense PSUs like BEL and HAL.

- Infrastructure: Government focus on infrastructure development benefits PSUs involved in sectors like railways, roads, and power.

- Attractive valuations: Compared to their private sector counterparts, some PSUs trade at lower valuations, making them attractive to value investors seeking potential upside.

- Government initiatives: While not the sole driver, government initiatives like infrastructure investment funds and asset monetization plans can create positive sentiment around PSUs. However, the actual impact of these plans on valuations might take time to materialize.

- Market liquidity: Ample liquidity in the Indian markets, combined with a search for yield in a low-interest-rate environment, can also contribute to increased interest in PSUs.

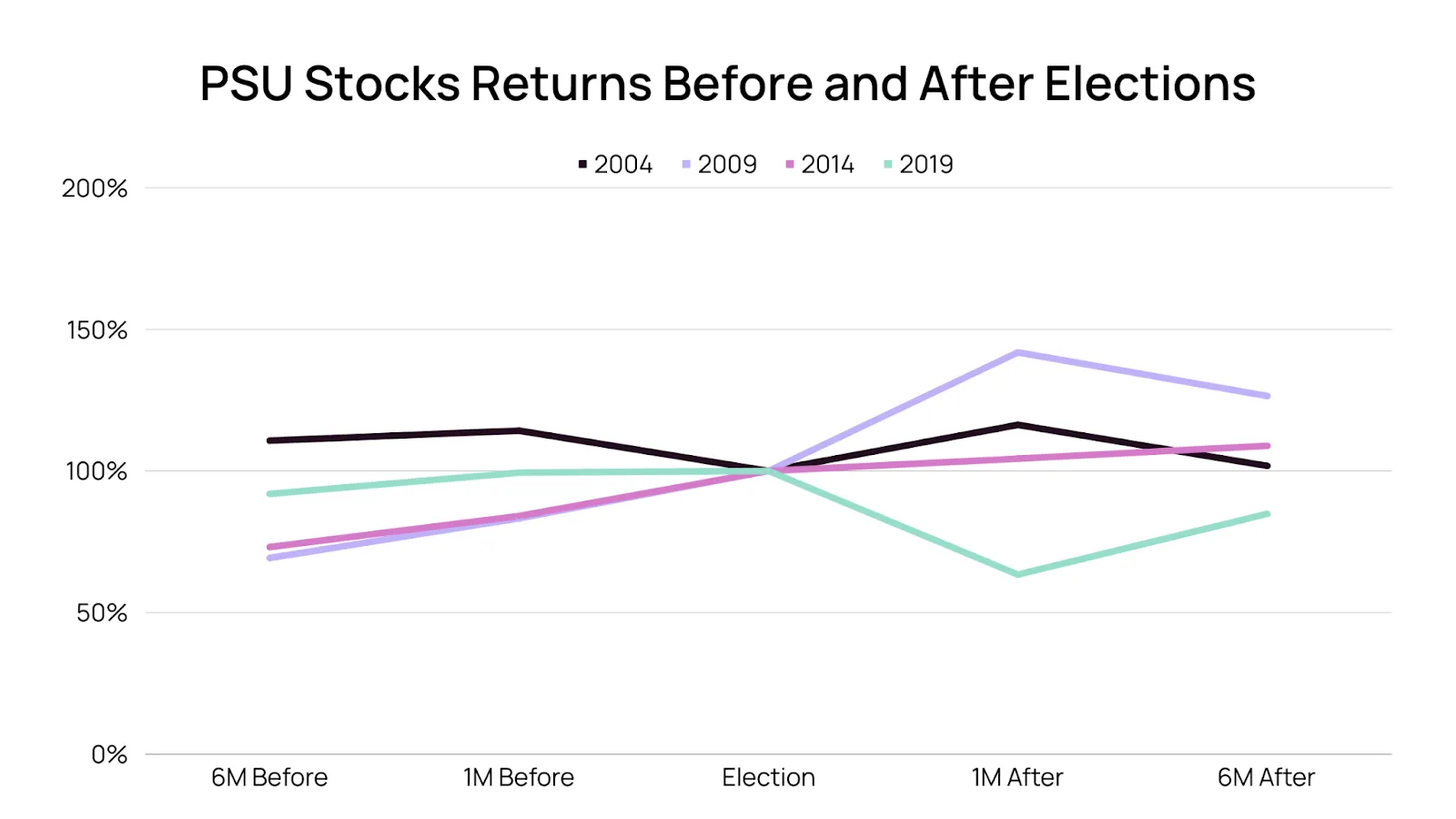

PSU Trends before and after Elections

Analyzing PSU trends pre- and post-election requires a nuanced approach, acknowledging the complexity of various factors at play. Here’s a breakdown:

Pre-Election:

- Historically, PSUs saw mixed performance before elections. Some witnessed rallies due to expectations of favorable policies or infrastructure spending promises. Others remained stagnant or even declined due to concerns about policy continuity or potential divestment plans.

- Market sentiment often factored in the incumbent government’s track record with PSUs. Positive experiences with reforms or improved financial performance could lead to optimism. Conversely, concerns about divestment plans or lack of reforms could dampen sentiment.

- Sector-specific dynamics also played a role. Sectors benefiting from government spending or reforms (e.g., infrastructure, defense) might see pre-election gains, while others facing divestment threats could experience volatility.

Post-Election:

- PSU performance often reflects investor confidence in the new government’s policies. A stable government with a clear vision for PSUs can trigger rallies if investors anticipate reforms, strategic investments, or favorable policy changes.

- Clarity on divestment plans post-election can impact specific PSUs. If a new government prioritizes divestment, targeted stocks might face downward pressure. Conversely, clarity on retaining and reforming PSUs can boost their valuations.

- Macroeconomic factors and global trends continue to influence PSUs. Even after elections, broader economic conditions, interest rates, and global commodity prices significantly impact PSU performance.

Should we invest in PSU Stocks Now?

Whether or not to invest in PSUs (Public Sector Undertakings) right now depends on your individual investment goals, risk tolerance, and understanding of the market. Here’s a breakdown of the pros and cons to help you decide:

Pros:

- Attractive Valuations: Compared to private counterparts, some PSUs trade at lower valuations, potentially offering higher returns if their fundamentals improve.

- Sector-Specific Tailwinds: Certain sectors like energy, defense, and infrastructure are experiencing positive tailwinds due to government initiatives and rising demand, benefiting related PSUs.

- Stable Dividends: Many PSUs have a history of paying healthy dividends, providing regular income for investors seeking yield.

- Government Support: Although not a guarantee, PSUs often receive some level of government support in times of crisis, potentially mitigating downside risks.

Cons:

- Slower Growth: Traditionally, PSUs have exhibited slower growth compared to private companies due to bureaucratic inefficiencies and government interference.

- Limited Public Float: Some PSUs have low free-float availability, hindering liquidity and potentially impacting price movements.

- Exposure to Government Policies: Changes in government policies, including divestment plans, can significantly impact specific PSUs.

- Macroeconomic Dependence: PSU performance is highly susceptible to macroeconomic factors like interest rates, commodity prices, and global uncertainties.

Additional factors to consider:

- Individual company fundamentals: Conduct thorough research on the specific PSU you’re interested in, analyzing its financial performance, management efficiency, and future prospects.

- Your investment horizon: Are you looking for short-term gains or long-term wealth creation? PSUs might be better suited for longer-term investors who can weather potential volatility.

- Risk tolerance: PSUs involve inherent risks due to factors mentioned above. Ensure your investment aligns with your overall risk tolerance level.

Conclusion: So, Should You Invest?

The answer, as always, is “it depends.” While the rally presents enticing opportunities, don’t get swept away by the current. Conduct thorough research on individual PSUs, assess your risk tolerance, and align your investments with your long-term goals. The rally holds promise, but remember, sustainability hinges on long-term improvements in efficiency and governance. So, research wisely, invest smart, and enjoy the ride, but do so with an informed and cautious approach.

Explore Wright Research smallcases here

Wryght Research & Capital Pvt Ltd•SEBI Registration No: INA100015717

103, Shagun Vatika Prag Narayan Road, Lucknow, UP 226001 IN

CIN: U67100UP2019PTC123244

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary.