Inflation in India 2023 – Causes, Impact & What to Expect for Indian Stock Market & Investors

Visiting a subway outlet revealed that sandwiches no longer come with a free slice of cheese. McDonald’s and Burger King had also dropped tomatoes from some of their burgers. Not just international fast-food chains, local restaurants had also increased the prices of tomato-based dishes.

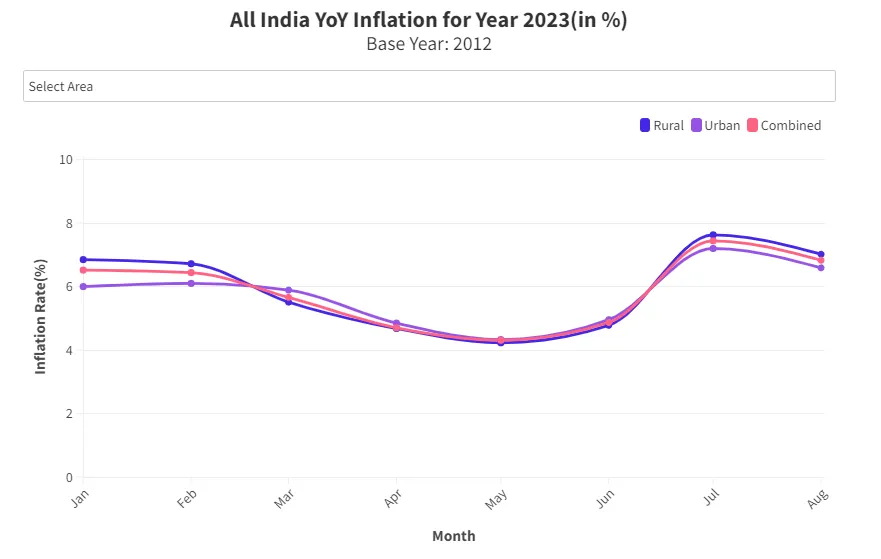

India’s Retail Inflation Falls

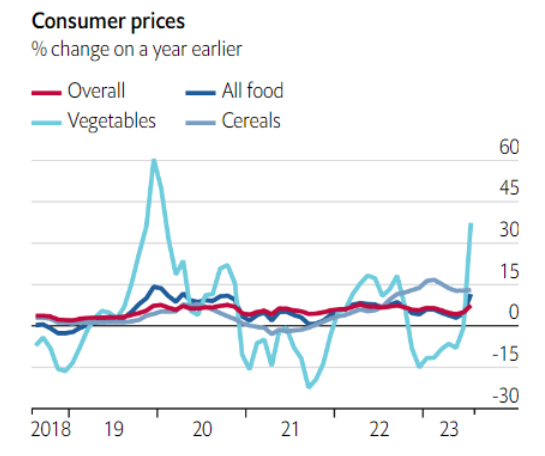

In July, vegetable prices increased by a staggering 37% year on year, with tomato prices at some wholesale markets increasing 1,400% over the 3 months . Annual food-inflation rate hit 11.5% in July, highest in over 3 years, pushing the overall inflation rate to a 15-month high of 7.4%.

India’s CPI (Consumer Price Index) or retail inflation, fell to around 6.83% from its 15-month high of 7.44% in July. Ministry of Statistics and Programme Implementation (MoSPI)’s data on food inflation has slowed from 11.51% in July to 9.94% in August.

This moderation was primarily due to falling prices of vegetables along with cost reduction in housing, clothing, non-essential commodities etc. In terms of food inflation, some items like potatoes showed a year-on-year decline of 14.3%, and refined oil prices are down by 24.5% year-on-year.

| Item in % | M-o-M | Y-o-Y |

| Potatoes | 2.3 | −14.3 |

| Onions | 12.3 | 23.2 |

| Tomatoes | −21.7 | 180.3 |

| Atta | 1 | 9.3 |

| Rice | 1.8 | 12.5 |

| Dals | 1.5 | 13 |

| Chicken | −3.1 | 5.1 |

| Refined oil | −0.8 | −24.5 |

However, tomatoes saw prices rise by a staggering 180% from a year ago. This was around 201% in July on a year-on-year basis – so on a month-on-month basis tomato prices have fallen around 21.7% which is a positive sign. Potato, Onion, Rice, Atta and Dals – basically staple items, all saw sequential increase between July and August.

Food prices between June and July increased by 8% which should’ve been around 2% looking at long term averages. In August, food prices have fallen by around 0.5% month on month and expectation is for September to show continued decrease of upto 2.5% month-on-month for food prices.

Going forward, a good monsoon for September would help Kharif production yields which could help reduce CPI further. There is no significant month on month change in inflation for utilities – with minor decreases being seen for airfares in the month of August.

| Item in % | M-o-M | Y-o-Y |

| Electricity | 0.1 | 13.5 |

| Diesel for vehicle | 0 | 0.4 |

| Petrol for vehicle | 0 | 0.2 |

| Air fare | −2.8 | −9.0 |

| LPG | −0.2 | 4.2 |

At the same time turbulence in the crude oil markets and late monsoon hurting pulse crop production could hurt any improvements in the inflation figures . Analysts are carefully monitoring other commodities like oil, pulse, and wheat.

Notably, the CPI is still above RBI’s target of 2-6% for India. But for now a reduction in inflation and slowing down of food inflation appears to be a positive development. Last month RBI maintained its repo rate at 6.5% and didn’t pay too much heed to the 15-month high inflation number of July – accounting it to a mismatch of demand and supply which spurred the vegetable prices and hence the food inflation figures.

Read this article on RBI’s Rate Pause, Inflation and Why Tomatoes are making Farmers Crorepatis .

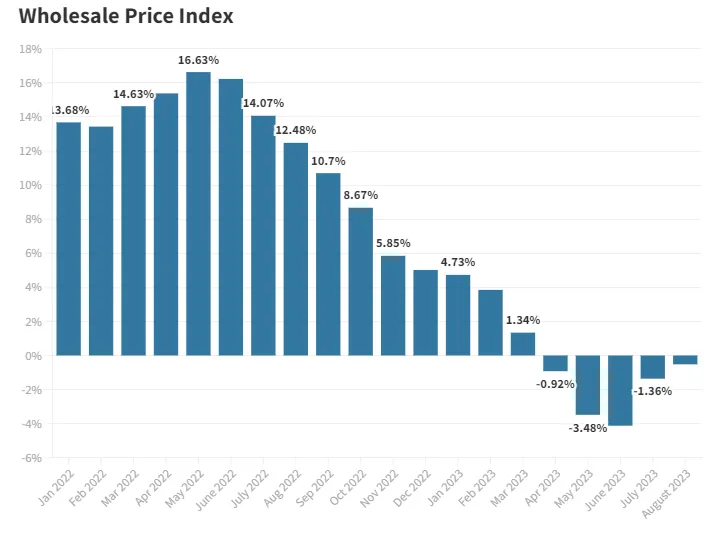

India’s Wholesale Price Index Deflation Eases

India’s Wholesale Price Index (WPI) continued in deflationary mode for the fifth consecutive month in August. However, the rate of deflation has eased to -0.52% from -1.36% in July. Moderation in deflation rate was driven by reduction in fuel and power prices.

- Year-on-year decline in fuel and power costs decreased from -12.8% in July to -6% in August. On a month-to-month basis, these costs rose 3%, marking a reversal from several months of decline.

- Deflation in manufactured products remained almost stable, dropping slightly from -2.5% in July to -2.4% in August. For the first time in four months, prices of manufactured products increased marginally by 0.14%.

- Wholesale food index rose 5.6%, with primary food articles inflation stayed high at 10.6%.

Source: CMIE

Source: CMIE

Deflationary trend in wholesale prices will likely reverse in the coming months. Factors like rising crude oil prices, cereals, and pulses could maintain Consumer Price Index (CPI) inflation within the range of 5.5%-6.5% over the next two quarters.

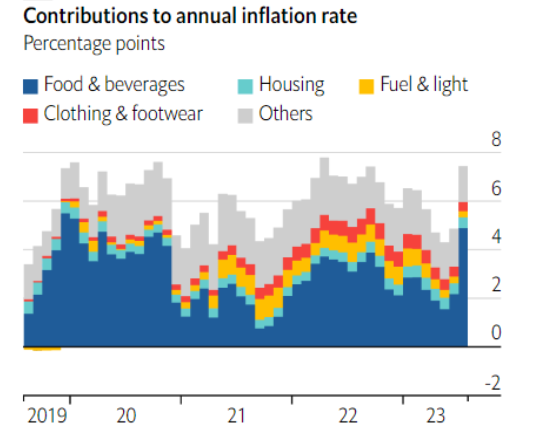

Why is Food Inflation so High?

Unpredictable weather conditions have wreaked havoc on Indian agriculture. Heavy rains in several regions have led to the submerging of farmlands and disrupting supply chains. Conversely, excessive heat has damaged crops. By the end of July, Indian farmers had sown 40% less than the typical cultivation for that period. August recorded a 36% deficit in rainfall, making it the driest August in over 120 years.

- Monsoon Rainfall: Monsoon in 2023 is expected to be below normal, with officials recording 90 to 95% of Long Period Average (LPA). IMD had earlier forecast a normal monsoon at 96% LPA with an error margin of +/- 4%. IMD predicts a rainfall of 91-109% of long period average (LPA) for September, which may not be sufficient to cover the existing deficit. Rainfall tracking for 2 weeks of September is 5.8% below long term averages, but Skymet expects it to improve for the remainder which could help reduce the deficit.

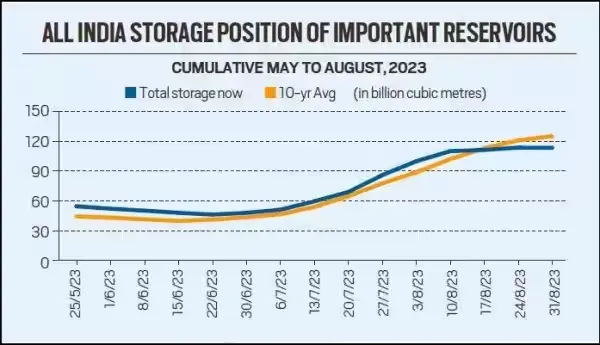

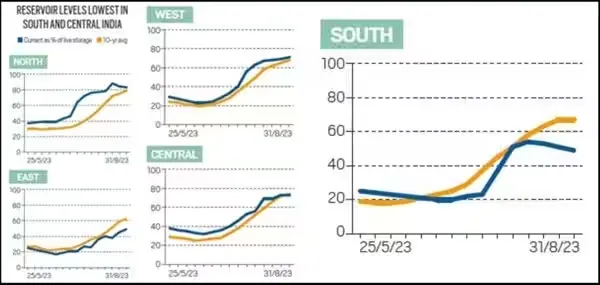

- Reservoir Levels: 150 large and significant reservoirs in India had about 113 billion cubic metres (BCM) of water as of August 31, a 10% shortfall compared to a 10-year average. The reservoirs in southern states were hit the hardest, with the 42 large reservoirs holding just about 53 BCM of water, which is 49% of their combined capacity. Normally, these reservoirs should be at 67% of their combined capacity at this time of the year – last year it was at 85%.

- Geographical Disparity: Central India had a rainfall deficit of 47%, and South India had a 60% shortfall in August.

- Agriculture: Uneven and erratic monsoons affected the Kharif sowing. Lower rainfall levels in August have the potential to affect flowering of crops, leading to concerns over food inflation and production levels. Area under Kharif crop sowing is 3.6% higher year-on-year but significantly lags in pulses, cotton, and oilseeds.

- Temperature: Both the average maximum and mean temperatures in August were the highest ever recorded since 1901. Above-normal maximum temperatures are expected over most parts of India.

Poor monsoon also meant that power demand increased unexpectedly, mostly for irrigation. A record high power generation was recorded in August, with coal contributing to 66.7% of the total power generated—the highest for the month in 6 years. Monsoon rains contribute to nearly 75% of India’s annual rainfall – imperative for our agricultural economy since more than 50% of India’s arable land relies on these monsoon rains – all of this impacts not just food production, but also employment opportunities for migrant workers, farmers and countless people involved in the food supply chain.

India’s Strategy to Control Inflation: Food Export Bans

Indian government & RBI have been proactive in their response to curb retail inflation & food inflation. RBI has maintained interest rates for 3 consecutive months since April 2023 – attributing high inflation to temporary mismatch of supply demand constraints and expects prices to stabilize from September onwards. The Indian Government has imposed a 40% tax on onion exports, imposed export restrictions on rice and removed import restrictions on tomatoes from Nepal – all to ensure sufficient domestic supply and push down prices. It is also releasing grain from its godams to restrain prices from spiralling out of control and to offer subsidized food items to impoverished households – expecting to spend a $12 billion to contain food prices. With election year approaching, inflation is a stickler in the government’s hopes for a continued term.

What does a Food Export Ban do? The logic is straightforward: by restricting exports, the aim is to increase domestic supply, which should theoretically lead to lower prices. Food security is not just a political issue it can become a volatile societal issue rapidly when the majority of the country is engaged in agriculture. There are consequences to such actions:

- Food Hoarding: Food export bans may exacerbate the very problem they aim to solve. Farmers may choose to hoard their produce until the ban is lifted, which can lead to even more volatile domestic prices.

- Impact on Agricultural Livelihoods: Even if domestic prices do fall due to an export ban, the repercussions can be harmful. Lower domestic prices can mean reduced income for the large majority of families engaged in agriculture, especially when you consider the high margin taken by several stakeholders in the food supply chain, which can worsen poverty.

- Political Biases: Benefits of lower food prices are disproportionately skewed toward urban cities who usually wield more political influence than their rural counterparts.

Global Implications of India’s Food Export Bans

India’s aggressive domestic policies have already triggered a hike in global food prices. India is the world’s largest exporter of rice with a 40% market share – the government has halted export of non-basmati white rice. It has increased prices for export of onions and a ban on sugar exports being more likely as production numbers appear to be lower. China, another major exporter of staples, especially rice, has also experienced erratic weather with torrential rains in July and floods damaging rice production. All of this has put pressure on the price of staples (rice, onion, sugar etc.) globally. Since then, prices of rice in Thailand have increased 20%. The UN’s Rice Price Index has increased by 2.8% in July, its highest level since 2011.

And it’s not just India, according to the International Food Policy Research Institute, at least 20 countries have imposed export restrictions since the Ukraine-Russia war. Another contributor to rising prices is the erratic climate change situation that has hampered yields. This could have a domino effect as around 80% of the world’s population lives in countries that are net importers of food. Political exigencies, especially in a politically sensitive period in India, might make food self-sufficiency and inflation control more immediate concerns than the global repercussions.

Impact of Crude Oil Prices on Inflation & Indian Economy

Saudi Arabia has reduced its oil supply by 1 million barrels per day, Russia has restricted output by 300,000 barrels per day. Soon after the announcement, Brent crude futures rose 1.2% closing above the $90 mark for the first time since November 16, 2022. US WTI futures had gained 1.3% settling above a 10-month high.

1. High Import Bill

India’s heavy dependence on crude oil imports to meet its energy needs means that any international price fluctuation will substantially affect its import bill. According to the Petroleum Planning & Analysis Cell, the net import bill for oil and gas was $9.8 billion in July 2023, compared to $15.8 billion in the same month last year. High international crude oil prices are expected to significantly inflate this figure, impacting the country’s current account.

2. Soaring Fuel Prices

Domestic oil marketing companies, including Indian Oil, BPCL, and HPCL, may find it increasingly untenable to maintain current petrol and diesel prices. Last year, despite international crude oil prices peaking at $140 per barrel, OMCs refrained from significantly increasing retail fuel prices. This inaction led to substantial losses for these refiners, which now will likely pass on to consumers.

3. Depreciation of Indian Currency

Rising crude prices often strengthen the U.S. dollar against other currencies, including the Indian rupee. This depreciation makes oil imports even more expensive, creating a vicious circle. Recently, the Indian rupee touched a 10-month low, declining to 83.18 to the US dollar, largely due to a rally in crude oil prices and a strong dollar index.

4. Widening Fiscal Deficit

A surge in crude oil prices will significantly increase the subsidy burden for the Indian government, which covers the difference between the market and controlled prices of essential fuel like kerosene, diesel, and LPG. This additional burden could potentially widen India’s fiscal deficit beyond the estimated ₹17.9 trillion for FY24.

5. Unfavourable Trade Balance

Increased dependence on imported oil could affect India’s trade balance and expose the economy to currency fluctuations and external shocks. Higher crude prices also pose a threat to trade agreements, impacting the overall economic stability.

6. Inflationary Pressures

Rising fuel prices directly contribute to inflation by increasing the cost of goods and services. According to the Reserve Bank of India (RBI), such a surge could decrease aggregate demand due to lower disposable incomes, affecting the broader economic activity.

7. Lower Economic Growth

Elevated crude oil prices lead to higher production and transportation costs across sectors , negatively affecting profitability and competitiveness. This could result in a decline in discretionary spending, thereby affecting consumer behaviour and, by extension, the overall economy.

Impact of Inflation on Investors & Markets

High inflation affects all of us – investors and markets. RBI expects inflation to remain above % until Q1 2024-25 on account of persistent food price pressures & rising crude oil prices. What does high inflation outlook mean for interest rates? Well it looks unlikely that RBI will significantly reverse its 250 bps increase in interest rates over the last year. For 3 consecutive months, it has maintained the repo rate at 6.50%. Expectations are that nay rate cut is unlikely in the short term, until inflation is under RBI’s control. RBI has revised its inflation expectation upwards for the year from 5.1% to 5.4%.

Impact of Inflation on Indian Markets

- Equities: High inflation and interest rates raise the cost of capital, thereby affecting company valuations. High interest rates mean cost of borrowing goes up which impacts companies future cashflow projections. Stock prices are usually discounted by future cash flows; higher discount rates mean lower valuations.

- Gold: Traditionally gains ground during high inflation, serving as a hedge against devalued currency.

- Bonds: Rising inflation pushes bond yields higher, making them less attractive. India’s benchmark 10-year bond yields increased by 10 basis points to 7.20% in the last month.

Impact of Inflation on Investor Strategies

- Stocks: Long-term investors should focus on companies with strong earnings and growth potential. Given the inflation and interest rate scenario, equities that are fundamentally strong and well-priced could be good additions.

- IPOs: Exercising caution is crucial. With inflation and interest rates high, there could be a rush to launch IPOs at inflated valuations. Only invest if the valuations are justifiable.

- Mutual Funds: In a high-inflation environment, long-term investing in equity mutual funds is advisable. The focus should be on the right fund selection and disciplined asset allocation – using SIPs to average out your entry and exit points.

New India’s Growth Opportunity

Fitch has maintained India’s growth forecast at 6.3% for the current fiscal year, citing resilience in the economy despite a tighter monetary policy and weakened exports – with growth forecast for next fiscal year at 6.5%. While the Indian economy grew by 7.8% in the Q1, there could be moderation in growth for Q2 since food export bans have weakened exports, credit growth has stagnated, and diminished consumer confidence. With Diwali & other festivals around the corner, there could be an uptick in discretionary spending on consumption which helps boost the growth of the economy however this counterbalanced with inflation playing spoilsport and dampening any household spending.

Explore Wright Research smallcases here

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Visit bit.ly/sc-wc for more disclosures.