The Good Bad and Ugly weekly review : 26 Sep 2023

The WeekendInvesting App !

A quick introduction to the Weekend Investing app, now available on Google Play and App Store. The app has been received with great enthusiasm, with over 4,000 users already joining. We encourage all weekend investors to download the app, as it provides numerous benefits and features that can enhance your investment experience.

By joining the app, you will receive immediate notifications for urgent messages from us. Additionally, all our content, including YouTube videos and Twitter posts, can be accessed in one place. This ensures that you stay up to date with relevant and valuable information. Moreover, the app allows you to interact with our team, ask questions, and provide feedback. It offers a seamless and convenient channel for communication between investors and our support team.

One of the key advantages of the app is access to exclusive educational content and strategies tailored specifically for weekend investors. We offer educational US strategies, trend analysis posts, market psychology insights, and much more. By leveraging these resources, you can enhance your investing knowledge and make informed decisions. Furthermore, the app provides opportunities for online and offline meetups exclusively for WeekendInvesting subscribers, allowing you to engage with fellow investors and expand your network.

A unique feature of the app is the ability to book a one-on-one call with the Weekend Investing team. This personalised support ensures that you receive prompt assistance and have your queries addressed directly. Additionally, a chat feature is available to provide immediate solutions to any questions or concerns you may have. The aim of the app is to facilitate seamless interaction and provide phenomenal support to all weekend investors and app users.

Introducing “The WeekendInvesting Newsletter”

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our newsletters for this week.

Subscribe to the WeekendInvesting Newsletter

Markets this week !

The week ending on September 22nd, 2023, was one that investors would like to forget. Nifty experienced a sharp decline from 20,222 to 19,674 in just a week. This significant correction was mainly influenced by the global market sentiment, as the US market had not yet recovered.

The uncertainty in the market is primarily driven by expectations of increasing interest rates. The hopes for rate cuts have been challenged, and now the focus shifted to 2025. Despite these uncertainties, there is some good news. Domestic funds have provided support to the market, countering the foreign institutional investment sales. As long as the market holds above the previous top at 18,000 levels, there is no major cause for concern.

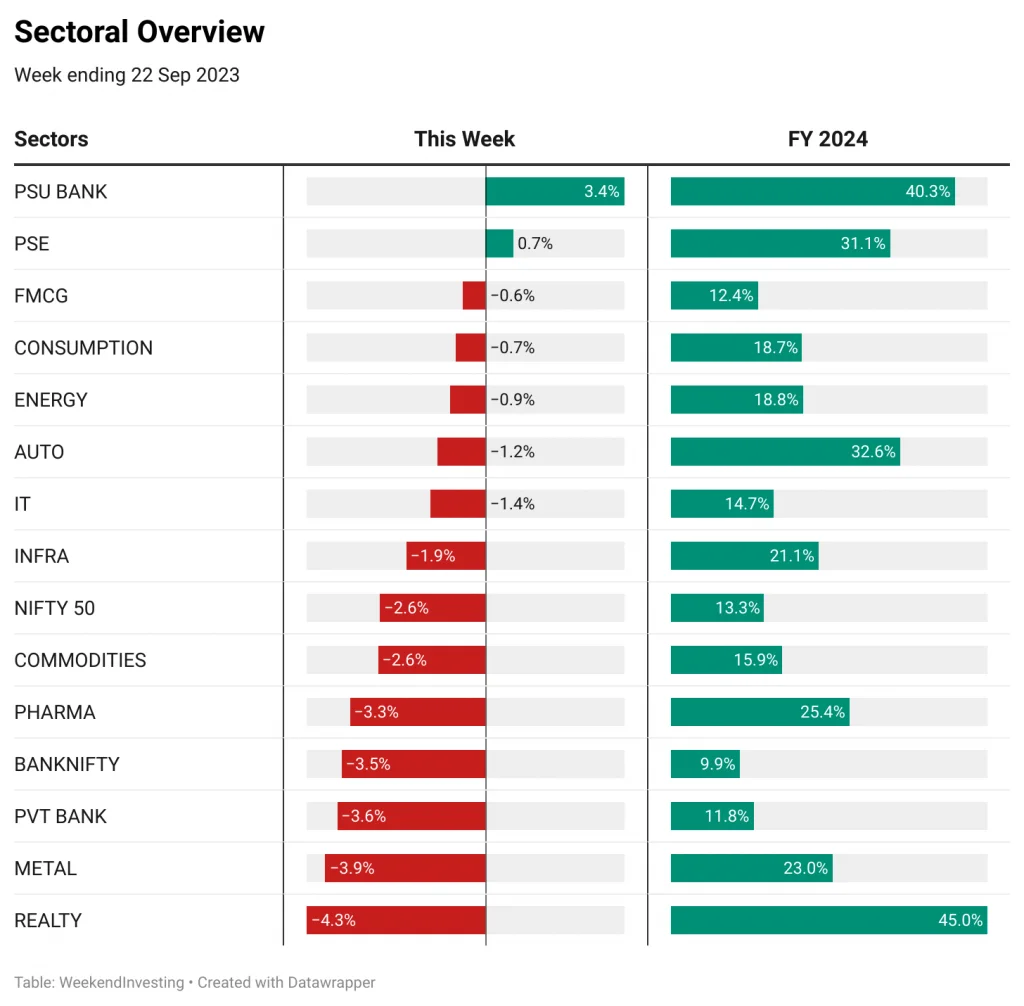

Sectoral Overview

Let’s take a closer look at the performance of various sectors. The PSU (Public Sector Undertaking) banks stood out as the top gainers, with a 3.4% increase. Public sector enterprise stocks also performed well, gaining 0.7%. On the other hand, real estate experienced a significant drop of 4.3%, although it is still up by 45% on a FY24 (financial year 2024) basis. Other sectors such as metal stocks, private banking, pharma, commodities, and infrastructure also witnessed losses.

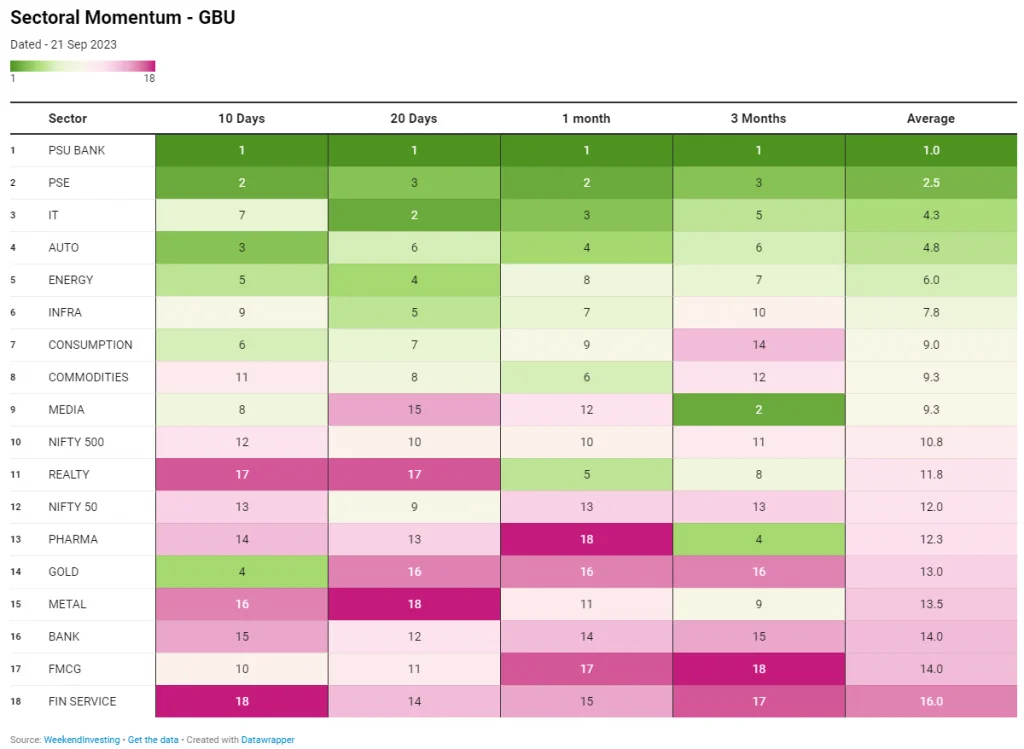

To understand sectoral momentum, we analyzed different periods—three months, one month, 20 days, and ten days. PSU banks consistently ranked high across all periods, signifying their consistent performance. Public sector enterprise stocks and IT stocks also maintained their positions near the top. However, real estate, metals, and financial services showed a decline in the short term.

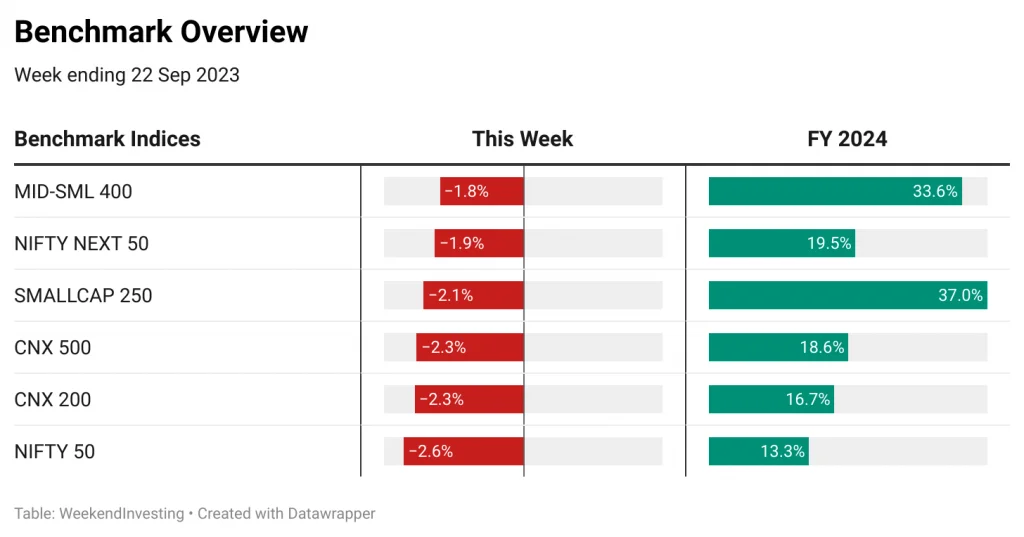

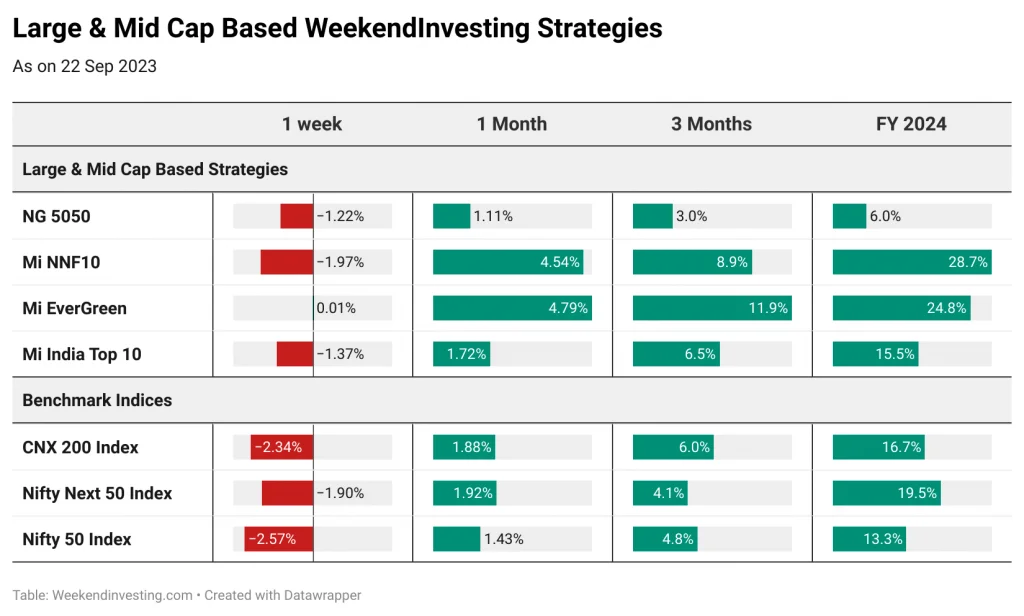

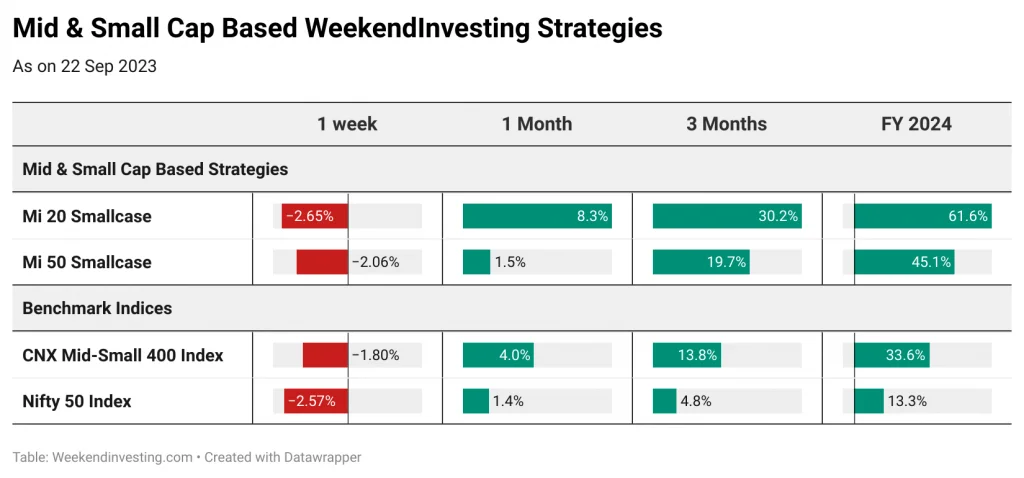

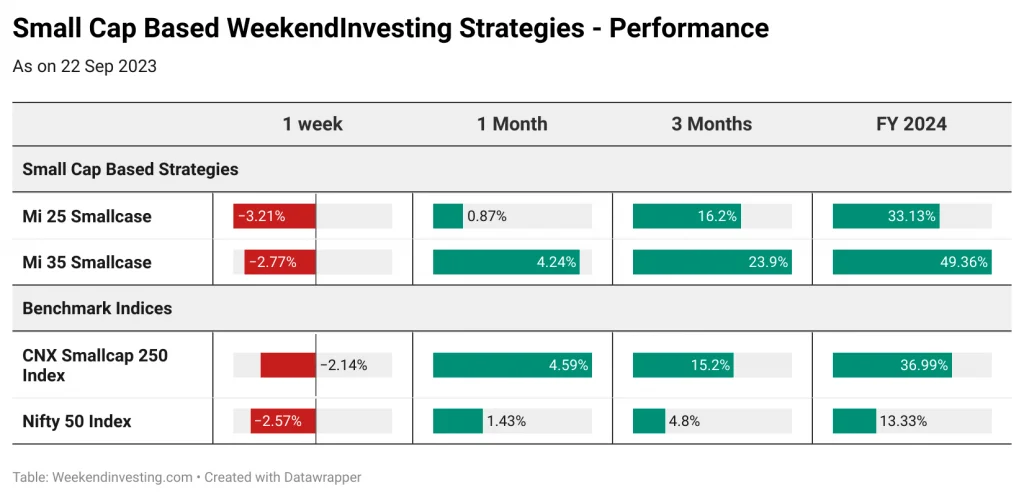

Benchmark Indices Overview

Mid-Small 400 Index and the Small Cap 250 Index experienced declines of 1.8% and 2.1%, respectively. However, they have performed remarkably well in FY 24, displaying double-digit growth. The Nifty Next 50 has also been doing well on a FY 24 basis having clocked 19.5%

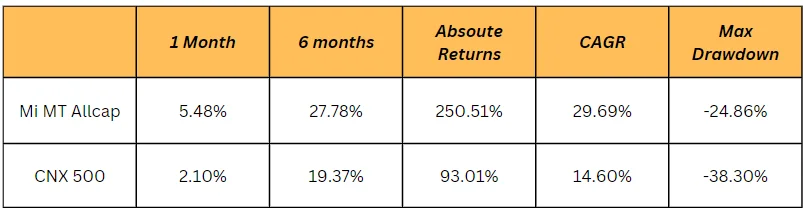

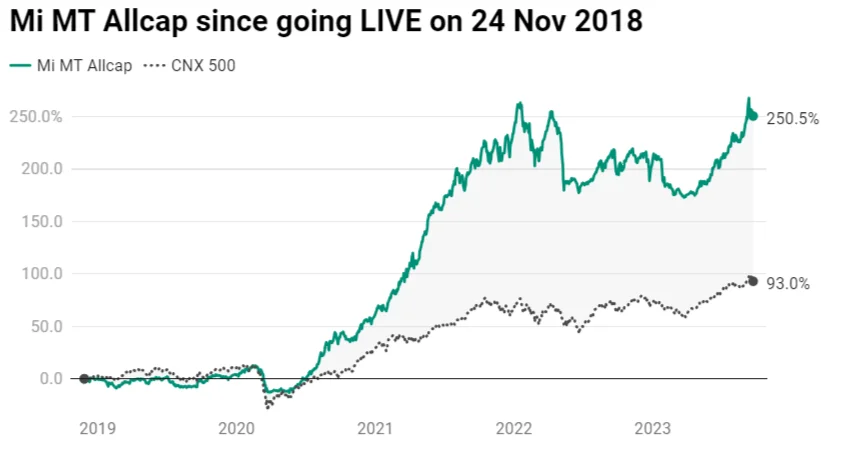

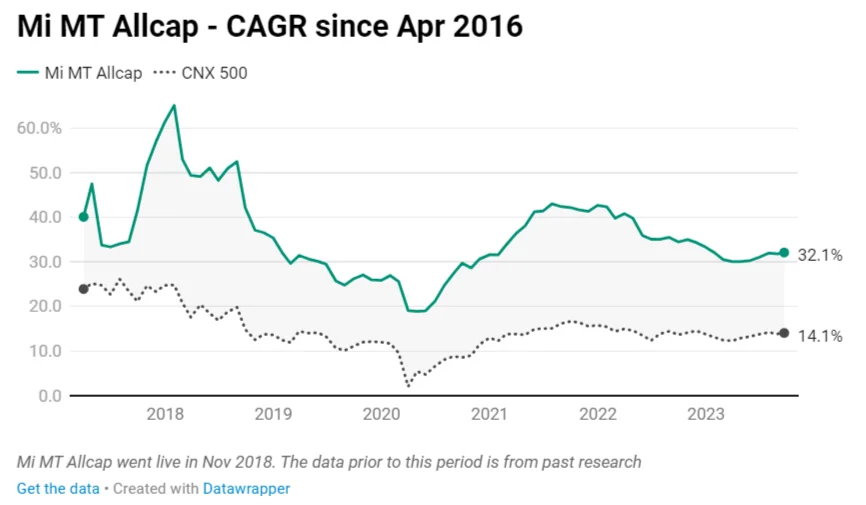

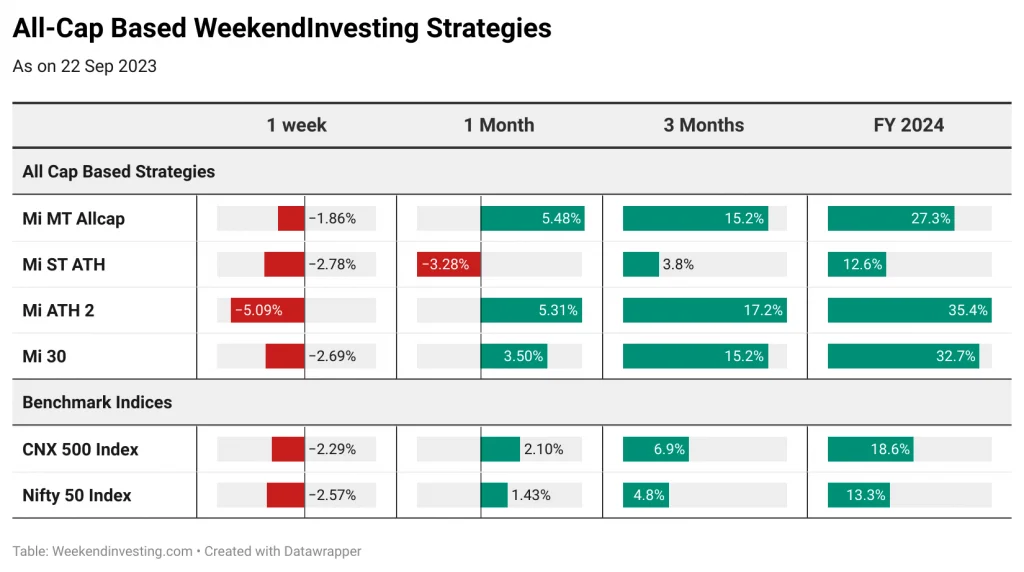

Spotlight – A Steady Core Portfolio – Mi MT Allcap

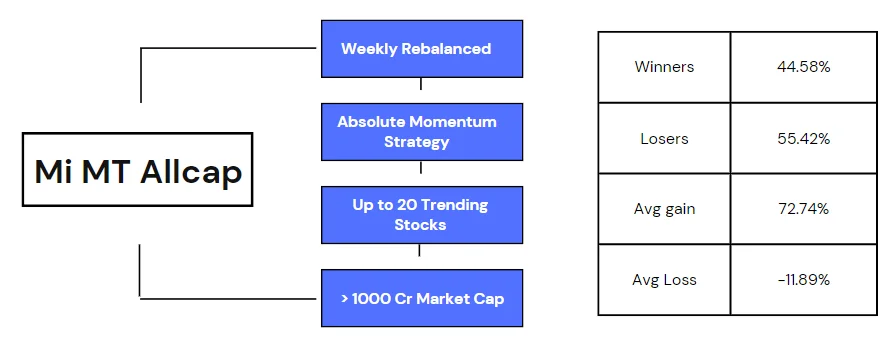

Now, let’s focus on one long-term favorite strategy called Mi MT All Cap. This strategy has gained popularity among investors, consistently outperforming the benchmark. Over a one-month period, the strategy has demonstrated gains of around 5.48% compared to 2.1% on the CNX 500 (benchmark) and over the six-month period, it has also shown positive performance. Since it went live in November 2018, the strategy’s absolute return has been remarkable at a staggering 250% compared to 93% on the CNX 500 index, with a CAGR (Compound Annual Growth Rate) of 32% as opposed to 14.6% on its benchmark.

It’s important to note that even successful strategies may experience periods of stagnation before catching up to their cycle again. Mi MT Allcap went through such stages, lagging behind the benchmark for some time before making a significant jump. It has since been recovering and is approaching its previous highs. One important aspect of successful investing is allowing winning strategies to run their course, as the strategy has shown an average gainer of 72% compared to an average loser of 11%

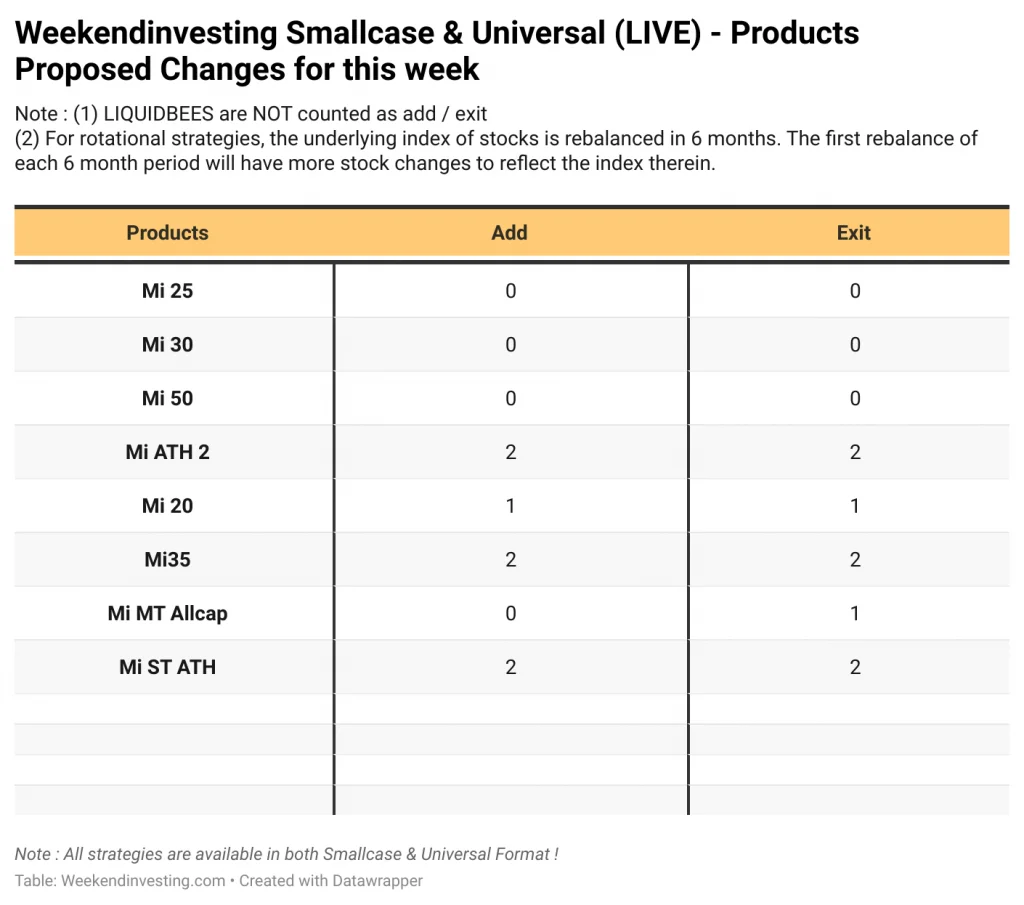

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

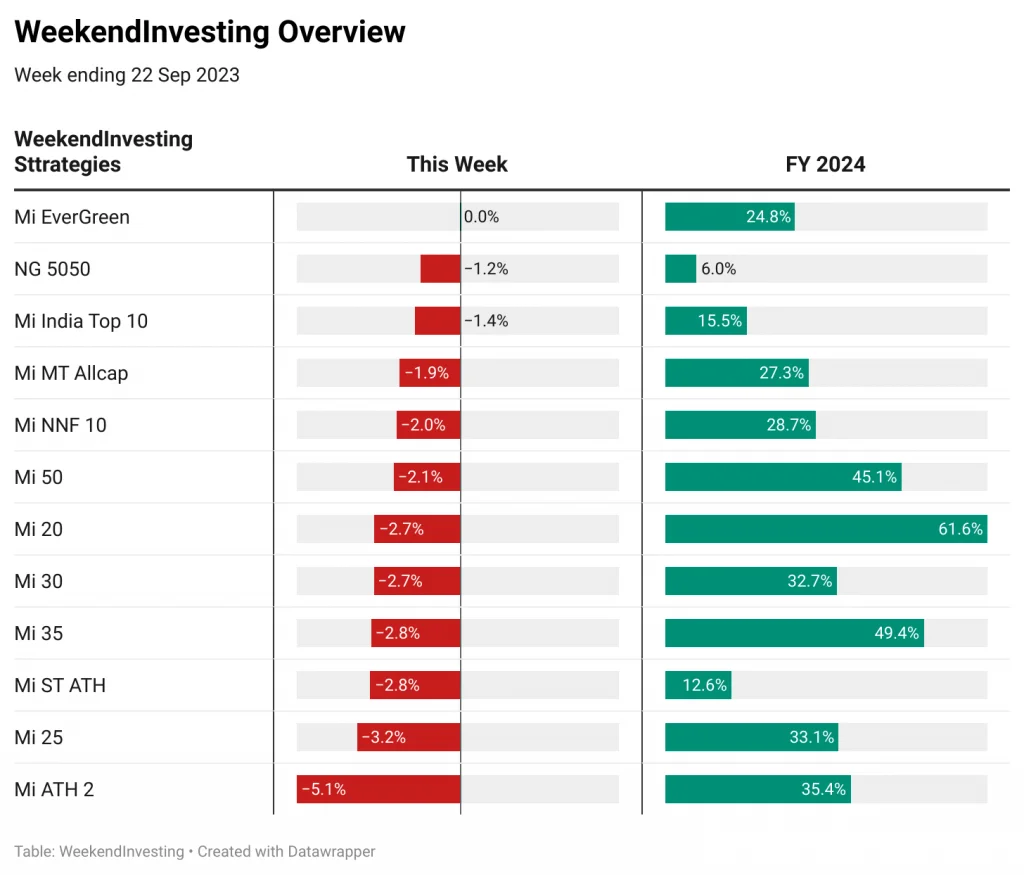

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Check out Weekend Investing smallcases here

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst